studiocasper/iStock by way of Getty Photographs

The Q2 2022 World X China Sector Report could be considered right here. The report supplies macro-level and sector-specific insights throughout the eleven main financial sectors in China’s fairness market. Along with a abstract of developments in Q2, we additionally supply our outlook for the present quarter. For a broader take a look at World X’s worldwide funds, please see the most recent Worldwide Report Q2 2022.

Q2 Abstract: Shanghai Lockdown Shakes Chinese language Economic system

China confronted important setbacks in Q2 2022 as a surge in Omicron instances introduced Shanghai, a metropolis that accounted for 3.8% of China’s GDP in 2020, into roughly a two-month lockdown, leading to year-on-year GDP development of 0.4% in Q2 and a pair of.5% in H1 (first half of) 2022, off observe for the unique purpose of round 5.5% development in 2022.1,2 Though China dodged a recession, Omicron did complicate its different purpose of financial stability above all in 2022.

Across the starting of Q2, Shanghai entered a state of lockdown that lasted from the start of April to the start of June, creating logjams in world provide chains and miserable home client confidence. Though policymakers moved to restrict the adversarial impacts of the lockdown by permitting employees to function in “closed-loop programs,” just like what was applied within the 2022 Beijing Winter Olympics, it was not sufficient to cease financial bleeding. Because the lockdown continued, common dwell occasions for import containers on the port of Shanghai ballooned whereas vans confronted obstacles in taking supplies and items out and in of town.

Originally of June, the lockdown was formally lifted, however sure restrictions remained in place, notably on dining-in and journey.

The convergence of headwinds in 2022 is prompting Beijing to keep up an accommodative stance on the financial system. Whereas central banks all over the world are shifting in step with the US Federal Reserve and elevating rates of interest, in Could, China made the choice to chop its five-year mortgage prime fee (LPR), used for mortgage pricing, by a more-than-expected 15 foundation factors.3 This was quickly adopted up by the discharge of a 33-point stimulus plan on Could 31, that features tax and charge reductions for MSMEs (Micro, Small, and Medium Enterprises), the issuance of special-purpose bonds for infrastructure tasks and providing incentives to rent new graduates, amongst many different factors.4 This dovish stance in financial coverage counters to the rising inflation narrative and hawkish insurance policies set by central banks globally, however speaks to China’s need to stimulate its financial system.

On the similar time, regulators started to see the deserves in easing the tech crackdown that grabbed headlines in 2021. The tone started to vary in Q2. In Could, high Chinese language Communist Celebration officers held a symposium with leaders of huge tech corporations and provided to revive confidence within the battered sector. In June, the Individuals’s Financial institution of China (PBoC) accepted Ant Group’s (BABA) software to ascertain a monetary holding firm whereas regulators provided tentative approval for its itemizing, the probe into Didi (OTCPK:DIDIY) wrapped up and its apps had been allowed again on Chinese language app shops, and a report by the Chinese language Academy of Social Sciences emphasised the position of web platform corporations as “high contributors” to the Frequent Prosperity initiative.

