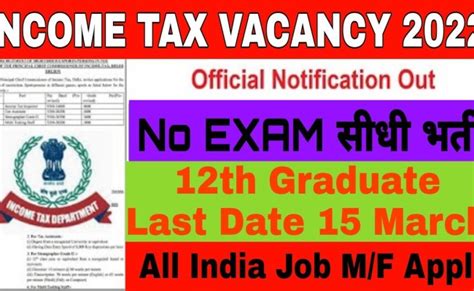

Income Tax Bharti 2022. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). The india 2022 tax tables provide additional information in relation to 2022 tax returns in india.

While total costs only increased by 4.8% compared to the same period last year, income tax expense surged 126% and finance costs rose 8%. Income tax recruitment 2022 tax assistant, mts posts apply online links can be checked from the official website of the department. Upcoming employment news advertisement for income tax.

“The Full Impact Of The Revised Mobile Tariffs, However, Will Be Visible” In The March Quarter, Gopal Vittal, Bharti’s Chief Executive Officer For India And South Asia, Said In A Statement.

18 to 30 years of age; 18 to 30 years of age; It has been told in our article that how you can apply for this post as well as complete information.

This Page Includes Information About Itat Bharti 2022, Itat Mumbai Recruitment 2022, Itat 2022.

Kindly go through the article. इस income tax department bharti 2022 में प्रोबेशन की अवधि कुल 2 वर्ष की निर्धारित है तथा इन पदों पर आवेदन दिनाकं 1 जनवरी 2021 से प्रारम्भ हो चुके है तथा इसमें आवेदन की अंतिम तिथि 28 जनवरी 2022 निर्धारित की गई है ।. There are seven federal income tax rates in 2022:

Age Relaxation Is Applicable As Per Given Table

Upcoming employment news advertisement for income tax. While total costs only increased by 4.8% compared to the same period last year, income tax expense surged 126% and finance costs rose 8%. 18 to 27 years of age

Andhra • Arunachal • Assam • Bihar • Chandigarh • Chhattisgarh • Delhi • Goa.

By mahabhartihindi last updated jan 31, 2022. 10 percent, 12 percent, 22 percent, 24. In 2022, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1).

The Following India Income Tax Slabs (Tax Tables) Are Valid For The 2022/23 Tax Year Which Is Also Knows As Financial Year 22/23 And Assessment Year 2022/23.

18 to 27 years of age; 18 to 27 years of age; The 2022 tax tables are provided in support of the 2022 india tax calculator.