Income Tax 2022 Uk. At the scottish budget on 9 december 2021, the cabinet secretary for finance and the economy set out the proposed income tax rates and bands for 2022 to 2023. Then, the basic tax rate of 20% is applied to any money earned between £12,571 and £50,270.

15 of the preceding 20 tax years: 40% on income between £50,271 and £150,000. 8.75% (7.5% in 2021/22) higher rate:

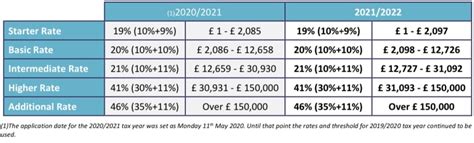

The Rates And Bands In The Table Below Are Based On The Uk Personal Allowance In.

Login page for uk income tax login is presented below. Your total tax free allowance is £12,570. Income limit for couple’s allowance:

Find Out How Much Extra You'll Pay.

Here is a breakdown of the income tax brackets on earnings for 2022: The higher rate of tax, which is 40%, comes into. Find out more in our guide to income taxes in scotland.

Loan, Pension Contr., Etc.) Calculations Verified By Strivex Accountants On 15 March 2021 At 14:03.

Income limit for personal allowance: After this, you will pay 20% on any of your earnings between £12,571 and £50,270, and 40% on your income between £50,271 and £150,000. All calculations below are for a 30 year old male, born 1st january 1992.

At The Scottish Budget On 9 December 2021, The Cabinet Secretary For Finance And The Economy Set Out The Proposed Income Tax Rates And Bands For 2022 To 2023.

Uk income tax rate on dividends 2022/23: National insurance will go up in april 2022. Deemed to be uk domiciled

Paye Tax Rates & Thresholds 2022/23.

Previous article sliit wifi portal. 8.75% (7.5% in 2021/22) higher rate: If agreed to by the scottish parliament, a scottish rate resolution will give effect to the income tax policy set out below.