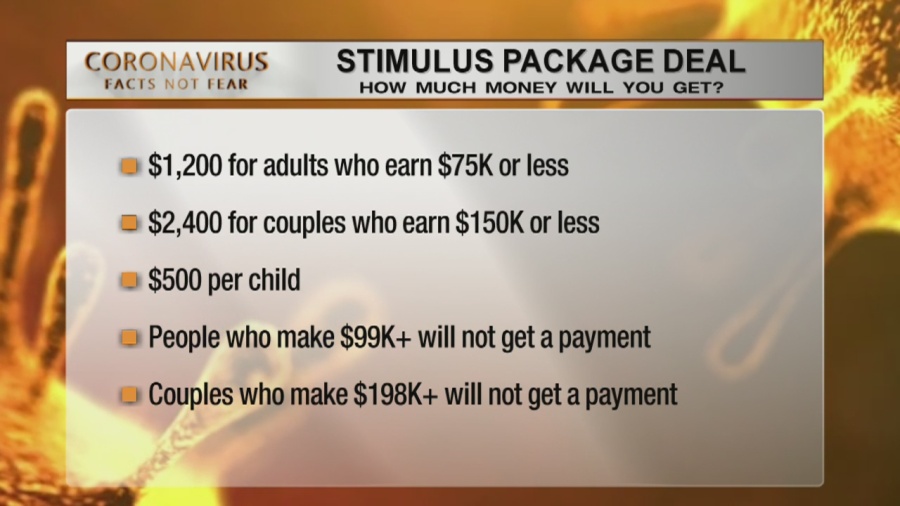

A couple filing jointly would not receive a stimulus check once. Unlike prior stimulus checks, the upper numbers are hard caps and filers with dependents would not be able to claim them even if they don't qualify for.

Coronavirus stimulus checks What would need to happen

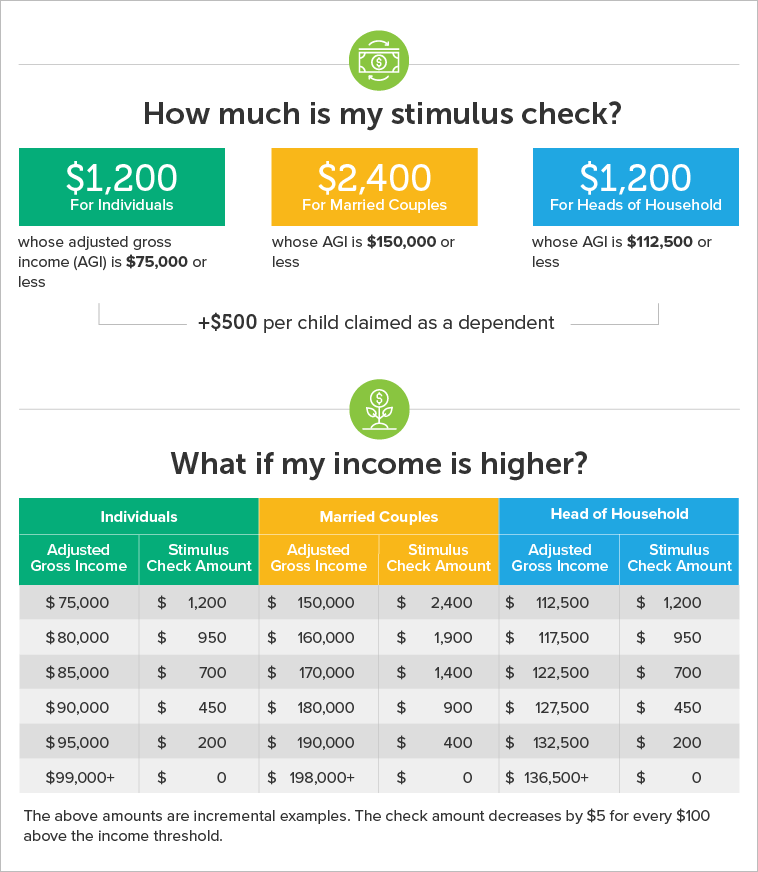

How much money you'll get.

