alvarez

History

Yearly I create a write-up on my previous year’s profile efficiency. For in 2014’s item, please visit this site. For those that are brand-new, I bet Big league Baseball worldwide Baseball Standard and also my routine period group is the MD Blue Crabs. I handle my moms and dads’ supply profiles and also have strategies to open my very own possession monitoring firm, DocShah Funding to the general public in the following one to 2 years. I have actually composed on Looking for Alpha given that 2018, when I began handling my moms and dads’ profiles.

In the previous 5 years:

- I have actually produced a CAGR of over 26%

- I ended up being rated in the leading 1% of experts on TipRanks

- My ordinary return per score mores than 40%

- My profiles have actually expanded from $200k to $637k, which stands for a 218% or 3.2 x gain.

In 2022, my return was 19%. This defeated the Nasdaq, which was down (30%) on the year, by virtually 50%. In a year where all indices remained in bearish market, I had the ability to create a return constant with years past. In this post, I will certainly review the details supplies I possessed, just how I assess a supply, and also what visitors can do to make wonderful financial investments themselves.

My 2022 Returns

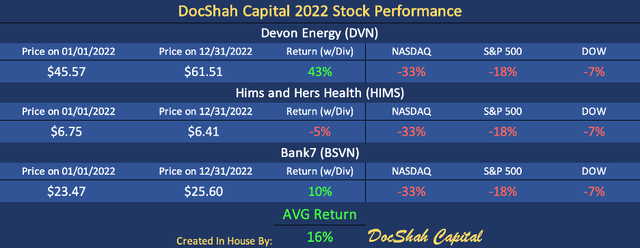

DocShah Funding’s Person Supply Efficiency ( Writer)

An equivalent weighting in each supply for the whole year would certainly have caused a 16% return. My profile returned 19% as I did not have equivalent weighting in each supply and also I dealt at numerous times throughout the year.

My 2022 Holdings

I mostly held 3 supplies in all of 2022: Devon Power (DVN), Hims & & Hers Wellness (HIMS), and also Bank7 (BSVN). Below is just how I examined each supply:

Devon Power

Devon’s supply rate depended greatly on the rate of oil and also gas. I initially acquired shares at the end of 2020. My key factor for getting Devon was I anticipated the rate of oil to increase considerably, which would greatly enhance the firm’s FCF and also press the supply rate greater.

Complying with COVID-19, need for oil plunged as the general public was purchased to stay at home and also excess supply developed, which cratered the rate of oil. Eventually, supply started minimizing to match need. Nonetheless, need resembles a faucet as it can be shut off and also on … yet, supply is not– it requires time, capital expense, and also sources to create oil. This timing distinction is what I anticipated would certainly press the rate of oil greater as there just would not suffice supply to stay on par with the recovered need.

As well as this is specifically what took place over the following twelve months as the rate of WTI Petroleum went from the top $30s to more than $100 per barrel. Because of this, Devon generated huge totally free capital which pressed their supply rate from $8 to $80 within 2 years. Below are several of the details points I suched as regarding the firm:

- Lengthy background of productivity

- 9% variable reward return

- No significant financial obligation payments till 2030

- $ 1.3 billion in money

- Investor pleasant monitoring

Hims & & Hers Wellness

Hims’ injury up being my most significant setting in the direction of completion of the year. I have actually composed several posts throughout 2022, yet the bull thesis is easy: Hims is a telehealth firm that makes it simpler for people to gain access to medical care utilizing their digital tools. The firm gets on the verge of productivity. Below are several of the details points I suched as regarding the firm:

- Income expanding at a CAGR of 95%

- Memberships are 6x more than at creation

- Experts very own 16% of shares

- $ 200 million in money and also no financial obligation

- Ideal branding and also massive TAM

Hims struck a reduced of $2.72 previously this year regardless of its constantly wonderful incomes records. The other day, Hims made a brand-new 52-week high of $7.56, standing for a virtually 200% gain. The supply virtually tripled within a year.

