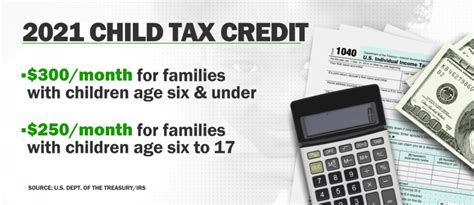

Child Tax Credit 2022 January 15. Without legislative changes, the ctc in 2022 will revert to its prior form — a $2,000 tax credit taken annually, versus the expanded ctc's credit of. If i learn anything i’ll mention it.

For this example, the maximum child tax credit owed for those two children would be $6,600 for a married couple filing a joint return or a single parent making $80,000 or less. It also raised the age limit for. A $2,000 credit per dependent under age 17;

Without Legislative Changes, The Ctc In 2022 Will Revert To Its Prior Form — A $2,000 Tax Credit Taken Annually, Versus The Expanded Ctc's Credit Of.

A $2,000 credit per dependent under age 17; If there is no extension, then the child tax credit in 2022 returns to what it was before the american rescue plan. It also raised the age limit for.

The Child Tax Credit Was Never A True Gib.

January 15, 2022 at 11:02 am you have to file for it now. Eligible families could continue seeing child tax credit payments of up to $900 in 2022 credit: For this example, the maximum child tax credit owed for those two children would be $6,600 for a married couple filing a joint return or a single parent making $80,000 or less.

I’m Going To Help A Friend With This Today.

But it was the monthly payments. Update 16 january 2022 at 05:10 est. January 15, 2022 12:03 am for the first time in half a year, families on friday are going without a monthly deposit from the child tax credit —.

The Child Tax Credit Payment Will Be Sent To You On January 15, But When You’ll Actually Get It Depends Mainly On The Payment Method.

It's $2,000 per child up. Parents who did not opt out of the monthly payments will get $1,500 or $1,800 per child, depending on the child's age, after they file their taxes in the spring of 2022. Due to congress's failure to pass an extension of the expanded child tax credit, over 30million families that might have gotten used to the monthly $300 payments did not see another round on january 15.

In The State’s Latest Budget Proposal, The Legislature Converted Dependent Exemptions For Children 12 And Younger Into A Fully Refundable Child Tax Credit That Covers Two Kids At $180 Per Child.

If there is no extension, then the child tax credit in 2022 returns to what it was before the american rescue plan. Just a pull forward of the tax credit. Our live blog this saturday, january 15, 2022, outlines our articles and guides on how to claim it.