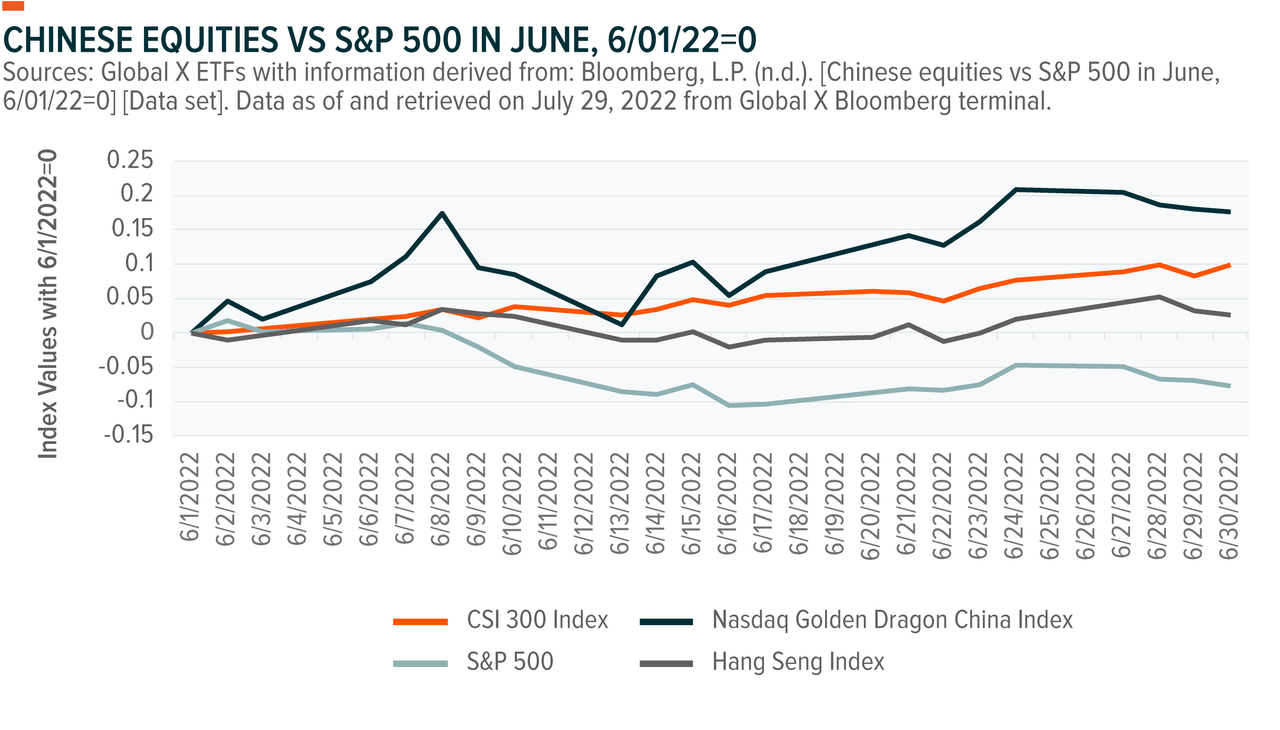

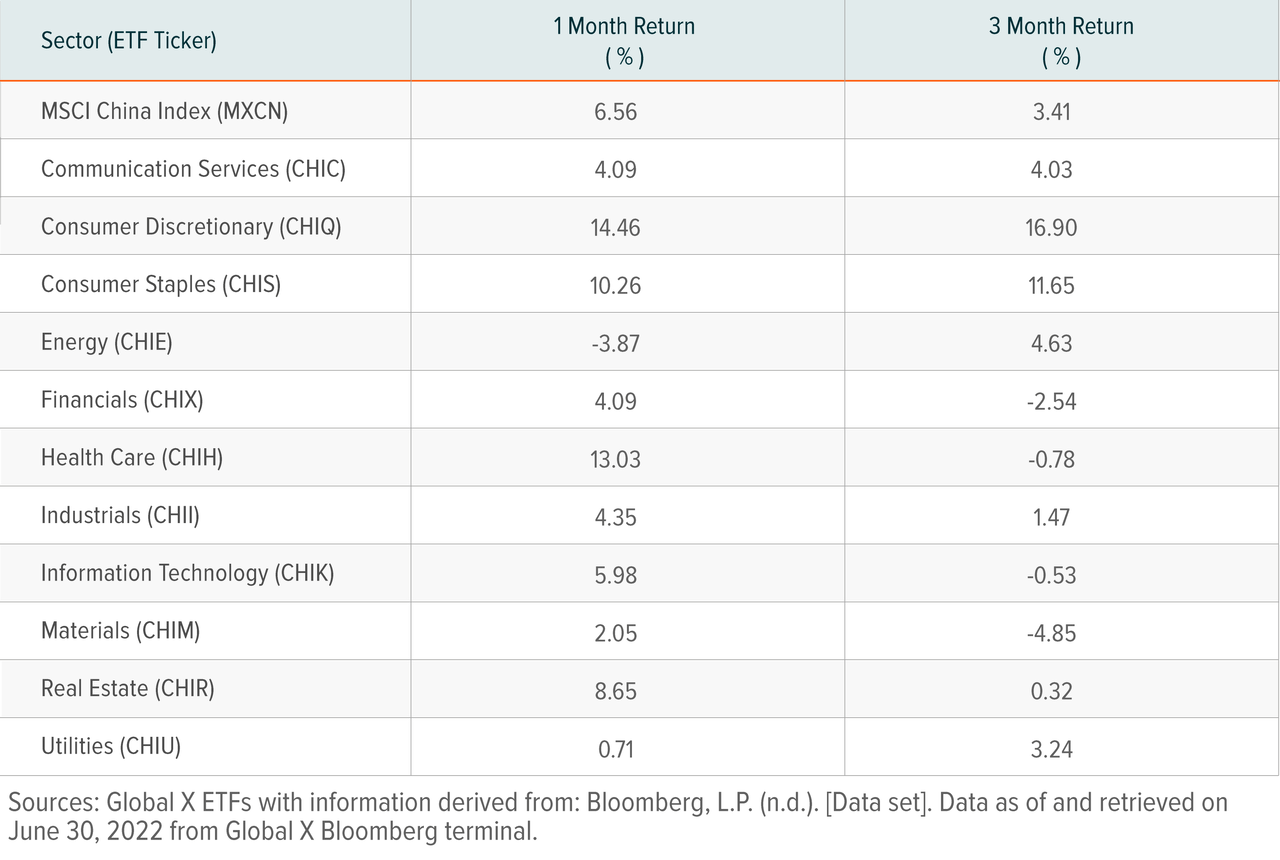

The mixture of those components led to a rally in Chinese language equities in June whereas equities in different markets fell. In June 2022, the CSI 300 Index jumped up by 9.6%, the Nasdaq Golden Dragon China Index jumped up by 16%, and the Grasp Seng Index made extra average good points of two.1%.5 Inside World X’s China Sector lineup, the World X MSCI China Shopper Discretionary ETF (CHIQ) carried out the perfect, posting good points of 16.90% in Q2. Over the identical time interval, the World X MSCI China Shopper Staples ETF (CHIS) delivered the second finest good points, rising by 11.65% in Q2.

