The Inflation Discount Act of 2022 was signed into legislation by President Biden on August 16, 2022, changing into the 169th public legislation of the 117th Congress (Wang, August 16, 2022; Tankersley, August 16, 2022; P.L. 117-169). Earlier articles reviewed the funding and provisions contained within the invoice related to the Farm Invoice and the Agriculture Committees (farmdoc day by day, August 11, 2022; August 12, 2022). This text evaluations the larger image of what’s included in all the invoice as reported to date by the Congressional Funds Workplace (CBO) and the Joint Committee on Taxation (JCT). A complete compiled rating from a number of sources is summarized beneath as a part of the introduction to and overview of the dialogue.

Background: Reconciliation Evaluation

The Inflation Discount Act (IRA) of 2022 shouldn’t be atypical laws, nor laws within the atypical course of enterprise or the common order of Congress. It’s reconciliation laws that operates underneath particular statutory authorities, and particular procedural guidelines. Federal finances legislation supplies for the inclusion of reconciliation directions in a concurrent finances decision (2 U.S.C. §641). Reconciliation consists of directions written by the Congressional Funds Committees and agreed-to by each the Home and Senate within the finances decision, however not signed into legislation by the President. Congress instructs committees to take actions associated to the finances, that are compiled right into a single legislative automobile that’s thought of underneath particular guidelines. The IRA 2022 started as Senate Concurrent Decision 14 which set finances ranges for fiscal years (FY) 2023 by way of 2031; Title II offered reconciliation directions that included the Agriculture Committees. The precise directions to the Senate Committee on Agriculture, Vitamin and Forestry (Senate ANF) had been to “report adjustments in legal guidelines inside its jurisdiction that improve the deficit by no more than” $135 billion “for the interval of fiscal years 2022 by way of 2031” (S. Con. Res. 14).

Detailed Dialogue

On August 11, 2022, the Congressional Funds Workplace (CBO) produced its preliminary rating for the Inflation Discount Act. The CBO rating reported a internet improve within the deficit from the titles of the invoice by committee for fiscal years (FY) 2022 by way of 2031 totaling $114.8 billion (CBO, August 11, 2022). Determine 1 illustrates the CBO rating. The provisions from the Senate Committee on Agriculture, Vitamin, and Forestry include simply over 30% of this whole rating.

The CBO rating didn’t embody estimates for the Committee on Finance, which wrote the tax provisions of the invoice. The Joint Committee on Taxation (JCT) estimated the finances results of the income provisions within the invoice because it handed the Senate (JCT, August 9, 2022). The JCT rating will be damaged into two classes: (1) tax adjustments to lift income that goes in the direction of lowering the deficit; and (2) tax credit (or expenditures by way of the tax code) for sure actions. Determine 2 illustrates the deficit discount tax adjustments, that are a brand new company various minimal tax and an excise tax on company inventory buybacks. In whole, JCT estimates $296 billion in deficit discount for FY2022 by way of 2031.

