Llc Tax Return Due Date 2022. 2021 income tax return due for people and organisations who do not have a tax agent or extension of time • 31 march 2022 2021 income tax return due for clients of tax agents (with a valid extension of time 9 quarterly fbt return and payment due 10 annual fbt return and payment due 11 income year fbt return and payment • 7 april 2021 2020 income year return. If a corporation got a tax extension earlier in the year, it has to file a tax return by sept.

For 2022, llcs filing as a c corporation must file form 1120 by april 18 without an extension. Tips for january 2022 reported to employer (form 4070) For applicable taxes, quarterly reports are due in april, july, october and january.

Washington — The Internal Revenue Service Announced That The Nation's Tax Season Will Start On Monday, January 24, 2022, When The Tax Agency Will Begin Accepting And Processing 2021 Tax Year Returns.

There are a few different forms that an llc may use to file taxes. February 2022 tax due dates. Due dates for tax returns.

Our Due Dates Apply To Both Calendar And Fiscal Tax Years.

Partnership and llc estimated tax payments nys and mctmt if applicable required to be paid on behalf of nonresident partners and members and c corporations are due on or before april 15 june 15 and september 15 of 2021 and january 18 of 2022. 2021 income tax return due for people and organisations who do not have a tax agent or extension of time • 31 march 2022 2021 income tax return due for clients of tax agents (with a valid extension of time 9 quarterly fbt return and payment due 10 annual fbt return and payment due 11 income year fbt return and payment • 7 april 2021 2020 income year return. When are llc taxes due?

Due To Emancipation Day On April 15, 2022 And Patriots’ Day On April 18, 2022, Those Who Reside In Maine And Massachusetts Have Until April 19Th To File Their Return.

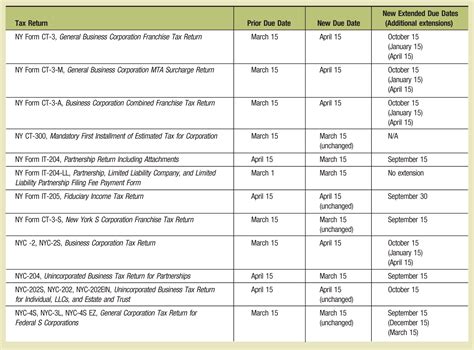

Amended due dates for tax returns became effective for taxable years beginning after dec. The extended deadline is oct. If you’d rather have someone else handle your bookkeeping and federal income tax filing, check out bench.

Due Dates On This Chart Are Adjusted For Saturdays, Sundays, And 2022 Federal Legal Holidays.

Your individual 1040 tax return is due on april 18, 2022, unless you extend your due date. For corporations, the due date is april 18, 2022. 04/18/22 (mon) file 6 month extension if residing within the us.

For Applicable Taxes, Quarterly Reports Are Due In April, July, October And January.

If you choose to treat your llc as a corporation, your tax dates are: The due date for these 2022 payments are april 15, june 15, september 15, and january 16 (2023). Likewise, if you want an extension to file your 2021 individual income tax return,.