Stimulus check 3 head of household. If you file as head of household, the reductions begin at $112,500 (if you are single, widowed or divorced and claim a child as a dependent, you probably have been filing as. I received a check for my $ 1700.00. The table below breaks down the third stimulus checks for heads of household with one dependent:

Qualifications for head of household. I need to know how or if my son is eligible to the stimulus check, and if eligible what he or i do to initiate the procedure. Upper income cap to receive all 3 stimulus checks.

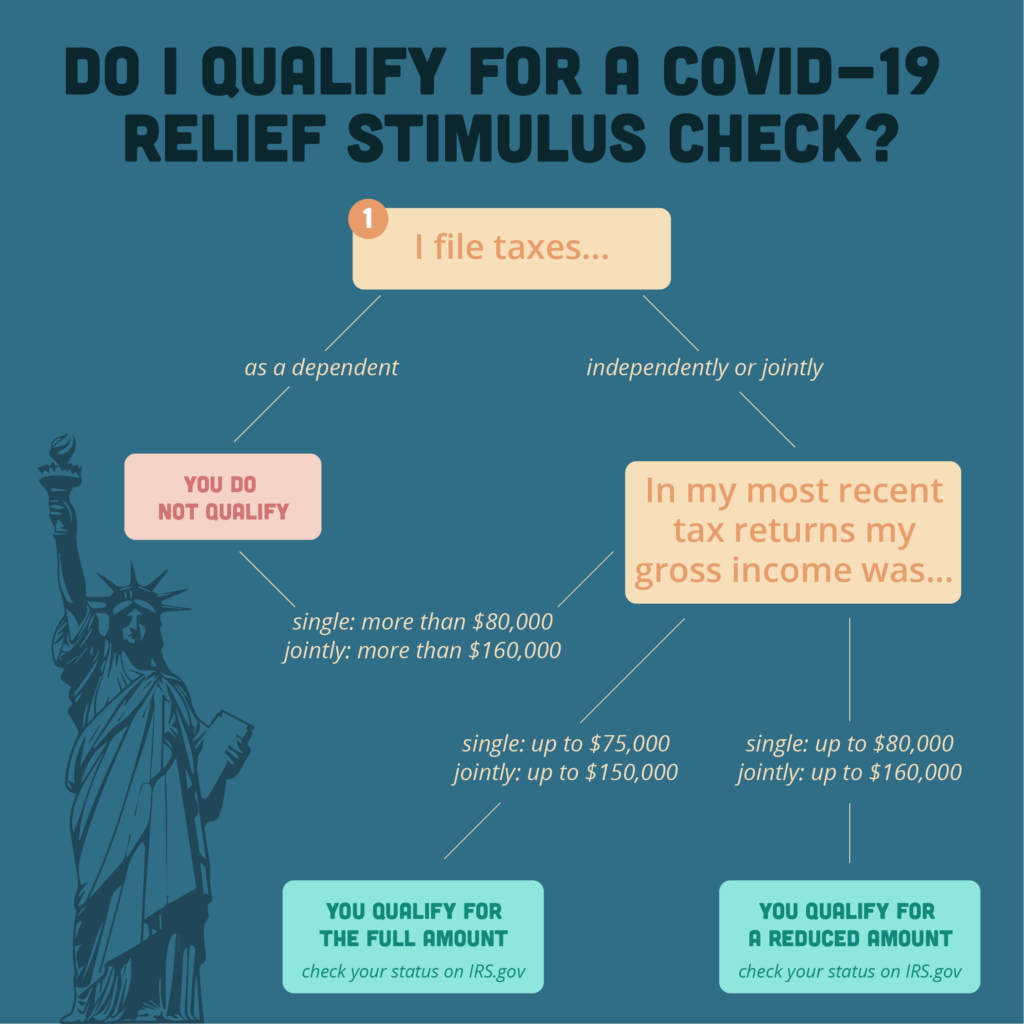

Any individual earning $80,000 or more, head of household earning $120,000 or more, and married couples filing jointly earning $1600,000 or more does not qualify for any amount. Head of household is usually defined as a single or unmarried taxpayer who keeps up a home for a qualified person. If you’re a married couple filing jointly, total yearly earnings must be $150,000 or.

