How To Apply For Stimulus Check Illinois. Getty should it become law, single taxpayers earning less than $75,000 would receive a $200 check , while the amount is $400 for joint filers earning less than $150,000, according to wcia. Return.” this should lead you to a page with the option to start an application for the stimulus check.

To help these workers bear those purchases, an additional $700mn has been announced by the government as financial relief. Income > $75,000 will have $5 taken from that $1,200 for every $100 they earn above $75,000. There are also other requirements that states can set, such as how much you have in your bank account.

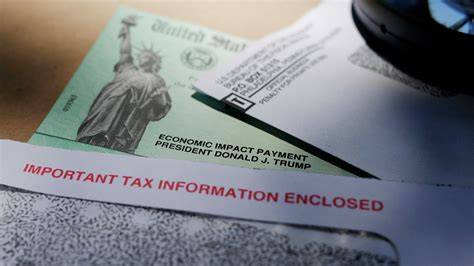

This latest $1,400 stimulus check will come as a major relief to many people across the. Most people who are missing stimulus checks can claim the missing amount by. 18 and must have proof they meet certain.

Only Eligible Applicants Will Receive The Payments.

It is not too late. In a nutshell, federal funding will help unemployed illinoians in the months to come, but not everyone will be eligible for all benefits, and some benefits will not begin immediately. But, the state has been generous with several of the other benefits, such.

You Must Have A Valid Social Security Number And You Can T Have Been Claimed As A Dependent On Someone Else S 2019 Tax Return.

In addition to the tax returns, this form must also be submitted. If you used turbo tax or h&r block to prepare your 2019 taxes, and chose the option to pay your tax preparation or filing fees out of your refund, the second round of stimulus payments may be sent by the department of the treasury to a temporary account that was used by h&r block or turbo tax for these refunds. Part of the government help will go to either a new dependent or a parent of a child who was born in 2021.

Income > $75,000 Will Have $5 Taken From That $1,200 For Every $100 They Earn Above $75,000.

Should the proposal become law, refundable tax credits would be given to individuals making less than $75,000 annually. It would give single filers $200, while joint filers would receive $400 as long as income does not exceed $150,000. There are also other requirements that states can set, such as how much you have in your bank account.

If Your Spouse, Parents, Or Other Dependents Require A Stimulus Check, You Should Disclose The Specifics Of Their Handicap.

To help these workers bear those purchases, an additional $700mn has been announced by the government as financial relief. Act now to sign up for the third economic impact payment if your income was less than $12,400 in 2020, or less than $24,800 if you are married. The illinois department of employment security (ides) announced on march 31st details regarding illinois unemployment benefits and the new coronavirus stimulus package.