Child Tax Credit 2022 Baby Born In 2022. This is a significant increase. If your child is eligible for the disability tax credit, you may also be eligible for the child disability benefit.

If your child was born in 2021, you’ll still qualify for the full $3,600 tax credit. Irs warns of errors in letter 6419, what should you do? 9 possible reasons you didn’t get your first child tax credit payment

Kairi Is The First Child Of Shifra And Gal Afik, Who Were.

If instead your child is born in december, then the entire $3,600 credit will just be applied as a lump sum at tax season. Families with babies or children born, adopted or fostered in 2021 will be able to claim the full enhanced ctc credit on their 2021 tax returns, giving them a. Tax refunds could bring another $1,800 per kid the last enhanced child tax credit payment will arrive with this year's tax refund.

Unless The Expanded Child Tax Credit Is Extended, Parents Of 2022 Babies Will Not Be Receiving Monthly Checks Or The Full 2021 Amount Of $3,600.

It would allow a taxpayer to claim the credit in the year before the birth if a social security number has been issued at tax time or to claim the credit for “the taxable year in which such child is miscarried or stillborn.”. The child tax credit for pregnant moms act adds onto the existing child tax credit. Can i claim child tax credit for a baby born in 2021?

In Addition, The Qualifications For The Child Tax Credit Have Broadened, Meaning More Families Can Now Qualify That Previously Could Not.

Read our child tax credit live blog for the very latest news and updates. Some news outlets are reporting that families might receive child tax credits of up to $7,200 per child in 2022. Meanwhile, some struggling families could be eligible for a payment of up to $1,400 in the early months of 2022.

Irs Warns Of Errors In Letter 6419, What Should You Do?

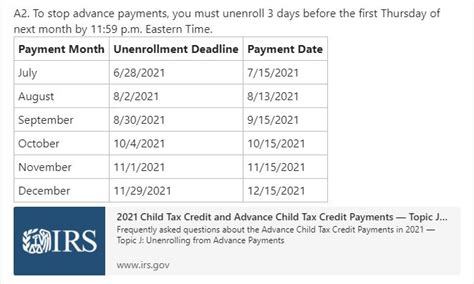

Families could receive two child tax credit payments in february 2022 if a new bill is passed to continue the stimulus relief program. If your kid was born between 2004 and 2015, you get the extra $250 a month, followed by the $1,500 credit when you file your 2021 taxes. You must reconcile these payments and claim anything more that's due to you when you file your tax return for the year in 2022.

If A Baby Was Born In 2021 Or The Family Adopted A Child In 2021, The Child Would Not Have Received Any Advance Payments And Those Payments Would.

The credit is also fully refundable in 2021. When filing taxes in 2022, claim your newborn as a dependent. The child tax credit is a credit equal to a dollar amount for each of your qualifying children.