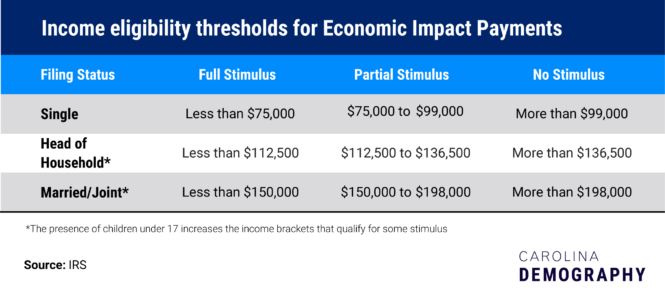

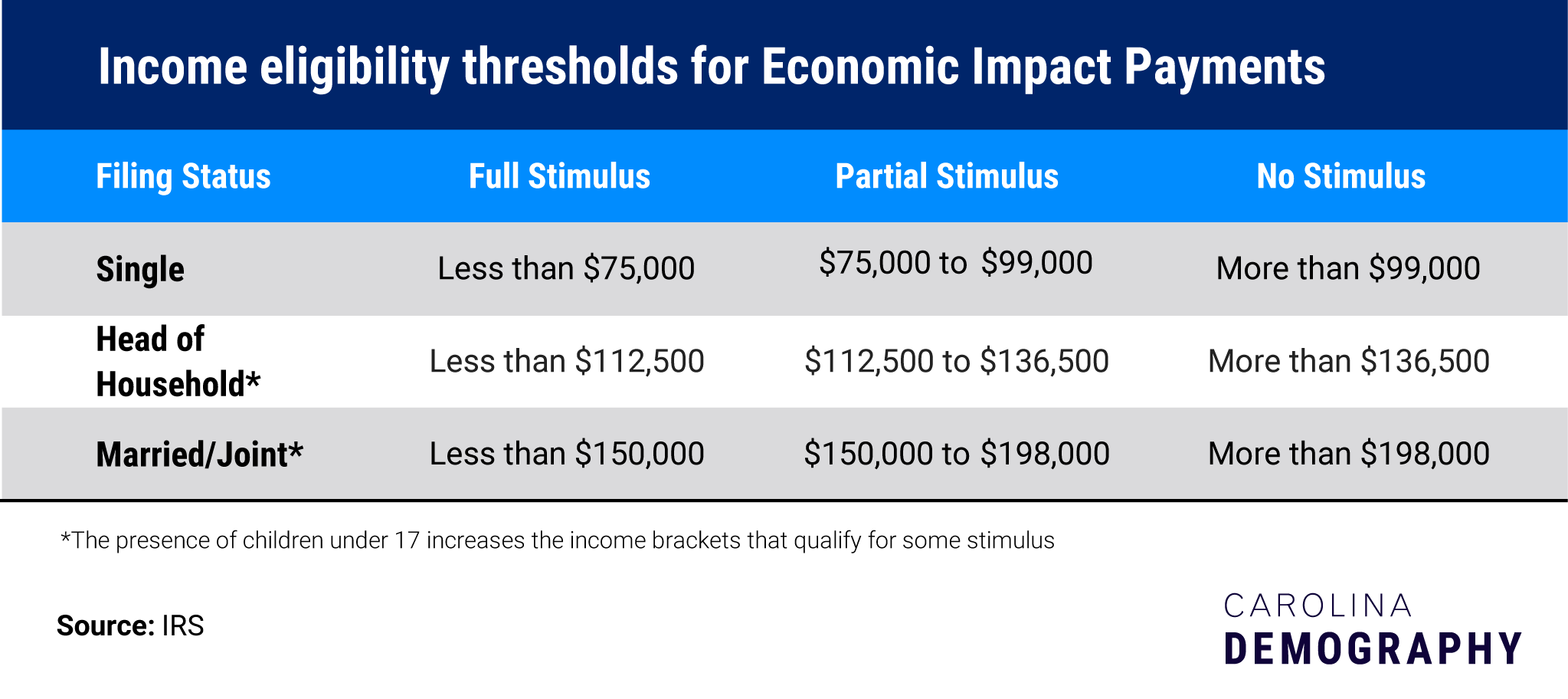

So individuals earning $75,000 or less, couples making $150,000 and head of households with a $112,500 annual adjusted gross income (agi) could expect the full payment once the bill is enacted. A single tax filer must make under $75,000, $112,500 as a head of household filer, or less than.

