Irs Tax Return 2022. Once the tax paperwork has been filed, the irs proceeds to pay out the refunds owed, although it may take a while for the money to land in bank accounts. The irs issues over 90% of tax refunds in less than 21 days after the tax returns are processed.

Once the tax paperwork has been filed, the irs proceeds to pay out the refunds owed, although it may take a while for the money to land in bank accounts. But the irs is still facing tax return backlogs and staff shortages. The deadline for submitting tax returns (or filing for an extension) remains monday, april 18, 2022.

That's About 3 Weeks Earlier Than Last Year.

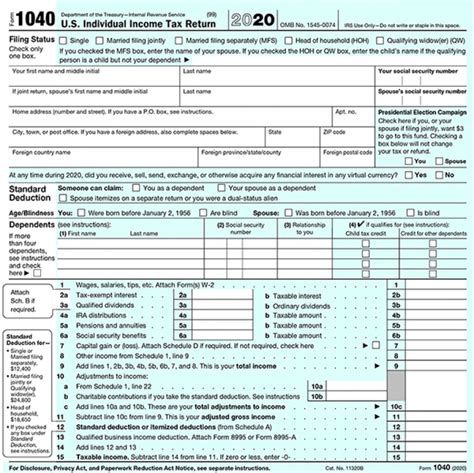

The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year. During the 2020 budget year, the irs processed more than 240 million tax returns and issued roughly $736 billion in refunds, including $268 billion in federal stimulus payments, according to the. For the 2020 tax year, the average tax refund for recipients was $2,827 , according to.

The Irs Has Yet To Announce An Official Start Date To The 2022 Tax Season, But It Typically Begins Accepting Tax Returns By The End Of January.

The irs will begin accepting tax returns on january 24, 2022. That is the first day that individual tax returns can be accepted and the irs will start processing returns. How to avoid refund delays and other headaches.

2022 Irs Key Tax Dates.

Urges extra caution for taxpayers to file accurate tax returns electronically to speed refunds, avoid delays. Irs will start accepting income tax returns on jan. The deadline for submitting tax returns (or filing for an extension) remains monday, april 18, 2022.

Once The Tax Paperwork Has Been Filed, The Irs Proceeds To Pay Out The Refunds Owed, Although It May Take A While For The Money To Land In Bank Accounts.

Let's hope no more last minute changes come in and delay this! The irs has currently not released an official tax refund calendar for the 2022 tax season (2021 tax year). Prepare and efile your irs and state 2021 tax return(s) by april 18, 2022.

For Single Taxpayers And Married Individuals Filing Separately, The Standard Deduction Rises To $12,950 For 2022, Up $400, And For Heads Of Households, The Standard Deduction Will Be $19,400 For Tax Year 2022, Up $600.

Keep in mind it can still take a week to receive your refund after the irs releases it. Treasury department officials said monday that the internal revenue service will face so many challenges this year that tax refunds could be delayed. Final estimated tax payment for 2021 due jan.