Mileage Expense Rates. The kilometres accumulated by an employee between 1 january 2017 and 1 april 2017 will not be altered by the introduction of these new bands and rates. To claim mileage rates as an actual expense you have to file a claim with hmrc.

It is still yet to be possible to compare the mileage reimbursement rate 2021 & 2022 because those rates in 2022 haven’t been announced yet. To claim mileage rates as an actual expense you have to file a claim with hmrc. Hmrc has different approved mileage rates depending on:

Gsa Has Adjusted All Pov Mileage Reimbursement Rates Effective January 1, 2021.

To make a claim, you must: For the year 2021 the usual rate for mileage is: While there are more expenses to driving than just fuel costs, they still play a significant role in calculating the 2022 irs mileage rate.

It Is Still Yet To Be Possible To Compare The Mileage Reimbursement Rate 2021 & 2022 Because Those Rates In 2022 Haven’t Been Announced Yet.

The tier 2 rate is for running costs only. The tier 1 rate is a combination of your vehicle's fixed and running costs. Beginning on january 1, 2022, the standard mileage rates for the use of a car (also vans, pickups, or panel trucks) will be:

You Can Repay Your Employees When They Use Their Private Cars, Motorcycles Or Bicycles For Business Purposes.

Kilometre allowance rates are recalculated four times a year. If an employee submits an expense report with 1,500 miles, the two mileage lines on the posted expense report would be: Reimbursement rates use of private vehicles.

You Just Need To Multiply The Miles You Travelled By The Specific Mileage Rate For Your Vehicle.

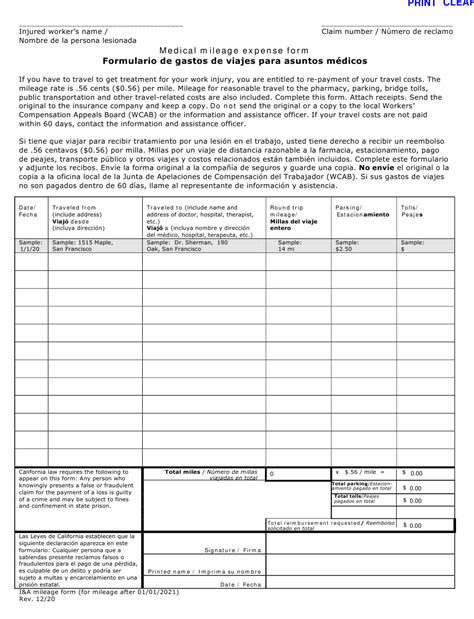

In some countries and in some companies, the mileage rate can change above a certain distance threshold according to either national regulations or company policies. If you need to apply a different rate when the mileage total is above a certain distance, follow the steps below: Report your mileage used for business with this accessible mileage log and reimbursement form template.

Using The Tier 1 And Tier 2 Rates.

Usually, the reimbursement of an employee for mileage rates and subsistence is a matter for individual employers. This payment can be made, tax free, by the amount of business kilometres travelled. This can be reflected when you set up mileage rates in expense management as well.