Medicare beneficiaries have the choice of receiving their Half A and Half B Medicare advantages by means of a non-public Medicare Benefit plan. The federal authorities contracts with non-public insurers to offer Medicare advantages to enrollees, and plans are required to fulfill federal requirements. For instance, Medicare Benefit plans are required to offer an out-of-pocket restrict, and will present extra advantages or decreased value sharing in comparison with conventional Medicare. They’re additionally permitted to restrict supplier networks, and will require prior authorization for sure providers, topic to federal requirements. This temporary gives details about Medicare Benefit plans in 2022, together with premiums, value sharing, out-of-pocket limits, supplemental advantages, prior authorization, and star rankings, in addition to tendencies over time. A companion evaluation look at tendencies in Medicare Benefit enrollment.

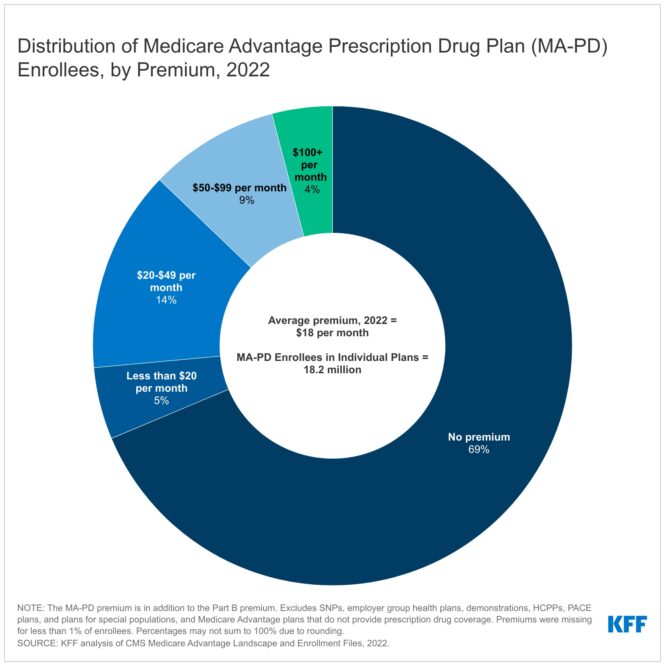

In 2022, practically 7 in 10 beneficiaries (69%) are in zero-premium particular person Medicare Benefit plans with prescription drug protection (MA-PDs), and pay no premium aside from the Medicare Half B premium ($170.10 in 2022). The MA-PD premium contains each the price of Medicare-covered Half A and Half B advantages and Half D prescription drug protection. In 2022, 87% of Medicare Benefit enrollees in plans open for basic enrollment are in plans that provide prescription drug protection.

Altogether, together with those that don’t pay a premium, the typical enrollment-weighted premium in 2022 is $18 per 30 days, and averages $11 per 30 days for simply the Half D portion of coated advantages, considerably decrease than the typical premium of $40 for stand-alone prescription drug plan (PDP) premiums in 2022. Larger common PDP premiums in comparison with the MA-PD drug portion of premiums is due partly to the power of MA-PD sponsors to make use of rebate {dollars} from Medicare funds for advantages coated below Components A and B to decrease their Half D premiums, which in keeping with the Medicare Cost Advisory Fee (MedPAC), are $300 per enrollee yearly in 2022.

For the remaining 31% of beneficiaries who’re in plans with a MA-PD premium (5.7 million), the typical premium is $58 per 30 days, and averages $35 for the Half D portion of coated advantages – barely decrease than the $40 month-to-month PDP premium.

Premiums paid by Medicare Benefit enrollees have declined since 2015

In 2022, the typical enrollment weighted MA-PD premium, together with amongst those that don’t pay a premium, is $18 per 30 days. Nevertheless, common MA-PD premiums range by plan sort, starting from $16 per 30 days for HMOs to $20 per 30 days for native PPOs and $49 per 30 days for regional PPOs. Almost 6 in 10 Medicare Benefit enrollees are in HMOs (59%), 38% are in native PPOs, and three% are in regional PPOs in 2022. Regional PPOs had been established to offer rural beneficiaries with better entry to Medicare Benefit plans.

