ipopba

Initially uploaded on November 7, 2022

Company revenue development heads right into the last optimal week of Q3 revenues period more powerful than it started. With 85% of firms reporting at this moment, S&P 500 EPS development for the quarter continues to be at 2.2%, the same from recently. This is a 0.5 percent factor decline where assumptions based on September 30, and also notes the most affordable development price in 2 years. (Information from FactSet)

Just like every revenues period, a bulk of leading names are defeating experts’ assumptions, however at a much reduced price for Q3. Presently, 70% of firms have actually exceeded sell-side revenue assumptions, as contrasted to the 5-year standard of 77%. The percent whereby firms are defeating is additionally restrained at simply 2.2% vs. the 10-year standard of 6.5%. (Information from FactSet)

Progressive quotes are additionally being modified downward, with Q4 assumptions transforming adverse in the recently, currently prepared for to report a YoY decrease of 1%. Fiscal year 2023 quotes still stay filled with air at 5.9%, however that number has actually begun to drop (from 8.1% on September 30) as experts downgrade as a result of the solid buck, financial stagnation and also the autumn of some large technology names.

Regardless of the unstable revenues period, firms remain to take part in and also accredit share repurchase programs, an advantage to investors. It is anticipated that 2022 will certainly be a document for overall bucks utilized to redeem supplies at an approximated $1T, going beyond the previous document in 2014 which covered $900M. This leads the brand-new 1% buyback excise tax obligation collection to start in January 2023.

What will the Recently of Optimal Revenues Period Bring?