Bank7

Bank7 is a tiny local financial institution centrally situated in Oklahoma. I acquired this supply in 2020 after really locating a rough diamond. A great deal of financial institutions supplies had a dangerous financing publication and also were substantially overpriced. Bank7 was the contrary– its financing publication was risk-free and also the supply was underestimated. Below are several of the details points I suched as regarding the firm:

- Constant record of incomes

- 70% inside possession

- Presented a reward throughout the heart of the pandemic (which is uncommon, yet that’s just how solid the firm’s monetary standing went to the moment).

- The reward return was substantially more than rivals

- Outstanding funding and also liquidity proportions

- Dramatically much better NIM, Performance Proportion, ROACE, ROATCE, and also ROAA than rivals.

Bank7 was a support in my profile; its supply rate hardly changed throughout 2022 and also it shook off wonderful reward revenue. The security and also uniformity in the underlying service ended up being specifically installed in its supply rate.

Features of a Great Financier

There are several attributes that wonderful financiers have, however, for the extent of this post, I will certainly review a couple of:

Self-control

In Contrast To what the majority of people assume, missing supplies is what makes you abundant. Excellent financiers do not chase after and also have the ability to consistently overlook supplies in which they do not comprehend business, despite just how prominent those supplies remain in the marketplace. Having the ability to adhere to what you recognize and also just purchase supplies in which you have an extensive understanding of business and also sentence in its future is what causes above ordinary returns.

Persistence

Those that look for to obtain abundant over night obtain neither abundant neither their rest. These people are speculators, not financiers and also will certainly not obtain above ordinary returns by going after energy supplies or speculative possessions. Ultimately, they will certainly shed a great deal of cash and also rest as a result of the anxiety of not understanding what they have When you have no idea what the possession you have does, you are mosting likely to be worried viewing its rate vary. Resting well in the evening is a deluxe just managed to financiers, not speculators. Capitalists have perseverance– they assess possessions which will certainly create returns long right into the future.

Positive Outlook

Stupid optimists make even more cash than clever pessimists. Always remember this. Pessimists will certainly not make great financial investment choices since their choice making is shadowed by negativeness. Spending for the long-lasting calls for confidence that the future will certainly be much better than today. Spend utilizing 90% reasoning and also 10% feeling.

Exactly How to Review a Supply

I wish to maintain this as easy as feasible to make it simple for financiers to use what they have actually picked up from my writing. There are particular points financiers should check out prior to buying a supply. Every person creates their very own technique and also analysis of what is essential versus what is not; nevertheless, there are some non-negotiables which should be evaluated thoroughly. They are as adheres to:

- Is earnings raising YOY?

- Is EPS raising YOY?

- Just how much money and also financial obligation does the firm have?

- What is the firm’s reward background?

- Just how does the firm contrast to rivals (some proportions I such as are: the money proportion, possession turn over proportion, gross margins, and also solvency proportion).

By especially addressing the above, financiers will certainly obtain a strong understanding of a service. From there, they are can obtain even more granular and also inevitably, job the future rate of a supply. I make use of an affordable capital version, yet that might not be simple to produce for somebody without experience. To maintain it easy, I suggest utilizing experts projection of EPS and also affixing P/E of 12-15 to forecast future capital.

For instance, if Supply A’s EPS is anticipated to be $5/share in 2025, after that we can anticipate Supply A’s rate to be someplace in the series of $60-75 in 2 years. We can contrast this projection to the present supply rate to establish what return, if any kind of, we can anticipate.

Takeaway

My 5 year collective return given that profile creation is 220% or 3.2 x greater, which exercises to be a CAGR of over 26%. I produced a 19% return throughout the bearishness of 2022 and also anticipate these outcomes to stay constant for the near future. I take wonderful satisfaction in being rated in the leading 1% of experts, yet the utmost objective is to be # 1 not 1%.

A capitalist with technique, perseverance, and also positive outlook has the qualities to be a wonderful capitalist. Complying with the 5 analysis standards in the post will certainly supply a strong base of recognizing for a lot of firms. After that, the capitalist can place a cost on business based upon its future incomes and also contrast it to the rate the marketplace has actually designated on its assumption of future incomes.

See you in 2024 with my 2023 outcomes. Many thanks for analysis, adhering to, and also commenting.