Common MA-PD premiums have declined from $36 per 30 days in 2015 to $18 per 30 days in 2022. The discount is pushed partly by the decline in premiums for native PPOs and HMOs, that account for a rising share of enrollment over this time interval. Since 2015, a rising share of plans are bidding under the benchmark, which allows them to supply protection with out charging a further premium. Extra plans are bidding under the benchmark partly as a result of Medicare Benefit benchmarks relative to conventional Medicare have elevated over time, and when benchmarks enhance, plans are in a position to maintain extra for Half A and B providers in addition to for further advantages. Additional, rebates paid to plans have elevated over time, and plans are allocating a few of these rebate {dollars} to decrease the half D portion of the MA-PD premium. Collectively, these tendencies contribute to better availability of zero-premium plans, which brings down common premiums.

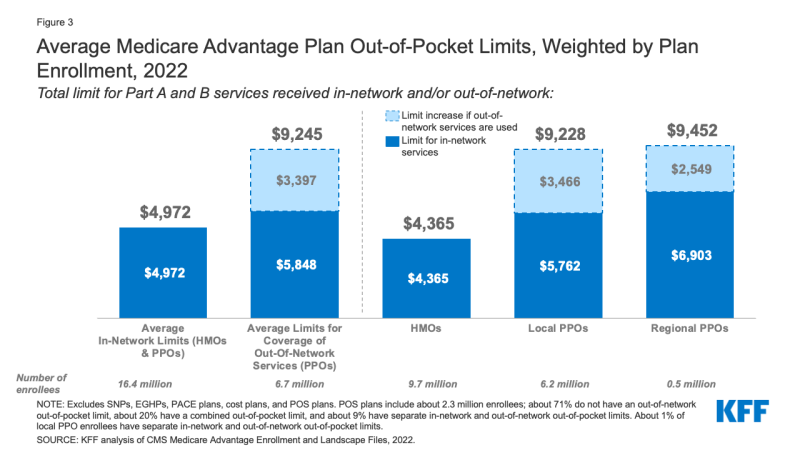

The common out-of-pocket restrict for Medicare Benefit enrollees is $4,972 for in-network providers and $9,245 for each in-network and out-of-network providers (PPOs)

Determine 3: Common Medicare Benefit Plan Out-of-Pocket Limits, Weighted by Plan Enrollment, 2022

Since 2011, federal regulation has required Medicare Benefit plans to offer an out-of-pocket restrict for providers coated below Components A and B. In 2022, the out-of-pocket restrict might not exceed $7,550 for in-network providers and $11,300 for in-network and out-of-network providers mixed. These limits will enhance to $8,300 for in-network providers and $12,450 for in-network and out-of-network providers mixed in 2023. These out-of-pocket limits apply to Half A and B providers solely, and don’t apply to Half D spending, for which there’s a separate out-of-pocket threshold of $7,050 in 2022, above which enrollees pay 5% of prices. Whether or not a plan has solely an in-network cap or a cap for in- and out-of-network providers is determined by the kind of plan. HMOs typically solely cowl providers supplied by in-network suppliers, whereas PPOs additionally cowl providers delivered by out-of-network suppliers however cost enrollees larger value sharing for this care. The scale of Medicare Benefit supplier networks for physicians and hospitals range vastly each throughout counties and throughout plans in the identical county.

In 2022, the weighted common out-of-pocket restrict for Medicare Benefit enrollees is $4,972 for in-network providers and $9,245 for in-network and out-of-network providers mixed. For enrollees in HMOs, the typical out-of-pocket (in-network) restrict is $4,365. Enrollees in HMOs are typically liable for 100% of prices incurred for out-of-network care. Nevertheless, HMO level of sale (POS) plans enable out-of-network look after sure providers, although it usually prices greater than in-network protection. For native and regional PPO enrollees, the typical out-of-pocket restrict for each in-network and out-of-network providers is $9,228, and $9,452, respectively.

The common out-of-pocket restrict for in-network providers has typically trended down from 2017, and the typical in-network restrict decreased from $5,091 in 2021 to $4,972 in 2022. The common mixed in- and out-of-network restrict for PPOs barely elevated from $9,208 in 2021 to $9,245 in 2022.

