American Rescue Plan Act Of 2022 Tax Changes. The future of premium credit expansions will have huge effects on the program’s appeal to prospective enrollees. The american rescue plan made several notable but temporary changes to child tax credit, including:

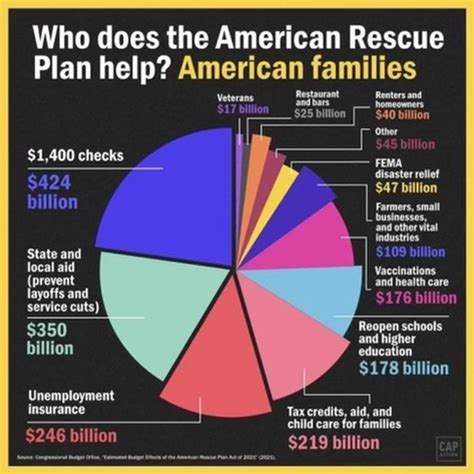

The act is a $1.9 trillion economic stimulus bill designed to facilitate us recovery from the economic and health effects of the pandemic. Some tax professionals already have had their eye on changes that will affect their clients. Individuals and families may be eligible for a temporary increase in premium tax credits for this year, with no one paying more than 8.5% of their household income towards the cost of the benchmark plan or a less expensive plan.

Some Tax Professionals Already Have Had Their Eye On Changes That Will Affect Their Clients.

Last modified on mon 3 jan 2022 07.12 est. The american rescue plan expanded who can claim the eitc by raising income limits for childless workers. According to reports, as of the start of 2022, small business.

This Should Only Take A.

Please consult with your tax accountant or professional tax expert before adhering to any of these recommendations. You can thank one small change buried in the american rescue plan act of 2021. Department of the treasury released the final rule on jan.

By Sidney Kess, Jd, Llm, Cpa, Joseph Buble, Cpa And James R.

Under the american rescue plan: It’s been a long time coming and will be effective on january 1, 2022. Extension of the child tax credit (ctc) — the increased ctc, including monthly advance payments as enacted by the american rescue plan act (arpa), would be extended through 2022.

Individuals And Families May Be Eligible For A Temporary Increase In Premium Tax Credits For This Year, With No One Paying More Than 8.5% Of Their Household Income Towards The Cost Of The Benchmark Plan Or A Less Expensive Plan.

6, 2022, governing the use of fiscal recovery funds (frf) as established under the american rescue plan. A new tax rule will impact millions of small businesses in 2022. The american rescue plan act had waived federal tax on up to $10,200 of benefits collected in 2020.

The Effective Date For These New Changes Is January 1, 2022.

If made permanent, the arpa changes—excluding repayment repeal—would reduce revenue by slightly more than $163 billion from 2022 to 2031, according to the treasury department. The act is a $1.9 trillion economic stimulus bill designed to facilitate us recovery from the economic and health effects of the pandemic. New small business tax rule for 2022.