Provisions Of The American Rescue Plan Act Of 2022. Thank you for your interests in applying for american rescue plan act (arpa) funding. Faces an unprecedented healthcare crisis due to covid, several temporary changes have been made to how health insurance plans function on behalf of the consumer.

The cares and american rescue plan act will not be offering the same flexibility in 2022. The american rescue plan act boosts premium tax credits for 2021 and 2022, eliminating or reducing premiums for millions of current marketplace enrollees to ensure that no marketplace enrollee spends more than 8.5 percent of their income on. 6, 2022, governing the use of fiscal recovery funds (frf) as established under the american rescue plan.

The American Rescue Plan Act Authorized The Advanced Payment Of These Tax Credits At A Rate Of $250 Or $300 Per Month From July To December.

The rfp and application materials can be accessed from the city of. Biden signed into law the american rescue plan act of 2021 (the act). Communicating affordability provisions on tuesday, march 23, state health and value strategies hosted a webinar to discuss how to best communicate with consumers and other stakeholders so residents can take full advantage of new financial help through the marketplace, free cobra plans, and more provided by the american.

The American Rescue Plan Includes Myriad Health Care Provisions, Focused Primarily In Two Areas:

The american rescue plan act of 2021 (h.r. 2022 american rescue plan act (arpa) application instructions applicant/organization information. Second, it enacts significant but largely temporary coverage policies.

The American Rescue Plan Act Of 2021:

American rescue plan act of 2021 The american rescue plan act boosts premium tax credits for 2021 and 2022, eliminating or reducing premiums for millions of current marketplace enrollees to ensure that no marketplace enrollee spends more than 8.5 percent of their income on. 6, 2022, governing the use of fiscal recovery funds (frf) as established under the american rescue plan.

No Pua Benefits Are Payable After September 4, 2021.

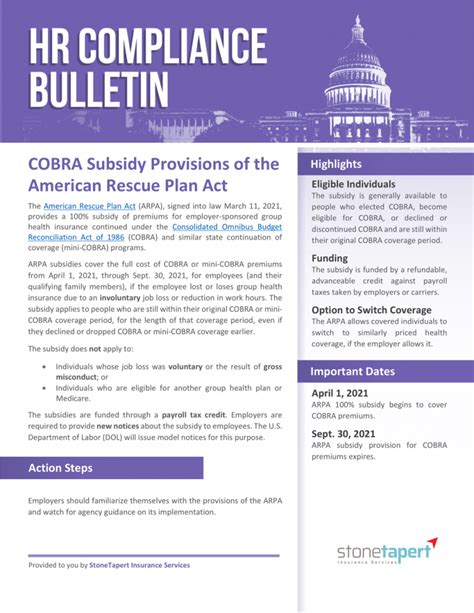

(“the american rescue plan,” arpa). Small business provisions • provides $7.25 billion for the paycheck protection program (ppp) forgivable loans. Congress passed the american rescue plan act of 2021 on march 10, 2021 and it was signed into law by president joe biden on march 11, 2021.

The American Rescue Plan Act Authorizes29Additional Weeks Of Pua Benefits (Not Retroactive;

Title ix, subtitle g—tax provisions congressional research service 1 he american rescue plan act of 2021 (arpa; The cares and american rescue plan act will not be offering the same flexibility in 2022. The stimulus bill passed by the house contains many tax provisions, including a new round of economic stimulus payments, tax credits for cobra continuation coverage, and expansions of the child tax credit, the earned income credit, and the child and dependent care credit.