Child Tax Credit 2022 Vote. The irs paid most american parents as much as $300 per child from july through december last year. Parents or guardians with at least one child under 18 in the household made up 27.

The fate of extending the child tax credit expansion in 2022 lies with the u.s. In 2020, you were eligible for the full child tax credit payment if you made $200,000 or less, or $400,000 for married couples. Any hope of receiving a child tax credit payment in january 2022 is slowly slipping away as congress holds the key to more money for americans.

Biden Pushed To Enact Bbb

The hopes of millions of families have been dealt a blow If the vote is no, the child tax credit will revert back to its original amount. Sentiment on the expanded child tax credit’s expiration.

Many People Are Concerned About How Parents.

I call on them to make the child tax credit a priority in 2022. The enhanced value of the child tax credit would be extended for another year, through 2022. A group of senate democrats is pushing president joe biden not to give up on the child tax credit after biden said he thought he’d be unable to revive the monthly child allowance program.

1, 2022 At 9:19 Am Pst.

This all means that a $250 or a $300 payment for each child has been direct deposited each month. Barring action from congress, the child tax credit will not cease to exist but it will revert back to a benefit which families see annually when they file their tax returns. Any hope of receiving a child tax credit payment in january 2022 is slowly slipping away as congress holds the key to more money for americans.

The White House On Thursday Ruled Out Trying To Pass An Extension Of The Expanded Child Tax Credit In A Standalone Bill, Saying Democrats Would Not Have The Votes To Pass It.

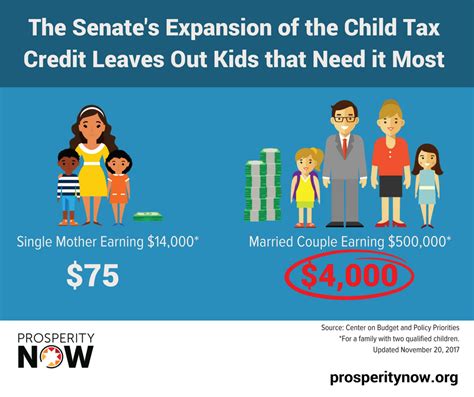

According to the working families party, an extension of the child tax credit, which expired on december 31, would benefit 90% of children in america. That expansion, which increased the $2,000 per child benefit to $3,600 for children under 6 and $3,000 for older children, allowed families to receive the credits in monthly installments and made. A $2,000 credit per dependent under age 17;

The Irs Paid Most American Parents As Much As $300 Per Child From July Through December Last Year.

As of now, the size of the credit will be cut in 2022 back to $2,000 (some families earned up to $3,600 in 2021), with full payments only. Parents would get up to $3,000 per child under age 18,. Why build back better vote is crucial.