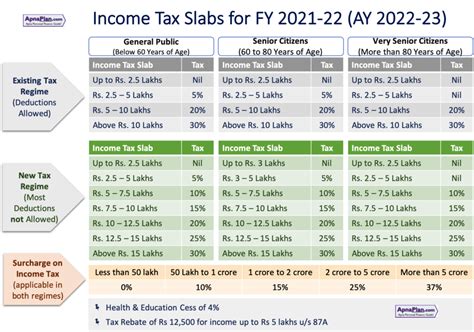

Income Tax Ay 2022-23. 10% ₹ 7,50,001 to 10,00,000: 25% of income tax, in case taxable income is above ₹ 2 crore.

10% of income tax, in case taxable income is above ₹ 50 lacs. 37% of income tax, in case taxable income is above ₹ 5 crore. 5% ₹ 5,00,001 to 7,50,000:

Income Tax Exemption Limit Is Up To Rs.

However, the surcharge shall be subject to marginal relief (where income exceeds one crore rupees, the. (i) the aggregate of all amounts received including the amount received for sales, turnover or. No major changes were made in income tax rules.

And Individuals Earning Above 15,00,000.

There will be two types of tax slabs. 15% ₹ 10,00,001 to 12,50,000: 10,00,000 20% 20% above rs.

Local Authority Is Taxable At 30%.

What is tds form 16 or income tax form 16? For those who wish to claim it deductions and exemptions. Only change which is made in budget is senior citizen above 75 years of age is exempted for filing income tax return if they have income only from pension and interest.

Proposed Changes Relating To Income Tax Search And Seizure Provisions February 11 2022 @ 3:01 Pm Ao Incorrectly Reopened Assessment On.

There will be two types of tax slabs. Short term capital gains (covered u/s 111a ) 15%. For those who do not wish to claim it deductions and exemptions.

10% ₹ 7,50,001 To 10,00,000:

There were no changes proposed in this budget 2022 with respect to income tax slab rates. 10% of income tax, where total income exceeds rs.50 lakh up to rs.1 crore. Long term capital gains (covered u/s 112a ) 10%.