Third stimulus check passed in the Senate when is voting

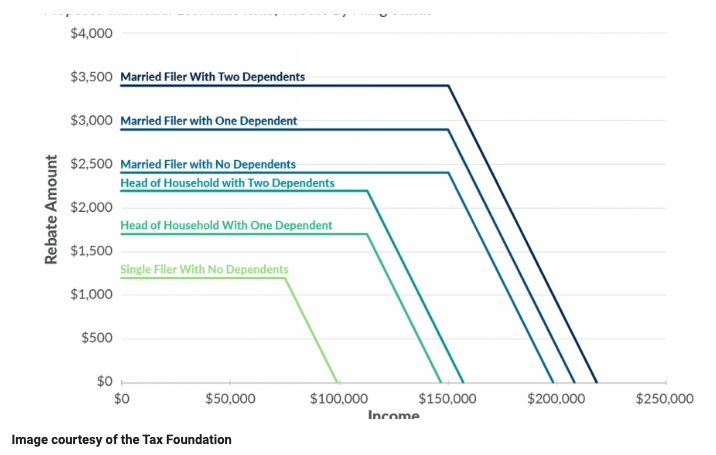

Married taxpayers who file jointly with an agi of $150,000 or less will receive $2,800.

Third stimulus check head of household. Third stimulus check — what you need to know single filers. Under the proposed legislation from the committee, the third stimulus check would be $1,400 for individuals making up to $75,000 and head of households making up to $112,500. Head of household filers are also entitled to additional sums for qualifying dependents, as set forth.

Dependents can help bring you money in 2021 and 2022. Recovery rebate for missed economic impact payments the irs is telling taxpayers that if you didn’t get the third stimulus check,. This new law provides a third round of stimulus payments of $1,400 for each qualifying tax filer and each qualifying dependent.

Previously, heads of households who made less than $150,000 were eligible. The american rescue plan was signed into law on march 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of americans. So, a head of household earning $112,500 or less can expect a stimulus payment of $2,800 ($1,400 for the filer and another $1,400 for.

Now, for heads of households, those who take home between $112,500 and $120,000 will qualify for the third set of checks. Taxpayers who file head of household with an agi under $112,500 will receive a $1,400 stimulus payment. According to the washington post, that would mean $1,400 checks for anyone making less than $50,000 and $2,800 for married couples earning $100,000 or less.

Head of household filers who have an adjusted gross income of $112,500 or less will receive the full $1,400 for themselves. Citizen or resident alien, posses a social security number, and not be claimed as a dependent. This amount is intended to top off the december $600 stimulus.

The third stimulus payment requires the eligible recipient to be a u.s. If an individual were considered a head. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

How the third stimulus check became law. Under the proposed legislation from the committee, the third stimulus check would be $1,400 for individuals making up to $75,000 and head of households making up to $112,500. New rules for the third stimulus check will affect you if you have dependents.

Households will receive an additional $1,400 for. If you file as head of household, the reductions begin at $112,500 (if you are single, widowed or divorced and claim a child as a dependent, you probably have been filing as. Each dependent counts for $1,400.

The amount of the stimulus check is reduced once agi exceeds these limits. The income requirements are the same as those for the three stimulus checks passed by congress. The third stimulus provides $1,400 to individuals with an adjusted gross income (agi) of $75,000 or less.

Individual taxpayers who filed a federal income tax return in 2019 or 2020 reporting adjusted gross income of $75,000 or less receive $1,400 in the third round of stimulus payments. The irs get my payment tool may be used to show the status of the third stimulus payment, not the first or second. Joint filers making up to $150,000 would receive $2,800.

An individual (either single filer or married filing separately) with an agi at or above $80,000 would not receive a stimulus check. Head of household filers who have an adjusted gross income of $112,500 or less will receive the full $1,400 for themselves. For those above those levels, the stimulus check amount would begin to phase out.

The adjusted gross income limit for someone filing a return as a head of household is $112,500.married couples filing joint returns cannot show more than $150,000 in adjusted.

Third stimulus checks Democrats could phase out 1,400

SSI, SSDI, veterans and stimulus checks IRS sending funds

Third Stimulus Check Update Today 2021 Head Of Household

Stimulus Check 2021 Head Of Household 1 Dependent ISWOH

Third Stimulus Check For Senior Citizens Takeaway For

Third Stimulus Payment Frequently Asked Questions

Stimulus Check 2021 Head Of Household 1 Dependent ISWOH

Do Married Couples Receive One Or Two Stimulus Checks ISWOH

Third Stimulus Checks Timing, Amount, Eligibility

Stimulus check update Some Americans may have to GIVE

9 reasons you may not qualify for a 1,400 stimulus check

Stimulus Check Eligibility Head Of Household Check the

What is a Head of Household and how does it affect the

How will the third wave of stimulus checks affect you?

Third stimulus checks Democrats could phase out 1,400

How Much Stimulus Does Head Of Household Get ZWHOIS

Do You Qualify for a Stimulus Check? Detailed Report Shows