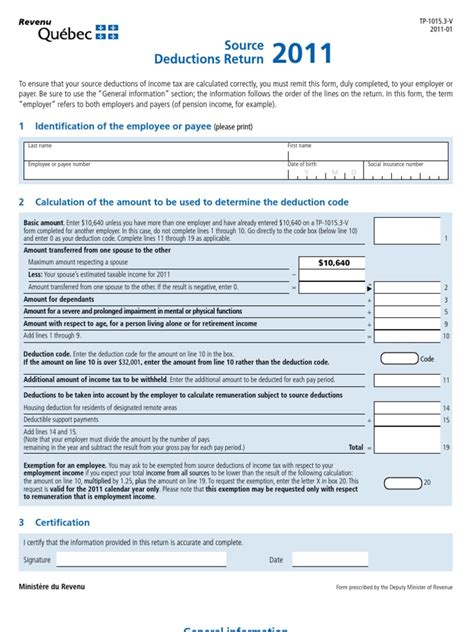

Quebec Income Tax Form 2022. Your employer or payer will use this form to determine the amount of your provincial tax deductions. Most software packages will include the quebec personal tax return.

It reflects some income tax changes recently announced which, if enacted by the applicable legislature as proposed, would be effective january 1, 2022. Most software packages will include the quebec personal tax return. For 2022, you must withhold income tax at a rate of 15% from the portion of a disability assistance payment from a registered disability savings plan (rdsp) that exceeds $19,727.

Income Tax Calculations And Rrsp Factoring For 2022/23 With Historical Pay Figures On Average Earnings In Canada For Each Market Sector And Location.

This is the main form you need to complete your federal taxes. Quebec tax returns can be filed electronically through netfile quebec. Td1sk 2022 saskatchewan personal tax credits return;

Individuals Paid By Commissions And Who Claim Expenses Can Elect To Use Form Td1X, Statement Of Commission Income And Expenses For Payroll Tax Deductions, To Take Into Consideration The Expenses In The Calculation Of Their Income Tax.

See tax tables for different income levels. The second version of free tax preparation software comes from vendors who sell their software, but provide conditions for free tax preparation. Simply put, a td1, personal.

Employment Income And Taxable Benefits.

Calculate the total income taxes of a quebec residents for 2022 the calculator include the net tax (income after tax), tax return and the percentage of tax. In addition to having to file a federal income tax return, trusts that are subject to québec income tax must file a separate provincial tax return. Use our simple 2021 tax calculator to quickly estimate your federal and provincial taxes.

Net Income Is $150,473 Or Lower:$13,229;

It may be beneficial for you to elect under section 217 of the canadian income tax act to pay tax at the same rate as residents of canada on your. The tax shield is not included in the calculation. Your employer or payer will use this form to determine the amount of your provincial tax deductions.

Net Income Is Over $150,473:

The total amount of your capital gains. Most software packages will include the quebec personal tax return. Eligible dividends up to $63,043 are not subject to federal taxation and up to $40,291 are not subject to provincial taxation.