Child Tax Credit 2022 Calendar. Irs begins 2022 tax season. The same as the second half of the previous year, the child tax credit will be sent to their rightful owners by the irs and treasury.

The bill passing will now only extend it. Parents can expect to receive their last ctc checks unless congress can make an agreement. The child tax credit payments for the 2022 calendar year will soon begin in january.

President Joe Biden Originally Wanted To Extend The Expansion Including Higher Credits And Advanced Payments To 2025.

19, 2022 at 8:59 pm est. 9, 2022 at 2:48 am pst. Here's what you need to know about the child tax credit as the calendar turns from 2021 to 2022, including what it will look like in the new year, how it.

The Enhaced Ctc Are Not Permanent Parents Of Newborns In 2021 Are Eligible For The Child Tax Credit.

Congress will need to take action to expand the $3,600 child tax credit. The irs’ child tax credit deadline for congress to extend $300 payments for families into 2022 is in four days. Families are pushing for another year of monthly $300 payments per child as the irs starts shutting down its child tax credit that runs out on december 31.

Credits Go Back To Normal.

“in january 2022, the irs will send letter 6419 with the total amount of advance child tax credit payments taxpayers received in 2021,” the irs said. The december 28 deadline looms as congress must come to a decision while families push for another year of $300 monthly payments. Possible outcomes for child tax credit in 2022.

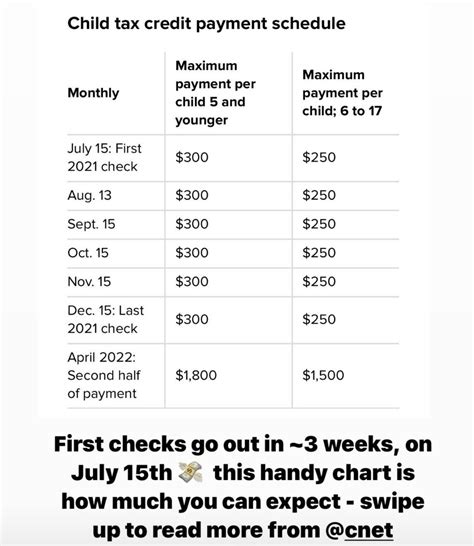

Parents Who Did Not Opt Out Of The Monthly Payments Will Get $1,500 Or $1,800 Per Child, Depending On The Child's Age, After They File Their Taxes In The Spring Of 2022.

The credits will be worth $2,000 again and there will be no monthly payments without the build back better bill. The irs said from july through december 2021, more than 36 million households received monthly advances on 2021 tax credits for children under 17 years old. The same as the second half of the previous year, the child tax credit will be sent to their rightful owners by the irs and treasury.

Carolina Bruckner, Managing Director Of The Kogod Tax Policy Center At American University, Said The Letter Documents How Many Children The Irs Is Aware Of That.

2022 changes to child tax credit in 2022, the monthly payments would continue, but this time would stretch throughout the full calendar year with 12 monthly payments, with maximums remaining the same. The build back better plan proposed by the biden administration would extend the expanded version of the child tax credit through at least 2022, with proponents hoping its popularity would make it permanent. Parents who did not opt out of the monthly payments will get $1,500 or $1,800 per child, depending on the child's age, after they file their taxes in the spring of 2022.