American Rescue Plan Income Limits. $300 per week through september 6, 2021 Individuals earning an adjusted gross income (agi) up to $75,000 (and married couples earning up to $150,000) will receive $1,400 each, plus $1,400 for each dependent.

Targeted income limits, however, exclude individuals earning. Progressively larger credits are given to families with lower incomes. How does the american rescue plan change pandemic unemployment insurance payments for 2021?

As Of July 12, 2021.

• people with annual income up to 150% ($19,140) of the federal poverty level can now buy silver plans for nearly $0 monthly premium with a $0 deductible (the amount you pay for covered health care services before your insurance plan starts to pay) and low copay and coinsurance amounts. Households with an income greater than $149,999 will not qualify. The state funding portion is approximately $195 billion with $25.5 billion distributed equally among the 50 states and the district of columbia and the remaining amount.

Progressively Larger Credits Are Given To Families With Lower Incomes.

For a household of two, the income limit was $68,960, and for a household of four, it was $104,800 (alaska and hawaii had. Article continues below advertisement for example, the. Individuals earning an adjusted gross income (agi) up to $75,000 (and married couples earning up to $150,000) will receive $1,400 each, plus $1,400 for each dependent.

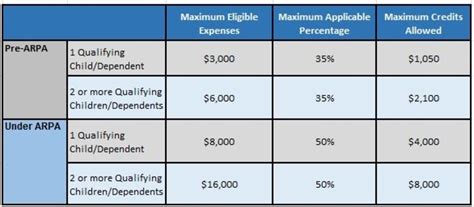

The Increased Portion Of The Credit Will Be Available For Single Parents With Annual Incomes Up To $75,000 And Joint Filers Making Up To $150,000 A Year.

The american rescue plan was signed into law on march 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of americans. The american rescue plan act increases and expands cost assistance under the affordable care act (obamacare). Those who exceed the income limit can still get some credit, but it will be reduced by $50 for every additional $1,000 in gross income earned.

How Does The American Rescue Plan Change Unemployment Insurance For 2020?

If your household makes $80,000 annually, you can multiply this income by 0.085 (8.5%) to • american rescue plan (arp) utility debt relief: Before the american rescue plan (arp) was enacted, eliminating the income cap for subsidy eligibility in 2021 and 2022, subsidies were available in the continental us for a single person with an income of up to $51,040.

Signed Into Law On March 11, 2021, The American Rescue Plan Act Of 2021 (“Arpa”) Provides $350 Billion In Additional Funding For State And Local Governments.

But for 2021 and 2022, section 9661 of the american rescue plan (arp) has eliminated the subsidy cliff. In addition, because the american rescue plan raised income limits and caps what most consumers will have to pay at 8.5 percent of their household income, people who are already enrolled in a plan through covered california will save an additional $119 a month on average. Please click here for gfoa’s analysis of arpa.