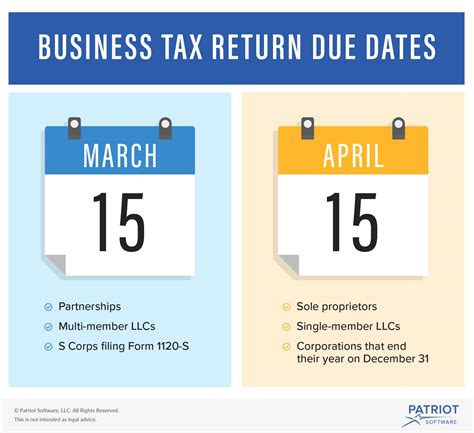

Partnership Tax Return Due Date 2022. Must file return on the 15th day of the 4th month for fiscal year, please find the note “b” below for more details if a fiscal tax year ending june 30. S corporations must file a 2021 calendar year income.

Here's what you need to know. Form 1120s, income tax return for an s corporation. However, april 15, 2022, is emancipation day.

How To Fill Out Form 1065:

The due date is april 18, instead of april 15, because of the emancipation day holiday in the district of columbia for everyone except taxpayers who live in maine or massachusetts. No extension yet — here's when taxes are due in 2022 the irs said tax returns can be submitted jan. Individuals, sole proprietors, and c corporations need to file their taxes by this date.

With An Extension, The Deadline For Filing Is September 15.

If your business has filed successfully for a tax extension, sole proprietors and c corporations must file income tax returns by october 15, 2022. 31 jan 2022 goods and services tax (gst) file gst return (period ending in dec) 31 jan 2022 property tax 2022 property tax bill. The main ‘tax day’ usually falls on april 15.

S Corporation And Partnership Tax Returns Due.

C corporation tax returns will be due the 15th day of the fourth month after the end of their fiscal tax year. Partnership and s corporation tax returns will be due the 15th day of the third month after the end of their fiscal tax year. March 15 is also the deadline to file for an extension for s corp and partnership tax returns.

A Special Rule To Defer The Due Date Change For C Corporations With Fiscal Years That End On June 30Th Defers This Change Until December 31, 2025.

Here's what you need to know. Complete data for your s corp, partnership, and personal returns is received between march 16, 2022, and august 15, 2022… we will file your s corp or partnership returns by the extension deadline of september 15, 2022. Form 1040 (for individuals) 18th april 2022:

As A Partnership, Your Business’ Income Tax Return, Or Extension, Is Due Within 15 Days From The Final Day Of Your Tax Year.

Unless you extend your business’s tax return, it is due this day. There’s usually a second payment deadline of 31 july if. Pay the tax you owe.