American Rescue Plan Act Of 2022 Dependents. Section 1011 extends from june 30, 2021 to september 30, 2021, the requirement that the value of supplemental nutrition assistance program benefits be calculated using 115 percent of the june 2020 value of the thrifty food plan. The maximum credit is available to taxpayers with a modified agi of:

The maximum credit is available to taxpayers with a modified agi of: The american rescue plan increased the child tax credit from $2,000 per child to $3,000 per child for children over the age of six and from $2,000. In the american rescue plan act, all dependents, regardless of age, would qualify for the extra payment.

The Maximum Credit Is Available To Taxpayers With A Modified Agi Of:

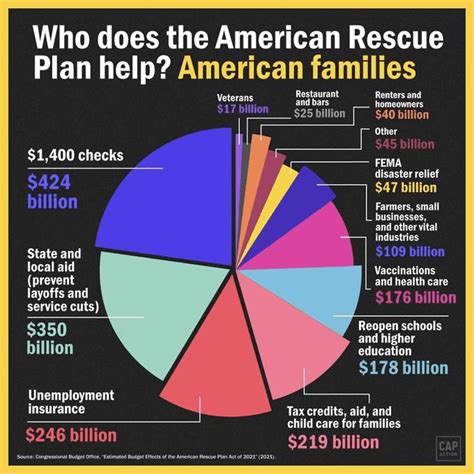

The payments would begin to phase out for individuals with an adjusted gross income (agi) of $75,000 ($150,000 for couples) and would be zero for agis of. Section 1011 extends from june 30, 2021 to september 30, 2021, the requirement that the value of supplemental nutrition assistance program benefits be calculated using 115 percent of the june 2020 value of the thrifty food plan. Provides a payment of $1,400 for a single taxpayer ($2,800 for joint filers), in addition to $1,400 per dependent.

This $1.9 Trillion Economic Stimulus Bill Included

In the american rescue plan act, all dependents, regardless of age, would qualify for the extra payment. The dependent, however, should be below 19 years of age unless they are a student, or of any age if he or she is permanently disabled. More dependents will receive stimulus money.

Since That Provision Has Expired, 2022 Will Be The Last Year People Can Bring Their Entire Fsa With Them Into The New Year.

So, if you had a baby or added a new dependent in 2021, then you need to claim the stimulus money for them in 2022. American rescue plan act of 2021. The american rescue plan act authorized payments of $1,400 per adult and $1,400 per dependent.

It Also Increases The Value Of The Dependent Care Tax Credit.

Title ix, subtitle g—tax provisions congressional research service 1 he american rescue plan act of 2021 (arpa; The relief legislation offers more than $1.9 trillion in help for individuals, families, and businesses. The credit phases out between $75,000 and $80,00 of adjusted gross income ($112,500 and $120,000 for head of household filers and $150,000 and $160,000 for joint filers).

The New Law Increases It To As Much As $3,000 Per Child For Dependents Ages 6 Through 17, And $3,600 For Dependents Ages 5 And Under.

The american rescue plan act of 2021: This resulted in just half the credit being paid out. In addition to the base amount of $1,400, the senate bill calls for an additional $1,400 for each dependent.