Single parent with two children, wages of $4,000, no federal income tax liability before child tax credit. The same restriction applied to a noncitizen head of household who claimed a us citizen child as part of. But under the third stimulus check, only heads of household making less than $120,000 could get a stimulus check with an additional payment for one dependent.

This breakdown shows that heads of household earning under $146,500 still qualify for a second stimulus check with an additional payment for one dependent. Here's who qualifies for a full $1,400 check: What are the income limits for the 3rd stimulus check?

The amount of the stimulus check is reduced once agi exceeds these limits. Previously, heads of households who made less than $150,000 were eligible. For individuals who are the head of household, the adjusted gross income must be $112,500 or below.

If your agi exceeds these amounts, your household will not qualify for. Head of households that make less than $112,500/year qualify for the $1,200 stimulus check — plus $500 per child. In that case, you will receive the full amount of stimulus if your income is less than $112,500.

Now, for heads of households, those who take home between $112,500 and $120,000 will qualify for the third set of checks. Head of household with children: I have a question on the stimulus check.

Head of households earning $120,000; With the new stimulus plan, however, both joint filers and heads of household get an additional $1,400 payment for each dependent, regardless of age. Single filers with agis of $75,000 or less;

Married households filing jointly earning $160,000; Additionally, there are changes to the 2021 child tax credit, the 2021 earned income tax credit, 2021 child and dependent care credit, and. If you are single or unmarried with dependents, you are probably filing as head of household.

The income requirements are the same as those for the three stimulus checks passed by congress. I filed head of household with my adult so and his son, my grandson. Head of household who makes less than $112,500.

This payment is composed of a $1,400 stimulus check to qualifying individuals and $1,400 per their dependents as part of the american rescue plan act, or president biden's early 2021 tax plan. So, a head of household earning $112,500 or less can expect a stimulus payment of $2,800 ($1,400 for the filer and another $1,400 for. Under the proposed legislation from the committee, the third stimulus check would be $1,400 for individuals making up to $75,000 and head of households making up to $112,500.

An individual (either single filer or married filing separately) with an agi at or above $80,000 would not receive a stimulus check. If you meet all 3 of these head of household filing. A single tax filer must make under $75,000, $112,500 as a head of household filer, or less than.

Who doesn't get a 3rd stimulus check? Examples of how the economic stimulus act of 2008 may effect taxpayers who are single, file as head of household and have children who qualify for the child tax credit payment:

Third stimulus checks Democrats could phase out 1,400

How To File For The Stimulus Check As A Dependent Parent

Third Stimulus Check For Senior Citizens Takeaway For

How To Get Stimulus Check As A Dependent On Taxes If you

6 reasons why your stimulus check is late Corona Alerts

When is Your Stimulus Check Coming? How Much Will You Get?

Stimulus Checks Tax Return Irs Head Of Household QATAX

Does Head Of Household Receive Stimulus Check QWHOIS

Third stimulus checks Democrats could phase out 1,400

Here's The Fastest Way To Receive Your Stimulus Check

Where's My Second Stimulus Check?

Stimulus Check What To Expect Common Cents Lifestyle

Stimulus Check 3 Chart Don't Believe These 12

COVID19 Stimulus Check Calculator 2020

2 trillion stimulus bill How much money will you get

3 Reasons You May Not Get a Stimulus Check The Motley Fool

How the CARES Act Helps Investors