About half of all Medicare Benefit enrollees would incur larger prices than beneficiaries in conventional Medicare for a 7-day hospital keep

Medicare Benefit plans have the pliability to switch value sharing for many providers, topic to limitations. Complete Medicare Benefit value sharing for Half A and B providers can not exceed value sharing for these providers in conventional Medicare on an actuarially equal foundation. Additional, Medicare Benefit plans might not cost enrollees larger value sharing than below conventional Medicare for sure particular providers, together with chemotherapy, expert nursing facility (SNF) care, and renal dialysis providers.

Medicare Benefit plans even have the pliability to scale back value sharing for Half A and B advantages, and will use rebate {dollars} to take action. In response to MedPAC, in 2022, about 43 % of rebate {dollars} (or $840 per enrollee anually) had been used to decrease value sharing for Medicare providers.

Within the case of inpatient hospital stays, Medicare Benefit plans typically don’t impose the Half A deductible, however usually cost a each day copayment, starting on day 1. Plans range within the variety of days they impose a each day copayment for inpatient hospital care, and the quantity they cost per day. In distinction, below conventional Medicare, when beneficiaries require an inpatient hospital keep, there’s a deductible of $1,556 in 2022 (for one spell of sickness) with no copayments till day 60 of an inpatient keep (assuming no supplemental protection that covers some or all the deductible).

In 2022, nearly all Medicare Benefit enrollees (99%) would pay lower than the normal Medicare Half A hospital deductible for an inpatient keep of three days, and these enrollees would pay $749 on common (Determine 3). However about half of all Medicare Benefit enrollees (51%) would pay greater than they’d below conventional Medicare (with its $1,556 deductible) for stays of seven or extra days, with common value sharing of $1,828, amongst these enrollees with prices above conventional Medicare.

For a keep of 14 days, greater than three-quarters (77%) of Medicare Benefit enrollees would pay greater than beneficiaries in conventional Medicare, and amongst these enrollees in plans with cost-sharing necessities that may exceed the Half A deductible, common value sharing could be $3,180. Complete prices in Medicare Benefit could be larger than they’d be in conventional Medicare (with out supplemental protection) however not excessive sufficient to achieve the typical Medicare Benefit out-of-pocket restrict. Nevertheless, this evaluation doesn’t keep in mind different spending by Medicare Benefit beneficiaries through the yr that will trigger them to achieve their most out-of-pocket limits.

This evaluation additionally doesn’t keep in mind the truth that a majority of individuals in conventional Medicare wouldn’t pay the deductible if hospitalized as a result of they’ve supplemental protection, though these with Medigap or retiree well being would have the extra value of a month-to-month premium. Nevertheless, 5.6 million beneficiaries in conventional Medicare haven’t any supplemental protection and could be answerable for the complete Half A deductible if admitted to the hospital.

Most Medicare Benefit enrollees have entry to some advantages not coated by conventional Medicare in 2022 and Particular Wants Plan (SNP) enrollees have better entry to sure advantages

Medicare Benefit plans might present further (“supplemental”) advantages that aren’t obtainable in conventional Medicare. The price of these advantages could also be coated utilizing rebate {dollars} (which can embody bonus funds) paid by CMS to personal plans. In recent times, the rebate portion of federal funds to Medicare Benefit plans has risen quickly, totaling $432 per enrollee yearly for non-Medicare supplemental advantages, a 24% enhance over 2021. The rise in rebate funds to plans is due partly to incentives for plans to doc extra diagnoses that elevate danger scores, which in flip, generate larger rebate quantities that make it doable for plans to offer further advantages. Plans may also cost extra premiums for such advantages, however most don’t do that. Starting in 2019, Medicare Benefit plans have been in a position to supply extra supplemental advantages that weren’t provided in earlier years. These supplemental advantages should nonetheless be thought-about “primarily well being associated” however CMS expanded this definition, so extra objects and providers can be found as supplemental advantages.

Most enrollees in particular person Medicare Benefit plans (these typically obtainable to Medicare beneficiaries) are in plans that present entry to eye exams and/or glasses (greater than 99%), listening to exams and/or aids (98%), a health profit (98%), telehealth providers (98%), and dental care (96%). Equally, most enrollees in SNPs are in plans that present entry to those advantages. This evaluation excludes employer-group well being plans as a result of employer plans don’t submit bids, and knowledge on supplemental advantages is probably not reflective of what employer plans truly supply.

