Child Tax Credit 2022 Reddit. Woody, a single mother, relied on the check to help raise her young son. Although the child tax credit is not available at the moment, there are other tax provisions that may affect your 2020 tax return.

/cdn.vox-cdn.com/uploads/chorus_image/image/70490373/AP21012683535483.0.jpg)

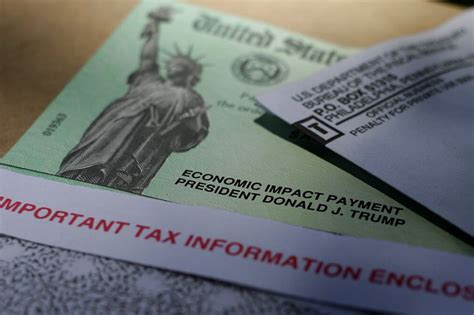

Between july and december, the expanded child tax credit provided parents a cross the united states a small financial reprieve from the pandemic’s economic turbulence. Except for citizenship, a basic income is entirely unconditional. The size of the credit will be cut in 2022, with full payments only going to families that earned enough income to owe taxes, a policy choice that.

The Child Tax Credit Was Expanded For Only A Year Under The Stimulus Law And It Expired At The End Of 2021.

President joe biden speaks in the east room of the white house, monday, feb. Americans must file 2021 taxes to get 2nd half of child tax credit payments. Larson, bronin urge extension of child tax credit.

Business Insider Reports That Half Of The Amount Owed To Families Through The Program Will Be Given In The Monthly Checks.

28, the tally of outstanding individual and business returns requiring what the irs calls “manual processing” — an operation where an employee must take at least one action rather than relying on an automated system to move the case. Except for citizenship, a basic income is entirely unconditional. A recent analysis by researchers at washington university in st.

The Expanded Child Tax Credits Were Seen As Slashing Child Poverty To The Lowest Levels On Record.

The size of the credit will be cut in 2022, with full payments only going to families that earned enough income to owe taxes, a policy choice that. Study on child brain activity another reason for congressional activity on child tax credit by the bdn editorial board january 27, 2022 january 27, 2022 share this: The program’s reach had been widened to.

Child Tax Credit Still Available For Families That File Tax Returns The.

Many parents who received the child tax credit payment throughout 2021 will likely see a smaller tax refund this spring, per cnn. For tax year 2022, the child tax payment reverts to $2,000 annually per qualifying child, which in. The enhanced portion of the child tax credit program has since lapsed.

Although The Child Tax Credit Is Not Available At The Moment, There Are Other Tax Provisions That May Affect Your 2020 Tax Return.

Between july and december, the expanded child tax credit provided parents a cross the united states a small financial reprieve from the pandemic’s economic turbulence. On the 15th of each month. Louis and appalachian state university found no evidence that the monthly payments caused parents to stop working, which was one of the criticisms by opponents of the expanded credit.