Irs Tax Return Date 2022. I update this during tax season with any changes and every year so you can subscribe (free) via email to get the latest updates. That means taxpayers can officially start filing their 2021 tax returns with the internal revenue service today.

April 1 —deadline for required minimum distribution (rmd) payments from retirement accounts for senior citizens who turned 72 in 2021. In 2021, americans received on average $2,775 in tax refunds, an 11% increase from the previous year, according to the internal revenue service. 2022 irs key tax dates.

Filing Deadline For Tax Year 2021

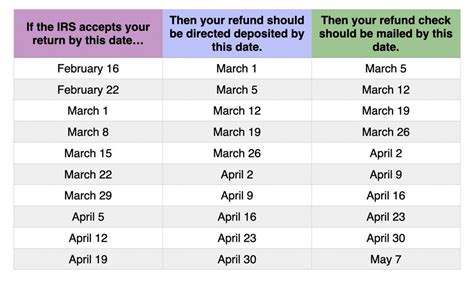

We understand your tax refund is very important and we are working to process your return as quickly as possible. In fact, the irs is informing those who claim these credits that they will most likely receive their refunds in early march, assuming they filed. Direct deposit sent (or paper check mailed 1 week later):

Some Only Got Their Tax Refunds In Early November 2021, After Experiencing Several Months Of Delays.

The date that us citizens have to file their tax by in 2022 is quite noticeably sooner than in 2020 and 2021, as the closing date is monday, april 18, 2022. Irs free file service opens to prepare tax year 2021 returns jan. That means taxpayers can officially start filing their 2021 tax returns with the internal revenue service today.

(This Page Is Being Updated For Tax Year 2022).

So jan 3rd, 2022 to jan 9th 2022 is week 1, january 24th to january 30th is week 4, february 7th to 13th is week 6. 2022 irs key tax dates. The irs issues over 90% of tax refunds in less than 21 days after the tax returns are.

This Applies To The Entire Refund, Not Just The Portion Associated With These Credits.

Please read the following information related to your tax situation: 2022 irs path (w/eic) refund direct deposit schedule the irs recently announced (see screenshot below) that wmr/irs2go will update by feb 19th with expected refund payment dates for taxpayers who have filed electronically and claimed the eitc or actc. Below is a full table below for 2022 cycle codes.

How To Avoid Refund Delays And Other Headaches.

How much you get back on your tax return depends on. 2022 tax returns are due on april 15, 2023. Irs will start accepting income tax returns on between jan.