Although these advantages are broadly obtainable, the scope of particular providers varies. For instance, a dental profit might embody preventive providers solely, reminiscent of cleanings or x-rays, or extra complete protection, reminiscent of crowns or dentures. Plans additionally range when it comes to value sharing for varied providers and limits on the variety of providers coated per yr, many impose an annual greenback cap on the quantity the plan can pay towards coated service, and a few have networks of dental suppliers beneficiaries should select from. Enrollees in SNPs have extra entry to sure advantages in comparison with enrollees in particular person plans, reminiscent of over-the-counter drug advantages (96% vs 84%); transportation (90% vs 39%); a meal profit (79% vs 71%) and in-home help providers (20% vs 12%). Nevertheless, there isn’t any publicly obtainable knowledge on how often supplemental advantages are utilized by enrollees or the quantities they pay out-of-pocket for these providers.

As of 2020, Medicare Benefit plans have been allowed to incorporate telehealth advantages as a part of the fundamental Medicare Half A and B profit bundle – past what was allowed below conventional Medicare previous to the general public well being emergency. These advantages are thought-about “telehealth” within the determine above, though their value is probably not coated by both rebates or supplemental premiums. Medicare Benefit plans might also supply supplemental telehealth advantages by way of distant entry applied sciences and/or telemonitoring providers, which can be utilized for these providers that don’t meet the necessities for protection below conventional Medicare or the necessities for added telehealth advantages (such because the requirement of being coated by Medicare Half B when supplied in-person). The vast majority of enrollees in each particular person plans and SNPs have entry to distant entry applied sciences (72% and 80%, respectively), however simply 4% of enrollees in particular person plans and in SNPs have entry to telemonitoring providers.

Starting in 2020, Medicare Benefit plans have additionally been in a position to supply further advantages that aren’t primarily well being associated for chronically ailing beneficiaries, often called Particular Supplemental Advantages for the Chronically Ailing (SSBCI). The vast majority of plans don’t but supply these advantages. Fewer than half of all SNP enrollees are in plans that provide some SSBCI. The share of Medicare Benefit enrollees who’ve entry to SSBCI advantages is highest for meals and produce (9.6% for particular person plans and 35.1% for SNPs), meals (past a restricted foundation) (7.8% in particular person plans and 17.3% for SNPs), transportation for non-medical wants (6.5% for particular person plans and 20.5% for SNPs), and pest management (6.4% for particular person plans and 18.9% for SNPs).

Medicare Benefit plans can require enrollees to obtain prior authorization earlier than a service can be coated, and practically all Medicare Benefit enrollees (99%) are in plans that require prior authorization for some providers in 2022. Prior authorization is most frequently required for comparatively costly providers, reminiscent of Half B medication (99%), expert nursing facility stays (98%), and inpatient hospital stays (acute: 98%; psychiatric: 94%), and is never required for preventive providers (6%). Prior authorization can also be required for almost all of enrollees for some further advantages (in plans that provide these advantages), together with complete dental providers, listening to and eye exams, and transportation. The variety of enrollees in plans that require prior authorization for a number of providers stayed the identical from 2021 to 2022. In distinction to Medicare Benefit plans, conventional Medicare doesn’t typically require prior authorization for providers and doesn’t require step remedy for Half B medication.

For a few years, CMS has posted high quality rankings of Medicare Benefit plans to offer beneficiaries with extra details about plans provided of their space. All plans are rated on a 1 to 5-star scale, with 1 star representing poor efficiency, 3 stars representing common efficiency, and 5 stars representing wonderful efficiency. CMS assigns high quality rankings on the contract degree, moderately than for every particular person plan, which means that every plan coated below the identical contract receives the identical high quality score; most contracts cowl a number of plans.

In 2022, practically 9 in 10 (86%) Medicare Benefit enrollees are in plans with a score of 4 or extra stars, a rise from 2021 (73%) and the best share enrolled since 2015. A further 3 % of enrollees are in plans that weren’t rated as a result of they’re in a plan that’s too new or has too low enrollment to obtain a score. Plans with 4 or extra stars and plans with out rankings are eligible to obtain bonus funds for every enrollee the next plan yr. The star rankings displayed within the determine above are what beneficiaries noticed after they selected a Medicare plan for 2022 and are completely different than what’s used to find out bonus funds.

