It’s simple to get caught up in all of the unfavourable information headlines we’ve acquired in 2022. Traders seemingly cannot catch a break, whether or not that be a hawkish Fed, geopolitical points, or lingering COVID-19 results spoiling the enjoyable.

Nevertheless, when taking a step again, a number of notable bulletins appear to have been forgotten amidst all of the negativity.

They usually’re not small bulletins by any means, both.

We’re speaking about vital acquisition information from large-cap tech corporations.

Alphabet GOOGL, Microsoft MSFT, and Broadcom AVGO have all introduced main acquisitions in 2022, indicating that they’re nonetheless laser-focused on progress alternatives.

Let’s take a deeper dive into every acquisition a bit of additional.

Broadcom To Purchase VMware

Broadcom introduced its plans to amass VMware VMW in a cash-and-stock transaction valued at roughly $61 billion in Might, anticipated to shut in Broadcom’s FY23.

VMware is a number one supplier of multi-cloud companies for all apps, having pioneered virtualization expertise, an innovation that has positively remodeled x86 server-based computing.

The mixed firm will supply enterprise prospects a broader platform of important infrastructure options to assist them speed up innovation and deal with probably the most advanced data expertise infrastructure necessities.

It’s been a difficult street for AVGO shares in 2022, down almost 30%.

Nevertheless, the corporate’s dividend metrics are too arduous to disregard; AVGO’s annual dividend yield sits at a steep 3.4%, visibly larger than the Zacks Laptop and Know-how sector common of 0.9%.

Additional, the corporate carries a large 26.3% five-year annualized dividend progress charge.

Picture Supply: Zacks Funding Analysis

For the cherry on high, Broadcom shares are low-cost for a expertise firm – the corporate sports activities a 13.9X ahead earnings a number of, nicely under its 16.6X five-year median and reflecting a large 34% low cost relative to its Zacks sector.

Picture Supply: Zacks Funding Analysis

Microsoft To Purchase Activision

Microsoft made an enormous splash earlier this yr, placing ahead its plans to amass Activision Blizzard ATVI for a whopping $68.7 billion – the biggest acquisition within the online game business’s historical past.

Activision Blizzard is a online game growth and interactive leisure content material writer greatest recognized for its Name of Obligation franchise. The explanations behind the deal are clear – Microsoft desires to bolster its stance within the online game business.

MSFT shares have been no exception to the market’s woes in 2022, down 30%.

Nevertheless, the corporate continues to be forecasted to develop at a strong tempo; earnings are forecasted to climb 9.2% in FY23 and an additional double-digit 16% in FY24.

Pivoting to the highest line, estimates recommend income progress of 11% and 13.4% in FY23 and FY24, respectively.

Picture Supply: Zacks Funding Analysis

Alphabet Acquires Mandiant

In March of this yr, Alphabet advised its plans to amass Mandiant for a price ticket of $5.4 billion. The deal was accomplished in September.

Mandiant is a dynamic supplier of cyber protection and response options, using its cloud-based Mandiant Benefit software program as a service (SaaS) platform.

It’s a transparent try from Alphabet to capitalize on the quickly rising cloud computing market, with Mandiant becoming a member of forces with Google Cloud.

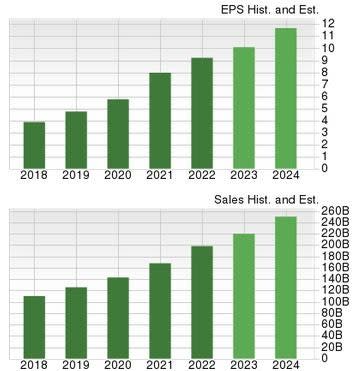

The opposed worth motion in 2022 has brought about GOOGL’s ahead earnings a number of to slip right down to 19.5X, nowhere close to its five-year median of an costly 26.8X.

Additional, the worth displays a decent 8% low cost relative to its Zacks sector.

Picture Supply: Zacks Funding Analysis

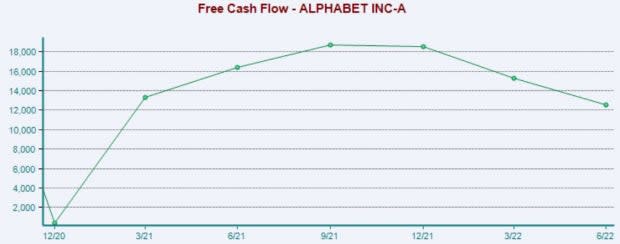

Alphabet generates critical money – in its newest print, the corporate reported quarterly free money circulation of $12.6 billion, the fourth highest of any S&P 500 firm in Q2 2022.

Picture Supply: Zacks Funding Analysis

Backside Line

Whereas unfavourable sentiment has been widespread all yr, there are nonetheless many constructive bulletins we’ve acquired from corporations, together with acquisitions from the three titans above.

Acquisitions permit for an unlimited vary of progress alternatives and for corporations to get their arms on spectacular expertise.

Additional, acquisitions communicate volumes about an organization’s future roadmap, telling us that it is keen to pursue long-term progress alternatives.

All three corporations above – Alphabet GOOGL, Microsoft MSFT, and Broadcom AVGO – have all taken on notable acquisitions in 2022.

Need the most recent suggestions from Zacks Funding Analysis? At present, you may obtain 7 Finest Shares for the Subsequent 30 Days. Click on to get this free report

Microsoft Company (MSFT) : Free Inventory Evaluation Report

Activision Blizzard, Inc (ATVI) : Free Inventory Evaluation Report

VMware, Inc. (VMW) : Free Inventory Evaluation Report

Broadcom Inc. (AVGO) : Free Inventory Evaluation Report

Alphabet Inc. (GOOGL) : Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis