Child Tax Credit 2022 Newborn. Child tax credit rates for the 2021 to 2022 tax year. That includes the late payment of advance payments from july.

Tax refunds could bring another $1,800 per kid the last enhanced child tax credit payment will arrive with this year's tax refund. If you had a baby in 2021 or planning on having one this year then that’s a damm lucky (tax) baby | when you file your taxes in 2022 your going to get a nice chunk of refund for the baby | there’s 2 refunds for the baby: Families that either had a newborn or adopted a child in 2021 will be able to claim the amount of the third economic impact payment (eip3) they are due through.

Tax Refunds Could Bring Another $1,800 Per Kid The Last Enhanced Child Tax Credit Payment Will Arrive With This Year's Tax Refund.

The $1,400 for each taxpayer and $1,400 for each qualifying dependent in 2021 meant a couple filing jointly. Half the total credit amount was paid in advance monthly payments in 2021. The basic amount (this is known as ‘the family element’) up to £545.

Families Could Receive Two Child Tax Credit Payments In February 2022 If A New Bill Is Passed To Continue The Stimulus Relief Program.

The child tax credit begins to be reduced to $2,000 per child if your modified agi in 2021 exceeds: That's because the child tax credit isn't based on being born prior to 2020. If instead your child is born in december, then the entire $3,600 credit will just be applied as a lump sum at tax season.

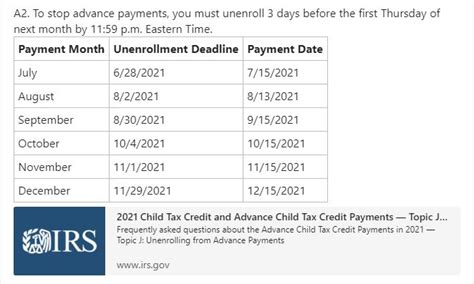

You Must Reconcile These Payments And Claim Anything More That's Due To You When You File Your Tax Return For The Year In 2022.

Can i claim child tax credit for a baby born in 2021? The child tax credit update portal shows that a payment was issued, but. $112,500 if filing as head of household;

Nearly Every Child Under The Age Of 18 Before January 1, 2022 Qualifies For The Child Tax Credit, An Estimated 65 Million People, And About 61 Million Received The Monthly Payments.

The payments for july through september ($900 total) will be applied when you file taxes in 2022. Thousands of families who welcomed a new baby into their family last year could qualify to receive up to $5,000 on their tax refund this year. The american rescue plan raised the maximum child tax credit in 2021 to $3,600 for qualifying children under the age of 6 and to $3,000 per child for qualifying children ages 6 through 17.

The Only Exceptions Are Newborns At The End Of 2021.

9 possible reasons you didn’t get your first child tax credit payment Stimulus checks and child tax credits worth thousands of dollars can be claimed in 2022 credit: Who qualifies for the child tax credit?