Income Tax 2022 South Africa. The minister of finance in february 2021 announced that the corporate income tax rate would be reduced to 27% (from 28%) for companies with years of assessment beginning on or after 1 april 2022. South african tax spreadsheet calculator 2022/ 2023.

I don't have a sa id number. It’s so easy to use. In 2021, sars’ revenue collection was down 7.8%.

The Budget Has Proposed An Additional Spending Allocation To Sars Of R3 Billion Over The Medium Term To Assist With These Efforts.

Calculate your income tax for 2021 / 2022. If you are looking for an alternative tax year, please select one below. It’s so easy to use.

The Tax Season 2021 For Individuals Is Upon Us.

Sars income tax calculator for 2022 work out salary tax (paye), uif, taxable income and what tax rates you will pay Using the calculator you will be able to estimate paye, sdl and uif and compare them to dwt taxes if you own your own business. However, the rate reduction has yet to be enacted.

If You Are 65 Years Of Age To Below 75 Years, The Tax Threshold (I.e.

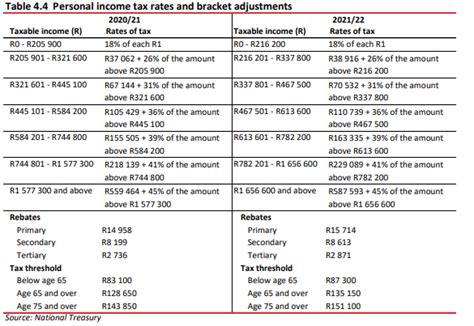

Sars definitely improving their service, they have realised there is a mad rush once the tax season starts so they have started early with their notifications. For taxpayers aged 75 years and older, this threshold is r151 100. The current tax year (1 march 2022 to 28 february 2022) in south africa is called the 2022 tax year because the tax year is named by the year in which it ends.

Some Of The More Significant Developments Of The Day Are A Lowering Of The Corporate Tax Rate From 28% To 27% With Effect From 1 April 2022.

Progressive tax rates apply for individuals. Our online salary tax calculator is in line with changes announced in the 2021/2022 budget speech. Only 37.5% (36.6% from 1 march 2015) of dividends from foreign companies are included in individuals' taxable income, so the maximum effective rate on these dividends is 15%.

South Africa’s Tax ‘Laws’ Have Been Updated — Here’s What You Need To Know.

South africa’s social distress relief grant of r350. In 2021, sars’ revenue collection was down 7.8%. When does sars tax season 2022 start in south africa?