Q3 Insights: Constructing Off June’s Momentum, Whereas Watching COVID Wildcard

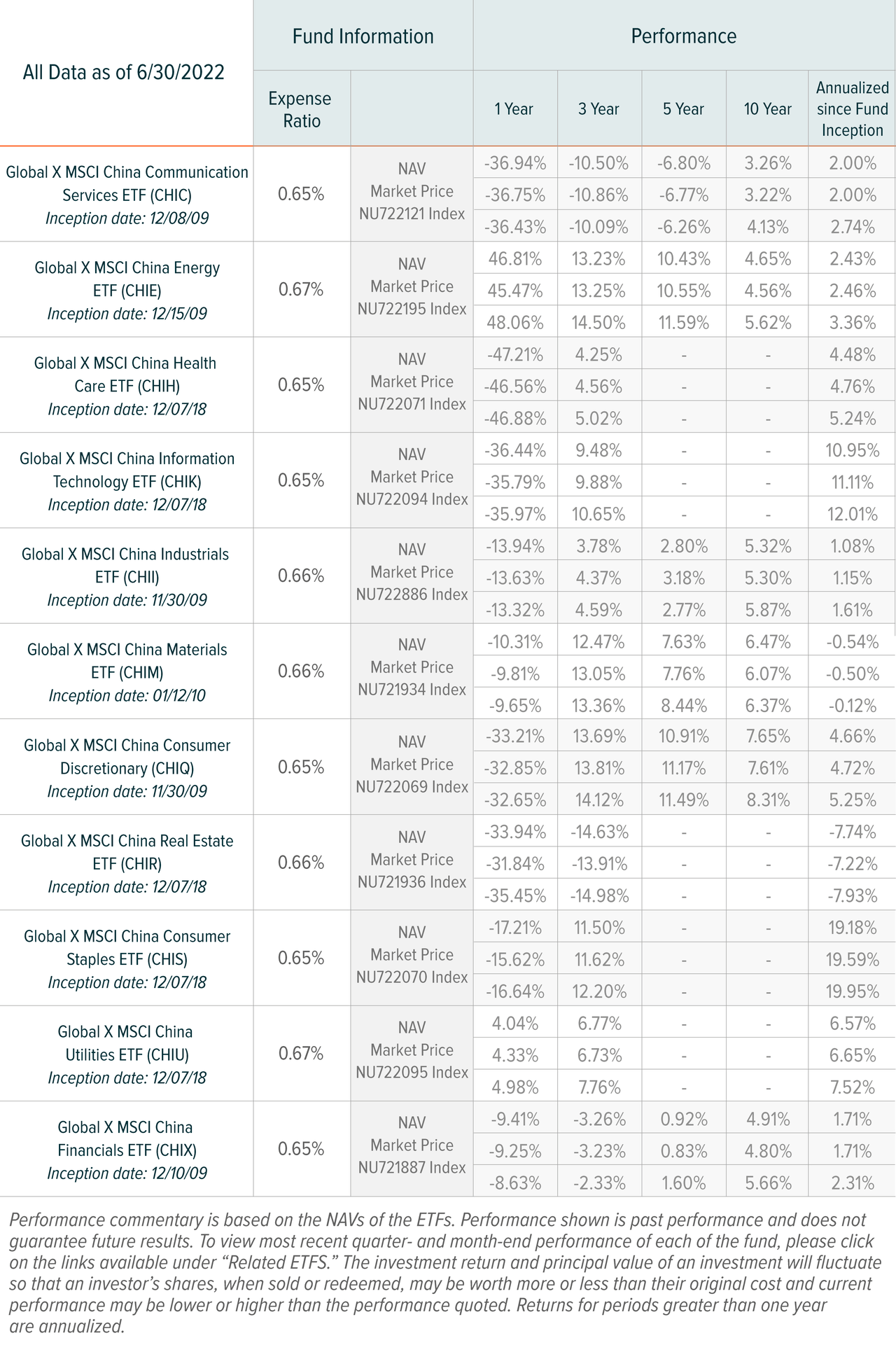

As we transfer into Q3, extra buyers at the moment are taking a look at Chinese language equities, portion of which we imagine at the moment are sitting at attractively low-cost valuations. The MSCI China Index has a 12-month ahead Value-to-Earnings (P/E) ratio of 11.28, whereas 12-month ahead P/E ratios of the World X MSCI China Financials ETF (CHIX) and World X MSCI China Shopper Discretionary ETF (CHIQ) are at 4.52 and 23.48, respectively, as of Jul 28, 2022.6

Greater than a month out from the formal finish of the Shanghai lockdown, China is shifting in the direction of restoration with the Buying Supervisor Index (PMI) returning to enlargement territory whereas a average Shopper Value Index (CPI) of two.5% in June provides policymakers room to keep up easing.7 Nonetheless, challenges exist. Specifically, the danger of one other lockdown in a significant metropolis is a wildcard that may undermine forecasts. China will probably publish first rate development in Q3, albeit boosted to some extent by a low-base impact.

The zero-COVID coverage will probably persist till after the top of 2022. Apart from political issues such because the upcoming 20th Celebration Congress, comparatively low vaccinations charges among the many aged make it troublesome to change away from the zero-COVID method. Proper now, the unfold of the brand new BA2.75 Omicron subvariant is creating nervousness and prompting officers to implement mass-testing in main cities like Beijing and Shanghai. As of Jul 19, the weekly common case rely in China was at 528, down from a peak of over 26,000 in mid-April.8 Whether or not this momentum will result in one other lockdown has but to be seen, however that’s definitely an consequence Beijing hopes to keep away from.

