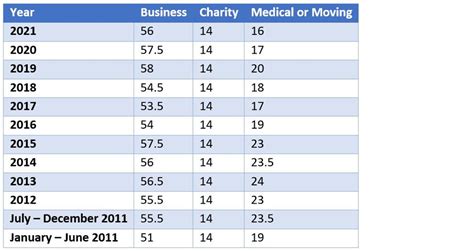

Irs.gov 2022 Mileage Rate. It is predicted that for 2022, the rate is going to be increased, but no more than a couple of cents. 56 cents/mile for business miles (reduced by 57.5 cents/mile in the prior year).

Irs mileage rate 2021 & 2022 for different purposes. 15 rows standard mileage rates. As of january 1, 2022, the standard mileage rates for the use of a car, van, pickup, or panel truck is:

The Irs Generally Releases The Inflation Adjustments Towards The End Of.

The following table summarizes the optional standard. Irs mileage rate 2021 & 2022 for different purposes. It’s not yet be possible to compare the mileage reimbursement rates of 2021 and 2022 because these rates 2022 aren’t yet announced.

The Internal Revenue Service (Irs) Issued A New Standard Mileage Rate For Driving A Car For Business, Charity, Medical, Or Mobile Purposes.

The increase that was determined for the irs mileage rate was will be announced by the end of december for the next year. The rates of reimbursement for mileage set by the irs for 2021 are: As soon as the irs updates the rates for the 2022 tax year, we’ll keep you updated.

The Rates Of Reimbursement For Mileage Established By The Irs For 2021 Are:

Beginning on january 1, 2022, the standard mileage rates for the use of a vehicle will be: New mileage rates have increased due to changes in fuel prices, fuel economy and insurance costs. 16 cents/mile for moving and medical miles (reduced by 17 cents per mile since the last three years).

16 Cents/Mile For Moving As Well As Medical Travel (Reduced To 17 Cents/Mile Over These Three Years).

At this time, the internal revenue service (irs) is also gearing up to release its annual mileage rate for the upcoming year. 56 cents/mile for business miles (reduced by 57.5 cents/mile in the previous year). The 2022 irs mileage rate of $.585/mile was derived from a blend of vehicle cost factors averaged out from across the u.s from 2021, including average gas prices, insurance costs, and depreciation for a vehicle driven an average number of miles.

14 Cents/Mile For Volunteer Mileage.

There are a few essential aspects to consider before employers planning to implement an incentive program. The rate is adjusted each year,. 18 cents per mile driven for medical or moving purposes, up 2 cents from.