Harris County Property Tax Due Date 2022. In that case, then the next business day (or first business day in february) is honored as timely for receipt of payment. The 2021 property taxes are due january 31, 2022.

1 sales formarch 1, 2022 location: “i hope this extension helps ease property owners’ burdens during this critical time,” bennett said. This is the last day to pay 2021 property taxes without incurring delinquent penalty and interest.

1,360 Annually Or About 113.00 Per Month.

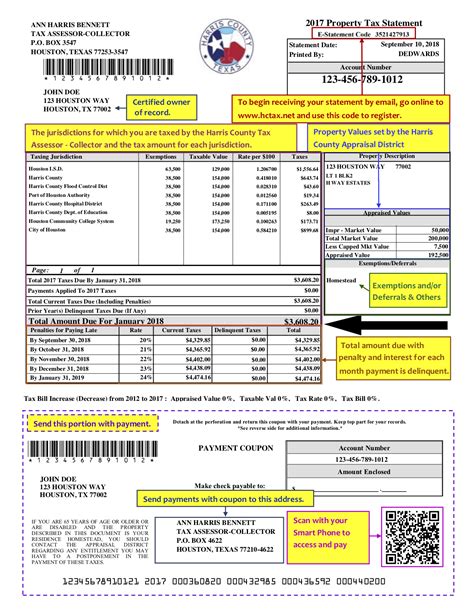

The median property tax in harris county, texas is $3,040 per year for a home worth the median value of $131,700. Last day to file a protest for property taxes with the appraisal review board. Complete the form and mail after jan.

If You Have A Mortgage Most Lenders Collect The Property Taxes Each Month, Hold It In Escrow, Then Pay The Tax Bill On Your Behalf Each Year.

8 sales for march 1, 2022 location: Harris county has one of the highest median property taxes in the united states, and is ranked 152nd of the 3143 counties in order of. Prior year(s) taxes due (if any):

The 2021 Property Taxes Are Due January 31, 2022.

Tax sales information* 1) tax foreclosure sales are conducted by the sheriff or constable of. The 38 best 'harris county georgia property tax due dates' images and discussions of february 2022. Tax sales information* 1) tax foreclosure sales are conducted by the sheriff or constable of the county where the property is located.

The Fiscal Year 2022 Budget Must Rely On Assumptions About The Tax Base And Tax Rate, Rather Than Actuals.

The basic rules of filing for the homestead exemption are. Learn all about harris county real estate tax. If your taxes are 8,500, homestead saving would be approx.

This Is The Last Day To Pay 2021 Property Taxes Without Incurring Delinquent Penalty And Interest.

Property tax payments are due by january 31st in order to be considered timely. 9401 knight road, houston, tx 77045. If your account is late certified and your delinquency date is anything other than february 1, 2022, then your future payment due dates will be based on that delinquency date.