Ird Mileage Rate 2022 Nz. Into law by 31 march 2022. The tier 1 rate is available to use for business miles incurred in the first 14,000 total kilometres travelled by the vehicle in the year.

Between 1 october 2021 and 31 march 2022 ana is charged $7,500 interest but can only claim 75%, which is $5,625. Ird mileage rate for business use reduced. Average selling rate in hong kong dollar.

This Rate Is Up From The Existing 73C Mileage Rate.

It could well be 77c per km but not necessarily. A recent review of the commissioner's mileage rate has resulted in a reduction to 74 cents (from 77 cents) per kilometre for both petrol and diesel fuel vehicles for the 2015 income year. The claim will be limited to 25% of the vehicle running costs as a business expense.

Between 1 October 2021 And 31 March 2022 Ana Is Charged $7,500 Interest But Can Only Claim 75%, Which Is $5,625.

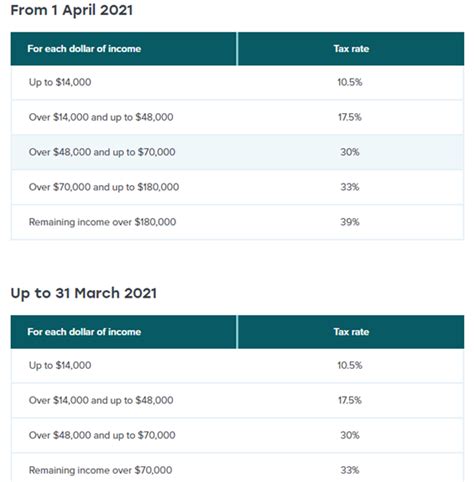

Tier one rate tier two rate; For the first time since the 2016 income year the main ir rate has decreased. Tax rate and data collection of trust information.

For Subsequent (Tier 2) Kms — Petrol And Diesel 28 Cents Per Km — Hybrid 17 Cents Per Km — Electric 9 Cents Per Km.

Using the tier 1 and tier 2 rates the tier 1 rate is a combination of your vehicle's fixed and running costs. Sustainable economy and the environment the government is committed to improving the environment, and tax settings that. Published mileage rates, as long as they represent a reasonable estimate;

New Zealand's Inland Revenue (Ir) Has Just Released Its Vehicle Kilometre (Km) Rates For The 2021 Income Year, And It’s Not Good News, Particularly For Employers Who Will Need To Quickly Update Mileage Reimbursement Systems For The New Rates.

The information provided may be used as a guideline for older vehicles outside this range, or the ird rate of 79c/km is often used. Internal revenue service mileage 2022; New rate for extra pays.

For The First 14,000 Km (Tier One) For The Motor Vehicle 82 Cents Per Km.

Before the 2018 income year, if the kilometre rates are used, the claim will be limited to 5,000 kilometres. Current mileage rate for 2022; The ird has proposed a new tax threshold / rate of 39% for income over $180,000.