Hmrc Tax Return Deadline 2022. Hmrc has, like last year, waived penalties on late tax returns until 28 february and late tax payments until 1 april. Thursday january 06 2022, 4.00pm,.

Hmrc announces one month extension to self assessment tax return deadline 14th january 2022 due to the ongoing issues relating to the coronavirus pandemic and its impact, hmrc has announced that it will waive late filing and late payment penalties (but not interest) on 20/21 self assessment tax returns and payments for one month. Today hmrc has announced that we will not charge: Midnight 31 january 2022 (you can submit up to 28 february 2022 without getting a late filing penalty) pay the tax you owe

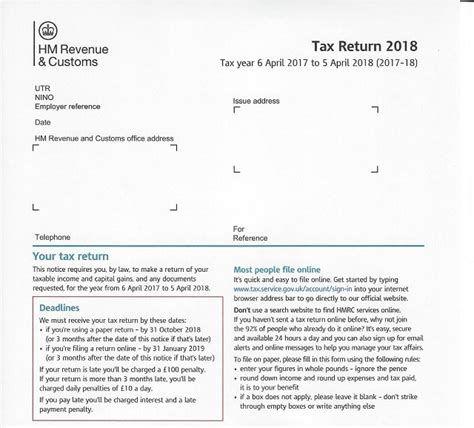

This Is The Deadline For Filing A Paper Tax Return, However, If You Receive A Notice From Hmrc That You Must File A Tax Return After 31 July 2022, You'll Need To Send Back The Completed Form Within Three Months Of The Date Issued On The Notice.

Almost 6.5m of the 12.2m self assessment taxpayers have already submitted their tax return in advance of the 31 january 2022 deadline. The deadline to file and pay remains 31 january 2022. Hmrc has, like last year, waived penalties on late tax returns until 28 february and late tax payments until 1 april.

You will usually pay a penalty if you’re late. The due date of 31 january 2022 remains and hmrc is still encouraging taxpayers to try and meet this deadline. There are many unexpected ways that you can find yourself saving money and time with things such as a marriage allowance or paying your tax bill in instalments.

Anyone Who Cannot File Their Return By The 31 January Deadline Will Not Receive A Late Filing Penalty If.

If you submit a paper tax return, you need to. Thursday january 06 2022, 4.00pm,. Hmrc tax returns is a trading name of aces accounts and taxation ltd, we deal with individuals who need help completing their hmrc tax returns.

If That Is Not Possible, Tax Credits Will Be Finalised Based On The Information Hmrc Holds At The Time.

Midnight 31 january 2022 (you can submit up to 28 february 2022 without getting a late filing penalty) pay the tax you owe Hmrc must receive your tax return and any money you owe by the deadline. Hmrc is urging those who are still to file their tax return, pay any outstanding liabilities or set up a payment plan, to do so ahead of the deadline to avoid paying interest on all outstanding balances from 1 february.

Late Payment Penalties For Those Who Pay The Tax Due In Full Or Set Up A Payment Plan By 1 April 2022.

Hmrc extends tax return deadline by 30 days as half of workers yet to file late penalties waived after accountants call in sick with omicron by harry brennan 6 january 2022 •. The penalty waivers will mean that: The deadline for filing paper tax returns in the uk for the 2020/21 tax year has already passed, as this was october 31 2021.