Under the new legislation, federal unemployment checks have been extended to sept. We, the parents, today just received $4200 (3×1400) in stimulus money.

Stimulus Check 2022 Limits E Jurnal

Your third stimulus check could be eligible for a bonus payment find:

Stimulus check 3 overpayment. For the advance refund, you received the correct amount; Now, for the 2020 tax year, our son is not a dependent. I file as head of household for my 16 year old son.

There are two parts to the stimulus payment: The $1,400 stimulus is based on your 2019 salary. A second stimulus check for $600 was approved and sent out in december 2020.

Remember that stimulus checks are capped at $1,200 per individual and $2,400 for married couples, plus an additional $500 per. However, if the check is issued in both. The irs is basing the size of your stimulus check on the information provided in your 2019 tax return — or your 2020 one if you've already filed this season.(reminder:

If you received overpayment,none of the stimulus checks are taxable and won't impact your income tax filed this year. It won’t be redirected to cover late support payments. Your third payment is not subject to reduction or offset.

Considered solely her stimulus or. He, son, filed 2020 taxes and received the 3rd stimulus, $1400. I keep getting conflicting info everywhere.

The advance refund (the check) and the tax credit (in the case of the third stimulus payment, it's a tax credit for the 2021 tax year). To help the economy weather the coronavirus outbreak, the cares act is providing $1,200 for adults who make under $75,000, plus $500 per dependent and. This question 3rd stimulus check when 2020 dependents differ from 2019 seems at first to ask the same thing, but it doesn't include the key point of overpayment by the treasury.

Irs used out 2019 returns. If you made less income in 2019 than in 2020 and the irs calculated your check amount based on your 2019 tax data, then you can keep that difference, according to cnet.according to cnet. He received a stimulus check for $1,200 this morning into his hs checking account, for a household total of $2,900 for a family of two.

Our, the parents, 2020 returns have not been filed yet. The data point it's using is adjusted gross income, or agi.agi isn't your salary. 6 at a $300 weekly rate.

The $1,400 economic stimulus payment is not a loan. If you made less income in 2019 than in 2020 and the irs calculated your check amount based on your 2019 tax data, then you can keep that difference, according to cnet. And for the tax credit, the lowest it can be is 0 (it cannot be negative).

Considered an individual $1400 stimulus for her, me, and my sister (me and my sister were dependents for 2020 and before) that was paid to her. With the third check, if you’re past due on child support, you can still receive your full stimulus payment. I'm not sure if this payment is.

Alternatively, a little bit of math can help you catch an overpayment. Organizers of a major petition hope the answer is yes. This third stimulus check is an advanced tax credit on your 2021 taxes, and calculated based on your 2020 taxes.

The deadline is april 15.). If it feels like christmas morning, that's because the government has officially deposited the first wave of stimulus checks into americans' bank accounts. My mom received $4200 in mar 2021 for the eip 3.

By now, you probably know the basics. The third stimulus payout of $1,400 for every qualified. $1400 stimulus may be on the way — this time from your state

Technically, we received $1400 too much. Let's look at the text of the law. You both need to decide which.

He worked a part time summer job in 2018 and filed as my dependent in 2018 with his 2018 tax return deposited into his chase hs checking account. Under the american rescue plan act of 2021 signed in 3/11/2021, a family with household income of $150,000 or less will receive a stimulus of $1,400 per taxpayer and dependents including qualified dependents over 17 years old. $300 in additional weekly unemployment benefits, including a new tax break.

A change.org petition for $2,000 a month stimulus checks has hit 3 million signatures, according to cnbc.

President Biden changes eligibility to receive stimulus

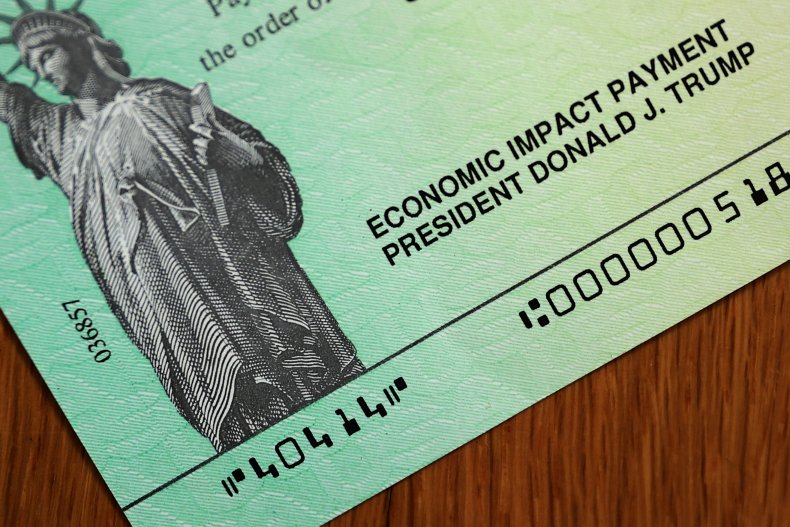

Economic Impact Payment Community TuDiabetes Forum

How Much Per Child Tax Credit 2020 CARUCUS

Stimulus update IRS issues more refunds for overpaid

Stimulus Check 2022 Limits E Jurnal

McConnell Blocks Push For 2,000 Stimulus Checks Flipboard

Tax return vs. tax refund How they're different, what's

Stimulus Check 2022 Irs E Jurnal GuitarCollectioner

tax rebate Archives Tax Banana

What Happens If You Get Two Stimulus Checks?

CBD Industry Tax Rebates Quartermaster Tax Management

Stimulus checks If the IRS overpaid you Covid relief

Do you have to return stimulus check money to the IRS

Stimulus check plans, finding hand sanitizer, and avoiding

Business Concept Meaning Form 8038R Request For Recovery

Child tax credit 2021 Here's three reasons why you may

Second Stimulus Check Calculator How Much Will You and