Income Tax Rates 2021 To 2022 Uk. The amount of gross income you can have before your personal allowance is reduced personal allowance is reduced by £1 for every £2 over the limit * personal allowance will only be reduced to the basic personal allowance unless income is over £100,000. The starting rate for savings is a maximum of £5,000.

It is the amount due on these products is dependent on the tax rate that began at 5 per cent and seven percent respectively. The amount that an individual pays in tax to the government every year is then sent to the. Income tax rates of tax 2021/2022 starting rate of 0% on savings income up to* £5,000 personal savings allowance basic rate £1,000 higher rate £500 basic rate of 20% £0 to £37,700 higher rate of 40% £37,701 to £150,000 additional rate of 45% £150,001 and over *for other income less than £17,570 only.

Income Tax Rates 2022/23 Uk Calculator.

Income limit for personal allowance: ** those earning more than £100,000 will see their personal allowance reduced by £1 for every £2 earned over £100,000. The amount of gross income you can have before your personal allowance is reduced personal allowance is reduced by £1 for every £2 over the limit * personal allowance will only be reduced to the basic personal allowance unless income is over £100,000.

Married Couple's Allowance Maximum Amount (For Those Born Before 6 April 1935) £9,125.

As well as complete personal income tar rates and allowances for the 2022 tax year. Married couple's allowance minimum amount (for those born before 6 april 1935) Income limit (born after 5 april 1948)

Find Out More In Our Guide To Income Taxes In Scotland.

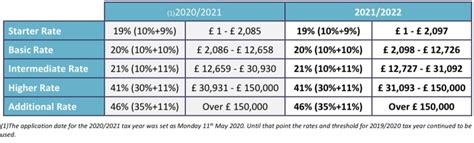

Income taxes in scotland are different. The amount of gross income you can have before your personal allowance is reduced personal allowance is reduced by £1 for every £2 over the limit * personal allowance will only be reduced to the basic personal allowance unless income is over £100,000. Tax year 2020 to 2021 tax year 2021 to 2022;

As Announced At Budget 2021, The Government Will Maintain The Personal Allowance At £12,570 And Higher Rate Threshold At £50,270 For 2022 To 2023, 2023 To 2024, 2024 To 2025 And 2025 To 2026.

Gst tax rate begins at five per cent and the tax rate is seven per cent. Income tax rates of tax 2021/2022 starting rate of 0% on savings income up to* £5,000 personal savings allowance basic rate £1,000 higher rate £500 basic rate of 20% £0 to £37,700 higher rate of 40% £37,701 to £150,000 additional rate of 45% £150,001 and over *for other income less than £17,570 only. The past 10 years have seen a drastic reduction in canadian tax rates.

In The Last 10 Years, We Have Witnessed A Dramatic Decline On Canadian Tax Rates.

The starting rate for savings is a maximum of £5,000. Income tax rates 2022 uk. It is the smallest tax bracket for 2021 in canada that is applicable to the taxable income of the individual or the company.