Usually, star rankings are calculated yearly primarily based on knowledge from the earlier yr. Nevertheless, because of the COVID-19 pandemic and disruptions to knowledge assortment, in addition to “to keep away from inadvertently creating incentives to position value concerns above affected person security”, CMS modified the calculation of star rankings. For some measures, if the score on that measure was decrease than the prior yr, the rankings reverted again to the 2021 worth to carry plans innocent. The substantial enhance within the variety of MA-PD enrollees in plans with 4 or extra stars from 2021 could also be on account of these and different methodological adjustments, and has value implications for the Medicare program as bonus funds reached $10 billion in 2022. In recent times, MedPAC has raised issues in regards to the star score system and the bonus cost system, together with that star rankings are reported on the contract moderately than the plan degree, and is probably not a helpful indicator of high quality for beneficiaries.

Dialogue

In 2022, practically 7 in 10 Medicare Benefit enrollees (69%) are in plans that don’t cost a premium (aside from the Half B premium) with the remaining third paying a premium, averaging about $58 per 30 days. Most enrollees are in plans that present entry to a wide range of supplemental advantages, reminiscent of eye exams, dental and health advantages. Almost all enrollees are in plans that require prior authorization for some providers. Medicare Benefit value sharing for Medicare-covered and different advantages varies throughout plans and may be decrease than conventional Medicare, however that’s not all the time the case. Plans additionally range in when it comes to supplier networks and prescription drug advantages, that are past the scope of this evaluation, however are necessary concerns for customers.

Whereas knowledge on Medicare Benefit plan availability and enrollment and plan choices is strong, the identical can’t be mentioned about service utilization and out-of-pocket spending patterns, which is important for assessing how properly this system is assembly its targets when it comes to worth and high quality and to assist Medicare beneficiaries examine protection choices. As enrollment in Medicare Benefit and federal funds to personal plans continues to develop, this data will develop into more and more necessary.

Meredith Freed, Jeannie Fuglesten Biniek, Tricia Neuman are with KFF.

Anthony Damico is an impartial advisor.

| This evaluation makes use of knowledge from the Facilities for Medicare & Medicaid Companies (CMS) Medicare Benefit Enrollment, Profit and Panorama recordsdata for the respective yr. KFF is now utilizing the Medicare Enrollment Dashboard for enrollment knowledge, from March of every yr.

In earlier years, KFF had used the time period Medicare Benefit to confer with Medicare Benefit plans in addition to different kinds of non-public plans, together with value plans, PACE plans, and HCPPs. Nevertheless, value plans, PACE plans, HCPPs at the moment are excluded from this evaluation along with MMPs. On this evaluation, KFF excludes these different plans as some might have completely different enrollment necessities than Medicare Benefit plans (e.g., could also be obtainable to beneficiaries with solely Half B protection) and in some instances, could also be paid in a different way than Medicare Benefit plans. These exclusions are mirrored in each the 2022 knowledge and in knowledge displayed trending again to 2010. For calculating how a lot Medicare beneficiaries might pay out-of-pocket for an inpatient hospital admission, we used the 2022 Medicare Plan Finder Profit Abstract knowledge. For conventional Medicare, beneficiaries with out supplemental protection would incur the Half A hospital deductible of $1,556 in 2022 (for one spell of sickness). For Medicare Benefit, we use 2022 Medicare Plan Finder knowledge to calculate out-of-pocket prices for inpatient stays for Medicare Benefit enrollees, weighted by 2022 plan enrollment. The evaluation doesn’t keep in mind deductibles that some Medicare Benefit enrollees face, and if taken under consideration, would enhance prices for some enrollees. The evaluation additionally doesn’t keep in mind most out-of-pocket limits below Medicare Benefit, which might cap the quantity enrollees pay for his or her care, together with hospitalizations. It’s doable that some Medicare Benefit enrollees would attain their out-of-pocket restrict throughout their inpatient keep, significantly if they’d incurred excessive bills previous to an inpatient admission. Nevertheless, in 2022 the typical out-of-pocket most is $4,972, which is above the cost-sharing quantity that each one Medicare Benefit enrollees would pay for a 7-day hospital keep, assuming no different medical bills through the protection yr. |