Federal Income Tax Estimator 2022. Estimate how much you'll owe in federal taxes, using your income, deductions and credits — all in just a few steps. You can estimate tax liability, taxes withheld, and tax refund.

Then taxable rate within that threshold is: How to calculate federal tax based on your annual income. 2022 federal tax withholding calculator.

Your Employer Withholds Tax From Your Income Every Pay Period But Keeping.

The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $539,900 for single filers and above $647,850 for married couples filing jointly. Click the following link to access our 2020 income tax calculator. 2022 tax return and refund estimator.

The 2022 Tax Calculator Uses The 2022 Federal Tax Tables And 2022 Federal Tax Tables, You Can View The Latest Tax Tables And Historical Tax Tables Used In Our Tax And Salary Calculators Here.

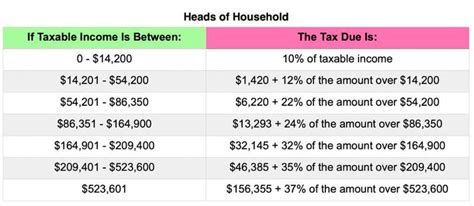

If you have only pension income (and no wage income): You can calculate your annual take home pay based of your annual gross income and the tax allowances, tax credits and tax brackets as defined in the 2022 tax tables. 2022 federal income tax rates:

This Is A Projection Based On Information You Provide.

Take note that the estimator only works for taxpayers that are paying taxes through federal income tax withholdings. Actual results will vary based on your tax situation. This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check.

Tax Estimator—Figure Out Your Taxes For The Upcoming Tax Season.

Estimate how much you'll owe in federal taxes, using your income, deductions and credits — all in just a few steps. Use the tax withholding estimator. Then taxable rate within that threshold is:

This Estimator Can Be Used By Almost All Taxpayers.

When estimating the tax on your 2022 tax return, include your household employment taxes if either of the following applies. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Last day to recharacterize an eligible traditional ira or roth ira contribution from.