Jersey Income Tax 2022. The new legislation is effective january 1, 2022. 2.45% of the excess of $50,000 minus $420.00:

1manufacturers and distributors of cigarettes. The first day to file 2021 tax returns is jan. Jersey annual salary after tax calculator 2022.

Tax Assessment Year The Tax Assessment Year Is Defaulted To 2022, You Can Change The Tax Year As Required To Calculate Your Salary After Tax For A Specific Year.

They become additional resilient and. The annual wage calculator is updated with the latest income tax rates in jersey for 2022 and is a great calculator for working out your income tax and salary after tax based on a annual income. This income tax calculator can help estimate your average income tax rate and your salary after tax.

The New Legislation Is Effective January 1, 2022.

Income tax is levied and charged for the year 2022 at the standard rate of 20 pence in the pound, in accordance with and subject to the income tax (jersey) law 1961. That’s two weeks earlier than last year. You don't pay tax if your annual income is below these thresholds and they are also used to calculate marginal relief.

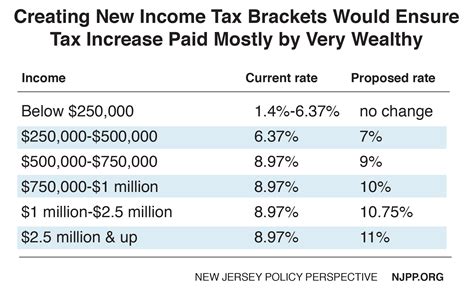

The New Jersey Income Tax Has Seven Tax Brackets, With A Maximum Marginal Income Tax Of 10.75% As Of 2022.

Detailed new jersey state income tax rates and brackets are available on this page. Now, new jersey taxpayers with gross income of $200,000 or less can qualify for a state income tax deduction of up to $10,000 per taxpayer for contributions to the plan. Jersey annual salary after tax calculator 2022.

Mailboxes, Many In New Jersey Will Be Wondering When They Can File And What Changes Are In Store For Their Returns This Year.

Do not subtract the biweekly federal thrift savings plan contribution. 5.525% of the excess of $80,000 minus. 1manufacturers and distributors of cigarettes.

Property Income Arising In Jersey:

(f) in excess of $12,000 for taxable years beginning on or after january 1, 2022. (d) illinois’ rate includes two separate corporate income taxes, one at a 7% rate and one at a 2.5% rate. 3.5% of the excess of $70,000 minus $1,154.50: