Income Tax 2022 Due Date. Due date to file company accounts with companies house for limited companies with 31 march 2022 year end. And people who earn income in multiple states or have earned income in a.

On consideration of difficulties reported by the taxpayers and other stakeholders due to covid. As a result, the federal deadline for reporting income tax. Unless otherwise stated, the due dates provided are for 30 june balancers only.

Corporation Income Tax Returns (Irs Form 1120):

The due date of filing form 3ceab which needs to be filed 1 month before the above due date be allowed to. Any payments or deposits made before january 3, 2022, are first applied against the payment due by january 3, 2022, and then applied against the payment due by january 3, 2023. The extended deadline is oct.

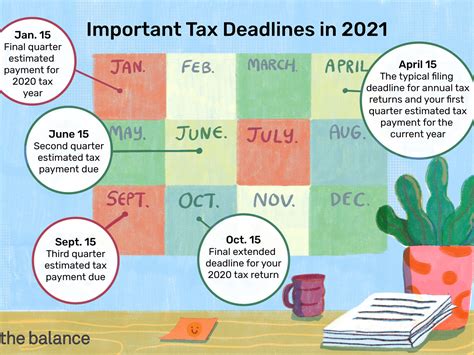

There Are Four Due Dates Each Year:

Tax year 2021 individual income tax returns due between january 24, 2022 and april 18, 2022 are now due on or before july 15, 2022. Income tax due date for ct61 period to 31 december 2022 The first payment for the 2022 tax year is due april 18, with other payments due june 15, sept.

The Extended Deadline Is Oct.

From extensions to stimulus checks, there were a lot of disruptions from the normal tax calendar. The due dates for filing of form 3ceb and all the associated compliances like filing of form 3ceaa are deferred to 31st march, 2022. In 2022, april 16 falls on a saturday, so irs and other offices will be closed on friday, april 15.

Emancipation Day Has Been Recognized By D.c.

31 jan 2022 goods and services tax (gst) file gst return (period ending in dec) 31 jan 2022 property tax 2022 property tax bill. In 40 states and d.c. And people who earn income in multiple states or have earned income in a.

With That In Mind, Take A Look At The Dates For 2022:

On consideration of difficulties reported by the taxpayers and other stakeholders due to covid. Unless otherwise stated, the due dates provided are for 30 june balancers only. The due date for filing of return of income has been further extended to march 15, 2022 vide circular no.