Income Tax Bands 2022. Currently, the cit rate is 35%. Basic rate band (brb) £37,700:

€36,800 @ 20%, balance @ 40%. €35,300 @ 20%, balance @ 40%. Rates and bands for the years 2018 to 2022.

These Rates Can Be Increased Or Decreased By Up To 15%.

Personal circumstances 2022 € 2021 € 2020 € 2019 € 2018 € single or widowed or surviving civil partner, without qualifying children. Income tax rates and thresholds (annual) tax rate taxable income threshold; Tax is paid on the amount of taxable income remaining after allowances have been deducted.

€35,300 @ 20%, Balance @ 40%.

We propose no changes in rates. If agreed to by the scottish parliament, a scottish rate resolution will give effect to the income tax policy set out below. The basic rate limit is also indexed with cpi, under section 21 of the income tax act 2007.

Currently, The Cit Rate Is 35%.

Universal social charge (usc) standard rates of usc there are changes to usc thresholds but no changes to usc rates. €36,800 @ 20%, balance @ 40%. €34,550 @ 20%, balance @ 40%

Tax Rates For Basis Year 2022.

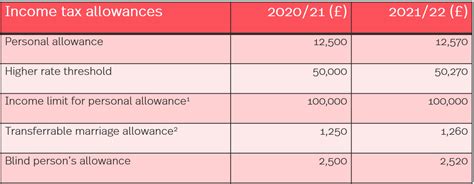

The rates and bands in the table below are based on the uk personal allowance in. €35,300 @ 20%, balance @ 40%. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Each Of The Personal Tax Credit, Employee Tax Credit And Earned Income Credit Will Be Increased By €50.

At the scottish budget on 9 december 2021, the cabinet secretary for finance and the economy set out the proposed income tax rates and bands for 2022 to 2023. There are seven federal income tax rates in 2022: As income is taxed on a fractional, progressive basis, it means, for instance, that a someone with a net taxable income of €35,000 would pay no tax on the first €10,055, then at 11% for the income between €10,225 to €26,070 and at a.