Estate Tax Brackets 2022. Every year the irs modifies the tax brackets for inflation. It increases to $12.06 million for deaths that occur in 2022.

For example, let’s say your estate is valued at $12.5 million in 2022. 2022 tax brackets (for taxes due in april 2023) announced by the irs on november 10, 2021, for individuals, married filing jointly, married filing separately and head of household are given below. Taxable income between $41,775 to $89,075.

In 2021, The Estate Tax Exemption Threshold Increases.

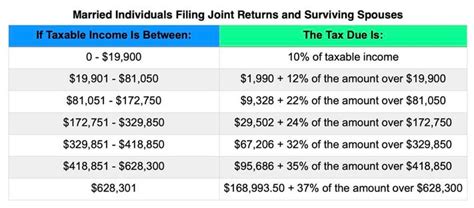

The estate tax rate in minnesota ranges from 13% to 16%. Tax brackets increase for all filing statuses. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

If You’ve Been Following The News, The Cpi (Consumer Price Index) Was 6.2% For Inflation For October, Which Was The Biggest Increase In 30 Years.

Beginning in 2022, the annual gift exclusion will be $16,000 per doner, up from $15,000 in recent years. This threshold is also indexed for inflation. For example, let’s say your estate is valued at $12.5 million in 2022.

The Alternative Minimum Tax Exemption For Estates And Trusts Will Be 26,500 (Was $25,700), And The Phaseout Of The Exemption Will Start At $88,300 (Was $85,650).

This, of course, could remain subject to change. They said due to the high amount of inflation, the brackets increase much more than normal. 10%, 12%, 22%, 24%, 32%, 35% and 37%.

Taxable Income Between $41,775 To $89,075.

The tax cut and jobs act doubled the estate tax exemption in 2018 to $11,180,000 for an individual. This jump was much higher than any increase in the past. The federal income tax consists of seven marginal tax brackets, ranging from a low of 10% to a high of 39.6%.

On Wednesday The Irs Released The Amounts For Tax Brackets And Standard Deduction For 2022.

This guide gives a full explanation of the estate tax in minnesota, so you know what to expect when estate planning. 10 percent, 12 percent, 22 percent, 24. It increases to $12.06 million for deaths that occur in 2022.