Llc Business Tax Filing Deadline. This means you file your business taxes at the same time you file your personal income taxes. Additionally, since llc members are considered self.

15th day of the 4th month after the beginning of your tax year. Llc members should also keep in mind the date to file form 1040 with schedule e attached. Whether you are required to file an annual report:

Additionally, Since Llc Members Are Considered Self.

A domestic llc with at least two members is classified as a partnership for federal. If you're filing taxes in maine or massachusetts, where the 18th is a state holiday, you can file taxes on april 19, 2022. States like california, iowa, and indiana require llcs to file biennial reports.

If You Follow The Calendar Year, This Would Be March 15, 2022.

There is no corporate taxation, since the irs does not recognize an llc as a separate, taxable entity. If the llc is a partnership, normal partnership tax rules will apply to the llc and it should file a form 1065, u.s. Many llcs use a calendar year system that runs from jan.

Thus, An Llc That Has Been Treated As A Partnership For Several Years May Be Able To Prospectively Change Its Classification To Be Treated As A Corporation By Filing Form 8832.

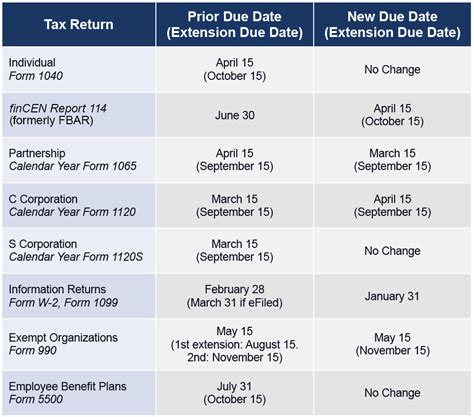

Llcs taxed as disregarded entity. Corporate tax returns are due, and taxes are payable on the 15th day of the fourth month after the end of the company's fiscal or financial year. Standard business tax deadlines are as follows:

Tax Due Dates For 2021, Based On Status:

Depending on elections made by the llc and the number of members, the irs will treat an llc either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity). What is the sole proprietorship. This means you file your business taxes at the same time you file your personal income taxes.

If Your Business Is Any Kind Of Partnership Operating On A Different Fiscal Year From The Calendar Year, Your Business’s Tax Deadline Is The 15Th Day Of The Third Month Following The End Of Your Fiscal Year.

For llcs that are taxed as a corporation or single member llcs, the tax deadline is april 15, 2022. The deadline for filing personal income taxes is april 15 of each year. For llcs that are taxed as a partnership, the tax deadline is march 15, 2022.