Income Tax 2022 Deposit Dates. 2022 tax refund update expected tax refund direct deposit dates for 2022 wmr. Irs will start accepting income tax returns on jan.

Child tax credit, irs tax refund deposit date. Cbdt is a statutory authority functioning under the central board of. Irs will start accepting income tax returns on jan.

Income Tax Is Paid In Assessment Year (Ay) For Income Earned During Previous Year (Py).

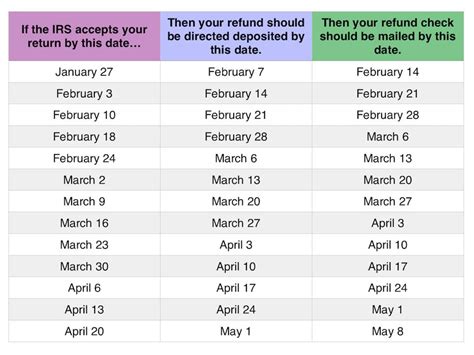

Due to this, the federal and state income tax returns filing process should also be relatively regular, which will result in taxpayers most likely receiving refund payments within just. Here is when the irs.gov website is saying you can expect to receive your 2022 tax refund deposit, after filing your 2021 tax return, in the 2022 tax season. Due date for deposit of tds for the period october 2021 to december 2021 when assessing officer has permitted quarterly deposit of tds under section.

Direct Deposit Sent (Or Paper Check Mailed 1 Week Later):

If the monthly deposit rule applies, deposit the tax for payments in december 2021. This is the official start of the 2022 tax season and the date that the irs began accepting and processing returns from tax year 2021. Corporation income tax returns (irs form 1120):

This Date Has Been Designated Earned Income Tax Credit Awareness Day, Which The Irs’s Website Says Is “To Raise Awareness Of Valuable Tax Credits Available To Many People — Including The Option To Use Prior.

However, many tax software programs will allow you to complete your return and “file” it before. 2022 tax filing season begins jan. Tax season 2022 is here and brings with it many new issues, related to direct payments, irs tax refund delays and other forms of financial aid.

Here Is When The Irs.gov Website Is Saying You Can Expect To Receive Your 2022 Tax Refund Deposit, After Filing Your 2021 Tax Return, In The 2022 Tax Season.

It shows the date your refund will be processed and paid based on the week your return is accepted and approved by the irs. Q3 2022 estimated tax payments. Q2 2022 estimated tax payments due;

For Corporations, The Due Date Is April 18, 2022.

Irs will start accepting income tax returns on jan. Here are the quarterly tax payment due dates in 2022: 2022 tax refund update expected tax refund direct deposit dates for 2022 wmr.