Fsa Vs Child Tax Credit 2022. Agi 150,000 and dcsfsa (row 5, with $5,000) state ca row 23 (original credit) and 24 (new credit) provide $1,170 and row 26 (original child tax credit) and row 27 (new tax credit) provide $3,600 the tax in row 29 (original federal income tax) and forw 30 (new. But, whether you choose the fsa or the tax credit may come down to how many dependents you have.

The credit percentage gradually phases down to 20% for individuals with adjusted gross income (agi) between $125,000 (currently $15,000) and $183,000, and completely phases out for individuals. Washington — the internal revenue service today issued guidance on the taxability of dependent care assistance programs for 2021 and 2022, clarifying that amounts attributable to carryovers or an extended period for incurring claims generally are not taxable. The credit begins to phase out for taxpayers with modified adjusted gross income in excess of $223,410 (up $6,750 from 2021) and is completely phased out for taxpayers with modified adjusted gross income of $263,410 or more (up $6,750.

Washington — The Internal Revenue Service Today Issued Guidance On The Taxability Of Dependent Care Assistance Programs For 2021 And 2022, Clarifying That Amounts Attributable To Carryovers Or An Extended Period For Incurring Claims Generally Are Not Taxable.

Child care tax credit you have another option for saving money on dependent care expenses via lowering your taxable income: The 2022 limits, as compared to the 2021 limits, are outlined below: The tax in row 29 (original federal income tax) and forw 30 (new federal income tax) show $2,890.00.

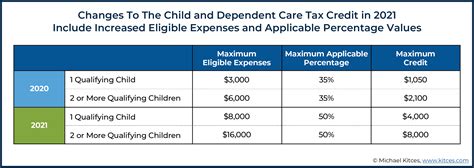

For Families With Two Or More Children, The Credit Was Raised To $16,000 From $6,000.

Form 2441 should be filed along with your 2021 tax return to take advantage of the dependent care tax credit. The maximum credit for one child is $3,000 per year, or $6,000 for two or more children (not to exceed $6,000). But, whether you choose the fsa or the tax credit may come down to how many dependents you have.

This Figure Accounts For The Pre.

Agi 150,000 and dcsfsa (row 5, with $5,000) state ca row 23 (original credit) and 24 (new credit) provide $1,170 and row 26 (original child tax credit) and row 27 (new tax credit) provide $3,600 the tax in row 29 (original federal income tax) and forw 30 (new. Approximate value of fully contributing up to your employer’s plan limit in a dependent care flexible spending account in 2021. If you used $5,000 in fsa dollars yet spent $12,000 in care for your one child, you could use $3,000 — the difference between $5,000.

The 35% Maximum Credit Applied To Taxpayers With An Adjusted Gross Income (Agi) Of $15,000 Or.

The federal tax credit for child care is lowers your federal taxes its a credit not a deduction by anywhere between 35 and 20 of up to 3000 for one child or 6000 for two or more. That means the fsa is still the better bet. In past years, the amount of the credit was 20 percent of expenses so $600 for one child and $1,200 for two or more children.

Child Care Tax Credit Vs Child Care Fsa For 2021 If You Did Not Request Reimbursement From The Fsa Custodian And The Full $5000 Is Still In Your Account:

For your 2021 taxes, the amount of credit gradually decreases based on your family’s household income, but most should see some increased tax. For families with two or more children, the credit was raised to $16,000 from $6,000. · both the dependent care fsa and the dependent care tax credit are limited to the childcare expenses incurred prior to the child turning 13, unless they meet other criteria, such as.