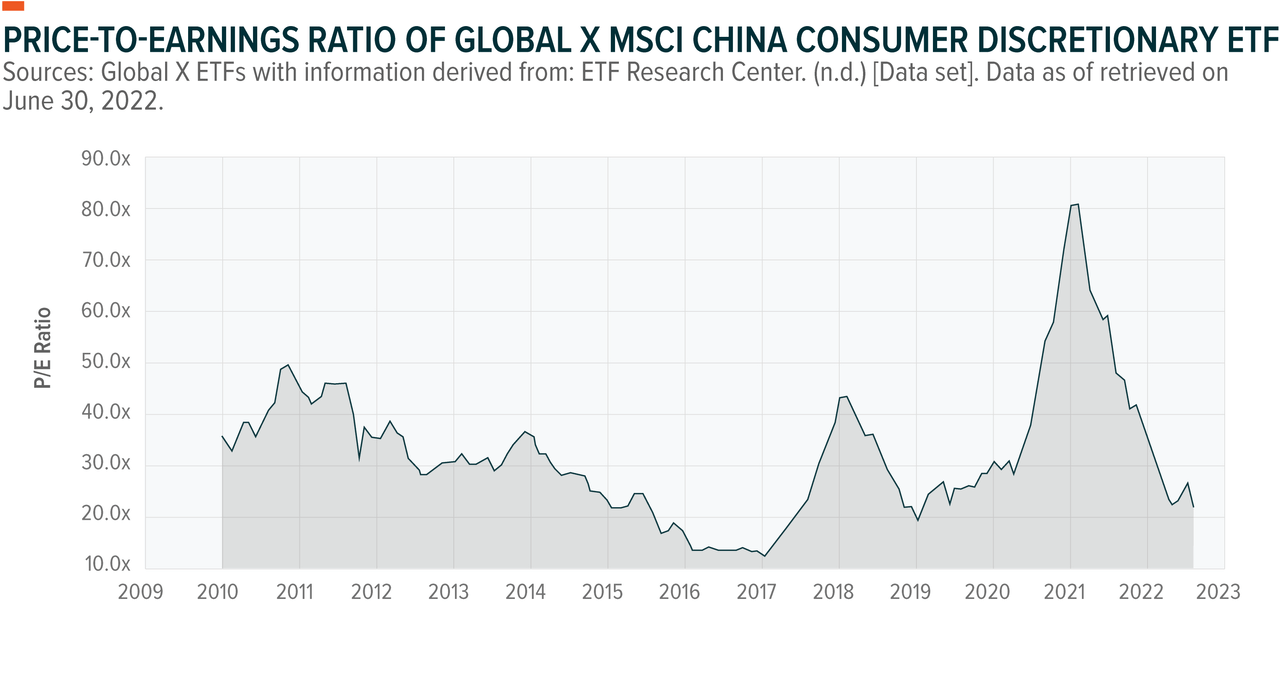

Regardless of uncertainty within the short-term macro story, low-cost valuations are drawing investor consideration, notably for the tech corporations, which together with training corporations bore the brunt of 2021’s regulatory strikes. Alibaba (BABA), Pinduoduo (PDD), and JD.com (JD) are examples of tech corporations that navigated via headwinds through the tech crackdown. With constructive indicators suggesting the relief of the tech crackdown, we imagine costs will probably climb as buyers start to imagine that the worst is behind us.

CHIQ’s P/E ratio suffered a precipitous collapse in 2021 through the regulatory crackdown.

Numerous these client web corporations with low-cost valuations fall into Shopper Discretionary, which is a part of the rationale why CHIQ carried out so nicely in Q2. The constructive indicators of easing on the tech crackdown will probably work in favor of those holdings. In the meantime, a number of the stimulus measures pushed by the federal government embrace extending incentives for Electrical Automobiles and vehicle purchases, which can also be a class below Shopper Discretionary. In fact, these potential constructive results should be weighed towards the truth that client nervousness lingers whereas sure restrictions stay on dining-in and journey.

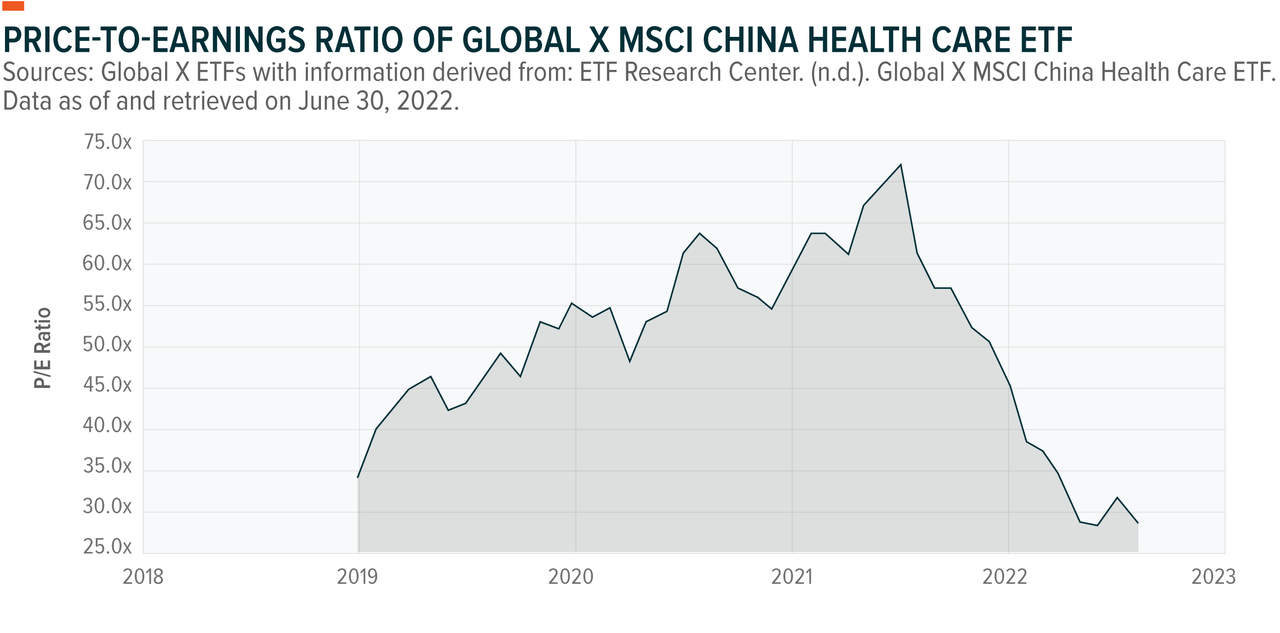

The Chinese language Healthcare sector was additionally hit exhausting by laws and noticed its worth tumble, nonetheless we see potential for restoration. Within the quick time period, China might want to put together to transition away from the zero-COVID coverage probably in some unspecified time in the future subsequent yr. Over a for much longer timeframe, China’s getting old inhabitants is a nearly irreversible pattern that ought to increase demand for healthcare providers. Enterprise capital buyers are seeing room for development within the Healthcare house, as evidenced by Sequoia China elevating $9bn for funds that may spend money on Healthcare and Data Expertise startups.9

Power shares have carried out nicely year-to-date with the World X MSCI China Power ETF (CHIE) delivering whole returns of 26.23%, as of Jun 30, 2022.10 A glance into the efficiency of holdings inside CHIE reveals a divergence between coal and oil shares, with the previous delivering exceptionally excessive returns. Power safety is high of thoughts for Chinese language policymakers this yr and approvals for coal energy are abnormally excessive because of this. As China prioritizes financial stability even additional within the aftermath of the Shanghai lockdown, and because the results of Western sanctions on Russian Power settle in, demand for coal could improve additional.

Efficiency proven is previous efficiency, primarily based on the NAVs of the underlying sector ETFs and doesn’t assure future outcomes. The funding return and principal worth of an funding will fluctuate in order that an investor’s shares, when offered or redeemed, could also be value roughly than their authentic price and present efficiency could also be decrease or greater than the efficiency quoted.

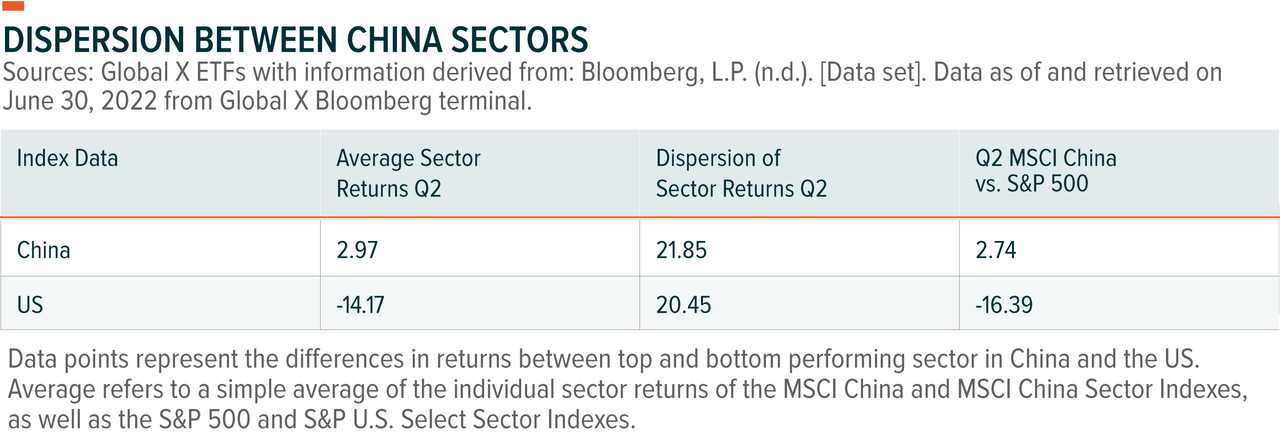

Dispersion Between China Sectors

Sector dispersion is the distinction between the perfect and worst performing sectors in every nation. In Q2, China and the US had comparable ranges of sector dispersion at round 20%. The clearest distinction is the typical sector returns. Whereas the US had strongly damaging common returns of -14.17%, China remained constructive with 1.67% good points.