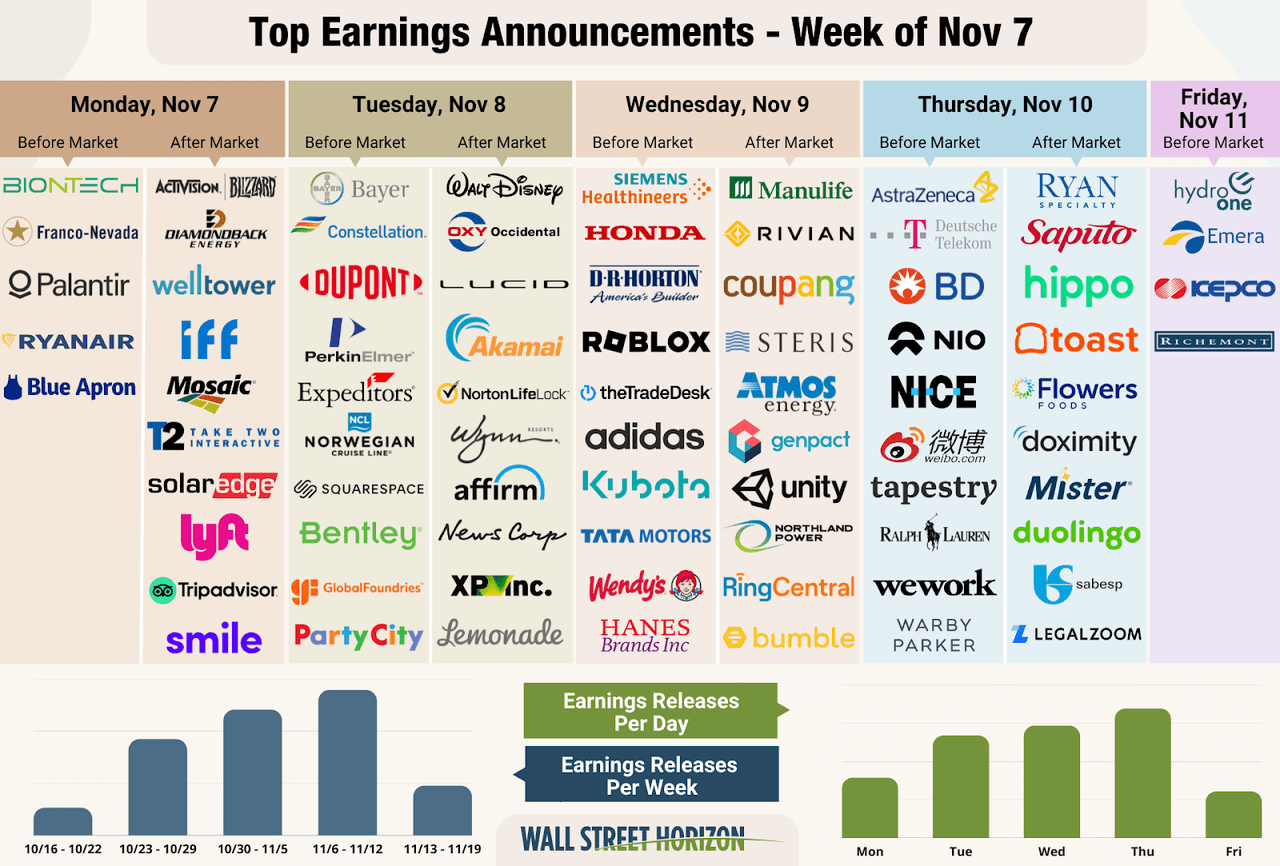

Today, we obtain Q3 arise from 33 S&P 500 firms from a touch of fields. Heavyweights to view consist of Lyft (LYFT) after their current news of a considerable labor force decrease, TripAdvisor (JOURNEY) for a more continue reading the traveling market, and also Walt Disney (DIS) for an upgrade on the streaming battles. We additionally begin to obtain arise from some clothing and also devices names such as Tapestry (TPR), Ralph Lauren (RL) and also Warby Parker (WRBY).

Leading Revenues News – Week Of November 7 ( Wall Surface Road Perspective)

Possible Shocks in the Week Ahead

Today we obtain arise from a variety of big firms on significant indexes that have actually pressed their Q3 revenues days past their historic standards. 5 firms within the S&P 500 verified outlier revenues days for today, every one of which are behind common and also as a result have adverse DateBreaks Aspects *. Those 5 names are The Mosaic Business (MOS), NiSource (NI), DuPont de Nemours (DD), Steris (STE), and also Becton, Dickinson & & Business (BDX).

NiSource Inc.

Business Confirmed Record Day: Monday, November 7, BMO

Projected Record Day (based upon historic information): Wednesday, November 2, BMO

DateBreaks Aspect: -3 *

NiSource generally reports Q3 outcomes throughout the very first week of November, and also they have actually done so for the last 8 years. There is no day of the week pattern, however over the last 4 years NI has actually reported on a Monday or Wednesday. The verified record day of November 7 is 5 days behind anticipated, possibly indicating problem will certainly be provided on the upcoming telephone call.

DuPont de Nemours

Business Confirmed Record Day: Tuesday, November 8, BMO

Projected Record Day (based upon historic information): Tuesday, November 1, BMO

DateBreaks Aspect: -3 *

Dupont traditionally has actually reported Q3 outcomes throughout the recently of October or the very first week of November on a Tuesday or Thursday. Because of this, a record day of November 2 was established. On October 20, DD verified an incomes record day of November 8, the most up to date they have actually reported third-quarter cause our 7- year background for that name. This additionally proceeds the pattern began in 2014 of Tuesday records, after on a regular basis reporting on Thursdays.

Becton, Dickinson & & Business

Business Confirmed Record Day: Thursday, November 10, BMO

Projected Record Day (based upon historic information): Thursday, November 3, BMO

DateBreaks Aspect: -3 *

Becton, Dickinson & & Business generally reports their monetary Q4 outcomes throughout the very first week of November, on a Tuesday or Thursday. On October 13, the firm verified they would certainly launch outcomes on November 10, their most recent record day in our ten years of BDX information. This recommends they will certainly share problem on the telephone call.

Q3 2022 Revenues Swing – Optimal Period Proceeds

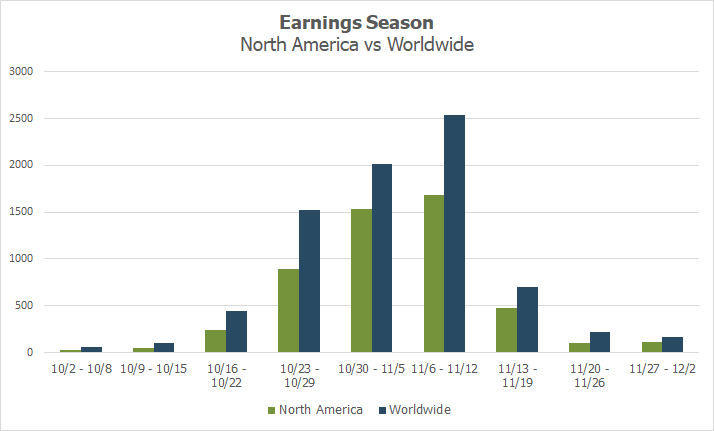

This is the last peak week of Q3 revenues period, with 3,026 firms prepared for to report (out of our world of 10,000 worldwide names). November 10 will certainly be the heaviest record day of the week with 880 firms anticipated to report. So far, 80% of firms have actually verified their revenues day and also 47% have actually reported.

Q3 2022 Revenues Period – The United States and Canada vs. Worldwide ( Wall Surface Road Perspective)

Original Blog Post