enigma_images/ E+ by means of Getty Photos

Acquiring business that remain in the product packaging room might not appear like one of the most interesting method to earn a profit. Yet in my point of view, product packaging companies provide several of the very best potential customers now in time. One of the gamers in this room, a firm that creates pressure-sensitive products like documents, plastic movies, steel aluminum foils, and also textiles, a lot of which are marketed to identify printers and also converters that transform claimed items right into tags and also various other offerings, is Avery Dennison ( NYSE: AVY). Historically talking, the firm has actually succeeded to expand on both its leading and also profits. About comparable companies, the supply is a little bit costly. Yet on an outright basis, it is still affordable sufficient to price a ‘acquire’. Yet certainly, financial problems doubt and also unpredictable. And also therefore, the photo for any individual company or market can modification at a minute’s notification. This makes it more crucial than ever before for financiers to pay unique focus when companies report their economic outcomes each quarter. It so occurs that, for Avery Dennison, the following incomes launch will certainly get on February second prior to the marketplace opens up. Leading up to that factor, financiers ought to recognize what to anticipate and also what to watch out for.

Terrific outcomes up until now

The last short article I created pertaining to Avery Dennison was released in late August of 2022. Leading up to that factor, solid sales and also earnings had actually contributed in pressing shares of the firm greater. In addition to that, administration was supplying financiers an extra beneficial sight of the 2022 than what they had formerly. Eventually, I ended that shares of the firm we’re still essentially appealing and also appealing from a rate viewpoint. At the very same time, nonetheless, I likewise identified that the gravy train had actually been made which additional advantage from that factor would certainly be a lot more restricted. This still did not stop me from ranking the firm a soft ‘acquire’, a ranking that mirrors my sight that shares ought to partially exceed the more comprehensive market for the direct future. While shares of the firm are still up 14.3% contrasted to the 3.2% decrease experienced by the S&P 500 when I blogged about the company in March of in 2014, they have actually been essentially level considering that my August short article. Comparative, the S&P 500 has actually been up just decently, publishing a gain of 0.7%.

Writer – SEC EDGAR Information

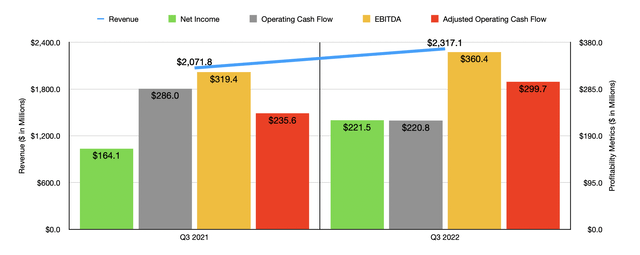

I recognize I pointed out currently that the gravy train had actually currently been made. Yet reality be informed, I am a little bit stunned and also just how restricted advantage has actually been. Think about just how the firm executed throughout the 3rd quarter of its 2022 . Throughout that time, sales can be found in at $2.32 billion. That stands for a boost of 11.8% over the $2.07 billion created one year previously. This rise, though excellent, was not as excellent as it ought to have been. Total sales for the Tag and also Graphic Products section of the firm handled to climb up about 12%, climbing from $1.37 billion to $1.54 billion. Yet had it not been for discomfort related to international money translation, development would certainly have been 20%. The firm likewise saw a 17% surge in sales for the Retail Branding and also Details Solutions section, with earnings leaping from $541.1 million to $633.2 million. Real natural development was just 7%. In this instance, international money in fact included 5% to the section’s leading line, yet the large vehicle driver was a 14% payment brought on by purchases.

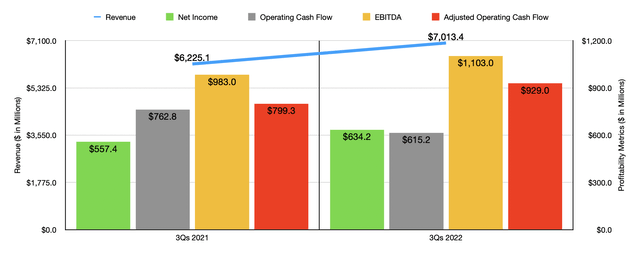

Revenues for the firm likewise boosted throughout this home window of time. Take-home pay of $221.5 million overshadowed the $164.1 million reported in the 3rd quarter of 2021. It holds true that running capital decreased, going down from $286 million to $220.8 million. Yet if we change for modifications in functioning resources, it would certainly have climbed from $235.6 million to $299.7 million. Likewise, EBITDA for the firm likewise enhanced, leaping from $319.4 million to $360.4 million. The 3rd quarter is just a preference of just how the firm executed for 2022 overall. Income of $7.01 billion was meaningfully greater than the $6.23 billion reported for the very first 9 months of 2021. That earnings boosted from $557.4 million to $634.2 million. Once more, running capital took a hit also, going down from $762.8 million to $615.2 million. Yet on a modified basis, it would certainly have expanded from $799.3 million to $929 million. And also ultimately, EBITDA for the firm boosted from $983 million to $1.10 billion.