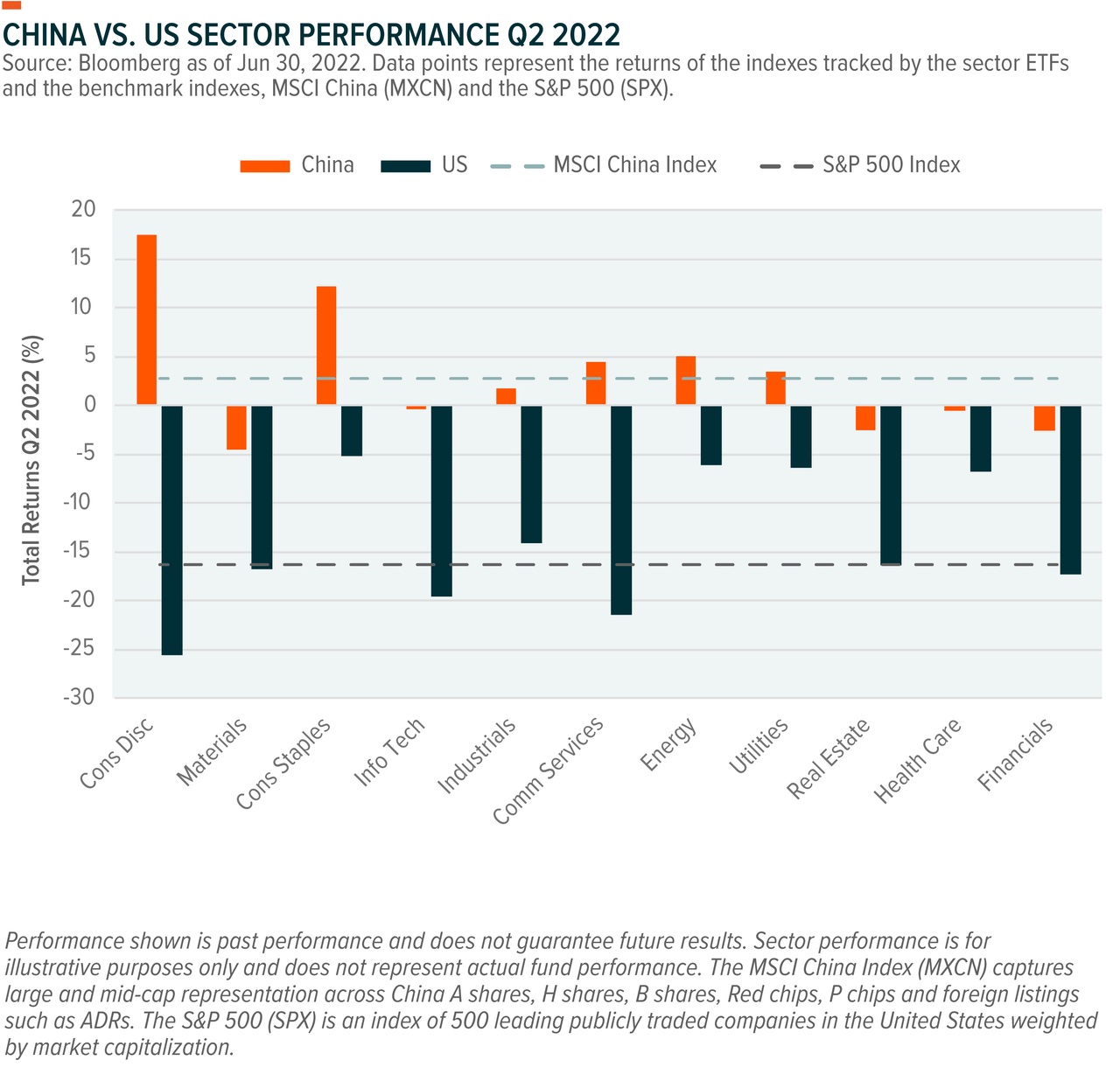

How China Sector Efficiency Measured Up In opposition to U.S. Counterparts

Within the chart beneath, we present efficiency of indexes that observe China’s 11 GICS sectors, in addition to their U.S. sector index counterparts.

Associated ETFs

FOOTNOTES

1. Textor, C. (2022, April 27). Shanghai’s share in China’s whole GDP 2005-2020. Statista. China: Shanghai’s share in China’s whole GDP | Statista

2. Yao, Okay. (2022, July 14). China GDP knowledge to indicate sharp slowdown in Q2, tepid restoration in June. Reuters. China GDP knowledge to indicate sharp slowdown in Q2, tepid restoration in June

3. Bloomberg Information. (2022, Could 19). China banks lower key fee by report to spice up ailing financial system. Bloomberg.

