Child Care Credit Payments 2022. Millions of american parents have benefitted from the child tax credit since the late 1990s. As of now, the size of the credit will be cut in 2022 back to $2,000 (some families earned up to $3,600 in 2021), with full payments only going to families that earned enough income to owe taxes.

Democratic senators who support the enhanced credit are urging. Tax cuts and jobs act tax deductible medical expenses tax returns health insurance. The bill signed into law by president joe biden increased the child tax credit from $2,000 to up to $3,600 and allowed families the option to receive 50% of their 2021 child tax credit in the form.

Will I Get The Child Tax Credit If I Have A Baby In December?

Millions of american parents have benefitted from the child tax credit since the late 1990s. The bill signed into law by president joe biden increased the child tax credit from $2,000 to up to $3,600 and allowed families the option to receive 50% of their 2021 child tax credit in the form. Child tax credits may be extended into 2022 as payments worth up to $900 could be sent out.

Here's Why Some Refunds Will Face Delays In 2022.

Up to $2,000 per eligible child under 17, in the form of an annual tax credit. Lawmakers in vermont approved a $50million tax cut package that would send $1,200 per child to families with children aged six or under. The payments were $300 monthly for each child who was 5 and younger and $250 monthly for children between the ages of 6 and 17.

More Than 36 Million Families Received The Payments In December.

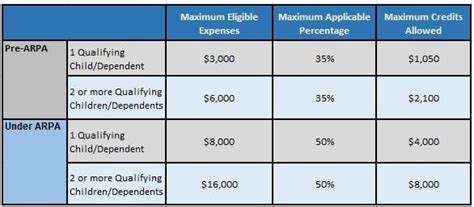

Prior to the american rescue plan, parents could only claim 35% of a maximum of $6,000 in child care expenses for two children, or a maximum tax credit of $2,100. Since july, more than 36 million households around the country have received a payment from the federal government on the 15th of the month, up to $300 per kid, from the child tax credit. Many people are concerned about how parents will struggle in the face of.

If You're Eligible For The Child Tax Credit And Didn't Receive Advance Payments, You Can Receive Between $500 And $3,600 Per Child As Credit.

As of now, the size of the credit will be cut in 2022 back to $2,000 (some families earned up to $3,600 in 2021), with full payments only going to families that earned enough income to owe taxes. The build back better plan proposed by the biden administration would extend the expanded version of the child tax credit through at least 2022, with proponents hoping its popularity would make it permanent. An increase in the maximum credit that households can claim, up to $3,600 per child age five or younger and $3,000 per child ages six to 17.

One Senator Has Demanded A Working Requirement And A Stricter Income Cap For The Payments.

The child tax credit is a tax benefit that all american taxpayers receive for each qualifying dependent child. That expansion, which increased the $2,000 per child benefit to $3,600 for children under 6 and $3,000 for older children, allowed families to receive the credits in monthly installments and made. Families who utilized the six monthly advance payments can expect to receive $1,800 for each child age 5 and younger and $1,500 for each child between the ages of 6 and 17 on their 2021 tax return.