Calculating Tax Return 2022. Use schedule 1 to figure out agi schedule 1 or additional income and adjustments to income is the tax form used for figuring out adjusted gross income. Enrol in australia's leading tax course | now $499 $300 limited time offer on instructor led in class course register now.

Let’s look at an example. We’ll calculate the difference on what you owe and what you’ve paid. Sars income tax calculator for 2022 work out salary tax (paye), uif, taxable income and what tax rates you will pay

If You’ve Already Paid More Than What You Will Owe In Taxes, You’ll Likely Receive A Refund.

For people with net taxable income below rs 3.5 lakh, the tax rebate has been reduced to rs 2,500 u/s 87a; This 2021 tax return and refund estimator provides you with detailed tax results during 2022. The income tax rates and thresholds used depends on the filing status used when completing an annual tax return.

Adding The Two Amounts Above Together.

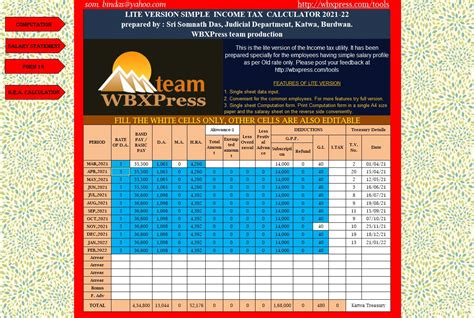

Federal and state tax calculator for 2022 annual tax calculations with full line by line computations to help you with your tax return in 2022 For turbotax live full service, your tax expert will amend your 2021 tax return for you through 11/30/2022. Enrol in australia's leading tax course | now $499 $300 limited time offer on instructor led in class course register now.

Tax Calculator 2022 | H&R Block Australia.

Please enter your salary into the annual salary field and click calculate. The china tax calculator is defaulted to produce a monthly tax and social insurance deductions illustration to allow monthly tax returns. Click here to view relevant act & rule.

After 11/30/2022 Turbotax Live Full Service Customers Will Be Able To Amend Their 2021 Tax Return Themselves Using The Easy Online Amend Process Described Above.

The calculator will show the standard monthly results necessary for calculating. If you don't prepare for tax season, it'll be arduous to find how to obtain the refund calculation. More information about the calculations performed is available on the about page.

See Your Tax Refund Estimate.

Income taxes in scotland are different. On january 1, 2022, new tax laws arrived in the game and make tax returns more complex than usual. Federal and state tax calculator for 2022 annual tax calculations with full line by line computations to help you with your tax return in 2022 the hst for ontario is calculated from ontario rate (8%) and canada rate (5%) for a total of 13%.