Writer – SEC EDGAR Information

Monitoring has actually claimed that modified incomes per share for 2022 ought to be in between $9.70 and also $9.85. This contrasts to the prior anticipated series of in between $9.70 and also $10. Taking the omphalos, we would certainly wind up with an analysis of around $800.6 million. If we likewise think that the various other productivity metrics will certainly increase at the very same price the earnings should, after that we ought to prepare for modified operating capital of $1.24 billion and also EBITDA of $1.47 billion. Yet certainly, this sort of efficiency is contingent on just how the firm made out throughout the last quarter of the year. Today, experts prepare for earnings of $2.17 billion. This would certainly contrast to the $2.18 billion business reported one year previously. This would in fact be instead shocking offered just how solid the remainder of 2022 tried to find the firm. When it involves incomes, administration offered a projection for GAAP of $2.025 per share at the omphalos and also a modified analysis of $2.075 per share. Experts, at the same time, are approximating that main incomes will certainly be just $1.98, while the changed number would certainly be $2.03. Comparative, at the very same time one year previously, main incomes were $2.19 per share, while changed incomes were $2.13.

Writer – SEC EDGAR Information

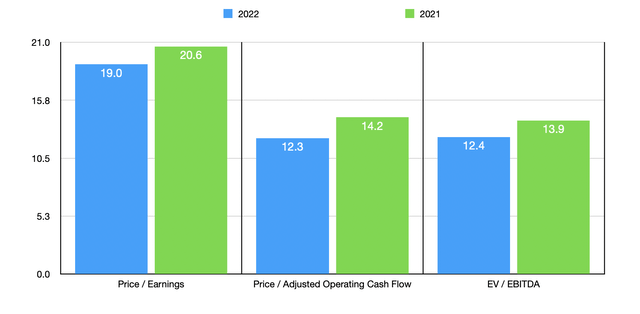

Making use of the price quotes that I currently supplied, I computed that the firm is trading at a price-to-earnings multiple of 19. The cost to changed running capital several is 12.3, while the EV to EBITDA several ought to can be found in at 12.4. Comparative, if we were to make use of the information from the 2021 , these numbers would certainly be 20.6, 14.2, and also 13.9, specifically. As component of my evaluation, I did likewise contrast the firm to 5 comparable companies. On a price-to-earnings basis, these business varied from a reduced of 10.5 to a high of 18. And also making use of the EV to EBITDA technique, the variety ought to be from 5.5 to 9.8. In both of these instances, Avery Dennison was one of the most costly of the team. When it involves the cost to running capital technique, the variety was from 4.9 to 14.8. In this circumstance, 4 of the 5 business were less costly than our target.

Firm |

Cost/ Incomes |

Cost/ Running Capital |

EV/ EBITDA |

Avery Dennison |

19.0 |

12.3 |

12.4 |

Sonoco Products (BOY) |

13.7 |

14.8 |

9.5 |

Product Packaging Company of America (PKG) |

12.6 |

8.8 |

7.0 |

Graphic Product Packaging Holdings (GPK) |

18.0 |

9.5 |

9.8 |

Sealed Air Company (SEE) |

13.7 |

12.1 |

9.5 |

WestRock Firm (WRK) |

10.5 |

4.9 |

5.5 |

Takeaway

Essentially talking, Avery Dennison has actually been knocking it out of the park. By practically every action, the firm is doing extremely well. Regrettably, this has actually led the marketplace to designate an instead high cost on shares contrasted to comparable companies. Yet on an outright basis, the supply does not look pricey, although it could be a little bit soaring contrasted to its rivals. definitely, the gravy train has actually been made, yet missing anything dreadful taking place throughout the last quarter of the year, I would certainly prepare for that shares ought to increase a little bit greater where they are today. Yet certainly, this photo might transform based upon the economic information reported in the following couple of days.