4. Huld, A. (2022, June 2). China releases 33 new stimulus measures to spice up financial system. China Briefing. China Stimulus Coverage – 33 New Assist Measures for Boosting Development

5. Shen, Y. (2022, June 30). Chinese language shares in US high S&P with finest month in three years. Bloomberg.

6. Bloomberg, L.P. (n.d.). [PORT function] [Data set]. Knowledge as of and retrieved on June 30, 2022 from World X Bloomberg terminal.

7. Liangping, G., Zhang, E., & Woo, R. (2022, July 9). China’s June manufacturing facility inflation cools counter to world tendencies. Reuters. China’s June manufacturing facility inflation cools counter to world tendencies

8. Ritchie, H, Mathieu, E., Rodés-Guirao, L., Appel, C., Giattino, C., Ortiz-Ospina, E., Hasell, J., Macdonald, B., Beltekian, D., & Roser, M. (2022, June 30). China: Coronavirus pandemic nation profile. China: Coronavirus Pandemic Nation Profile

9. Chen, L. Y., & Bloomberg. (2022, July 5). Sequoia China has raised $9 billion to spend money on tech and well being care as buyers flock again to the nation. Fortune. Sequoia China has raised $9 billion to spend money on tech and well being care as buyers flock again to the nation

10. Bloomberg, L.P. (n.d.). [PORT function] [Data set]. Knowledge as of and retrieved on June 30, 2022 from World X Bloomberg terminal.

GLOSSARY

CSI 300 Index: The CSI 300 Index is a free-float weighted index that consists of 300 A-share shares listed on the Shanghai or Shenzhen inventory exchanges.

Nasdaq Golden Dragon China Index: The NASDAQ Golden Dragon China Index is a modified market capitalization weighted index comprised of corporations whose frequent inventory is publicly traded in america and the vast majority of whose enterprise is carried out throughout the Individuals’s Republic of China.

Grasp Seng Index: The Grasp Seng Index (“HSI”) is a freefloat-adjusted index that features the most important and most liquid shares listed on the Most important Board of the Inventory Trade of Hong Kong.

This materials represents an evaluation of the market surroundings at a selected cut-off date and isn’t meant to be a forecast of future occasions, or a assure of future outcomes. This data shouldn’t be relied upon by the reader as analysis or funding recommendation concerning the funds or any inventory specifically. Dialogue of funds aside from the World X ETFs is meant for informational functions solely and isn’t meant as a suggestion to promote or solicitation of a suggestion to purchase any funds.

Investing includes danger, together with the doable lack of principal. Worldwide investments could contain danger of capital loss from unfavorable fluctuation in foreign money values, from variations in typically accepted accounting rules, or from financial or political instability in different nations. Rising markets contain heightened dangers associated to the identical components in addition to elevated volatility and decrease buying and selling quantity. Securities specializing in a single nation and narrowly centered investments could also be topic to greater volatility. The World X China Sector Funds are non-diversified.

Shares of ETFs are purchased and offered at market value (not NAV) and are usually not individually redeemed from the Fund. Brokerage commissions will scale back returns. Ahead wanting traits are usually not a forecast of the funds’ future efficiency. Starting October 15, 2020, market value returns are primarily based on the official closing value of an ETF share or, if the official closing value isn’t out there, the midpoint between the nationwide finest bid and nationwide finest supply (“NBBO”) as of the time the ETF calculates present NAV per share. Previous to October 15, 2020, market value returns had been primarily based on the midpoint between the Bid and Ask value. NAVs are calculated utilizing costs as of 4:00 PM Jap Time. The returns proven don’t symbolize the returns you’ll obtain for those who traded shares at different occasions. Indices are unmanaged and don’t embrace the impact of charges, bills or gross sales costs. One can not make investments immediately in an index.

Ahead wanting traits are usually not a forecast of the funds’ future efficiency.

Fastidiously contemplate the funds’ funding goals, dangers, and costs and bills. This and different data could be discovered within the funds’ full or abstract prospectuses, which can be obtained at globalxetfs.com. Please learn the prospectus rigorously earlier than investing.

World X Administration Firm LLC serves as an advisor to World X Funds. The Funds are distributed by SEI Investments Distribution Co. (SIDCO), which isn’t affiliated with World X Administration Firm LLC. World X Funds are usually not sponsored, endorsed, issued, offered or promoted by MSCI nor does MSCI make any representations concerning the advisability of investing within the World X Funds. Neither SIDCO nor World X is affiliated with MSCI.

Authentic Publish

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.