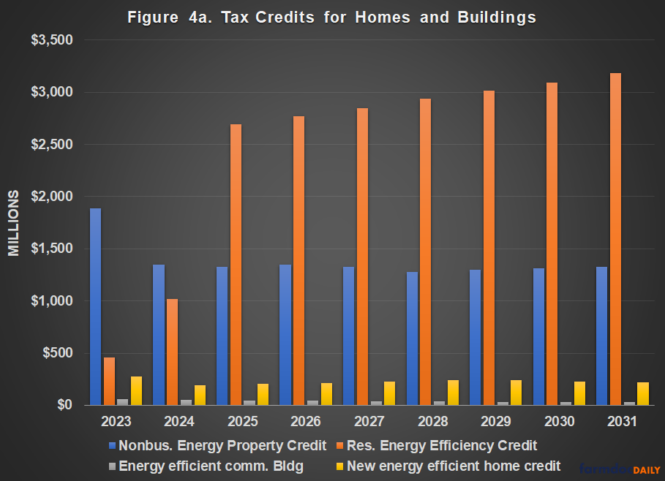

Within the second class, the Inflation Discount Act extends, modifies and creates a set of tax credit for renewable power, power effectivity and fuels. These embody tax credit for: photo voltaic, wind and different renewable sources of electrical energy; biodiesel, renewable diesel, sustainable aviation and clear hydrogen fuels; power effectivity in houses, business buildings and different properties; clear automobiles, new, used and business, in addition to refueling property; superior power and manufacturing; and clear electrical energy manufacturing, investments and certified amenities. It additionally contains tax credit for zero-emission nuclear energy manufacturing and for carbon dioxide sequestration. In whole, JCT estimates $271 billion in FY2022 to 2031 for these tax credit. Determine 3 illustrates the JCT scores by class, which typically align with the Components 1-5 and Half 7 of the subtitle of the invoice.

Figures 4a by way of 4d break down the JCT rating by particular person tax credit throughout the classes in Determine 3.

Not included within the above figures, but in addition scored by JCT are a number of provisions that elevate funding by extending present provisions. The invoice completely prolonged the tax that funds the Black Lung Incapacity Belief Fund, elevating $1.1 billion (FY2022-2031) and Reinstated the Superfund for environmental cleanups, elevating $11.7 billion (FY2022-2031). The invoice additionally prolonged the limitation on extra enterprise losses for noncorporate taxpayers for 2 years, elevating $52.8 billion. Lastly, the Inflation Discount Act elevated the analysis credit score towards payroll tax for small companies at a price of $168 million (FY2022-2031).

To spherical out the evaluation of all the Inflation Discount Act are two classes of provisions written by the Committee on Finance however not scored by JCT. The primary class pertained to well being care and pharmaceuticals. Congress approved Medicare to barter prescription drug costs to cut back prices. Preliminary estimates are that this provision will save the federal authorities between $229 billion and $265 billion over ten years (FY2022-2031) (examine, Penn Wharton Funds Mannequin, August 12, 2022; Senate Democrats, August 11, 2022; see additionally, Sachs, August 10, 2022). Congress additionally prolonged subsidies underneath the Inexpensive Care Act, initially estimated to value roughly $64 billion to $69 billion. These provisions are contained in Subtitles B and C (respectively) of Title I (P.L. 117-169).

The second has been the supply of a lot political and partisan consideration (see e.g., Rappeport and Hsu, August 19, 2022; Cercone, August 12, 2022). In Half 3 of Subtitle A of Title I—the subtitle for deficit discount—the Committee on Finance appropriated billions to the Inner Income Service (IRS) to boost providers and enhance taxpayer compliance. Congress appropriated $3.2 billion to enhance taxpayer providers and $4.75 billion for modernization. Congress additionally appropriated $25.3 billion for operations help, however the provision that has acquired essentially the most political consideration was the $45.6 billion appropriated to bettering enforcement of tax legal guidelines. Determine 5 summarizes these provisions.

Included within the funding for the IRS is one other $725 million for administrative bills such because the inspector basic, the workplace that writes the rules and the U.S. Tax Courtroom. In whole, the Inflation Discount Act supplies an almost $80 billion funding within the IRS which is anticipated to enhance compliance and improve income, lowering the federal deficit. One estimate scored this as elevating $147 billion over FY2022 to 2031 (Penn Wharton Funds Mannequin, August 12, 2022). Others have estimated it will elevate $204 billion to contribute a internet $124 billion to deficit discount over the ten years (FY2022-2031) and assist scale back the reported $600 billion annual hole between the taxes which are legally owed and the taxes which are truly paid (Jacoby, August 12, 2022).

Concluding Ideas

In response to a abstract doc ready by Senate Democrats, the Inflation Discount Act of 2022 will elevate $737 billion and spend $437 billion on local weather change and power investments, in addition to one other $64 billion on extending the Inexpensive Care Act subsidies and $4 billion for western drought resiliency (Senate Democrats, August 11, 2022). The Act is subsequently anticipated to contribute near $300 billion to deficit discount over the subsequent 10 years. The Senate Democratic estimates had been compiled from the scoring estimates ready by the Joint Committee on Taxation and the Congressional Funds Workplace however in no way scoring has been accomplished and the ultimate quantities may change. The distinctive and arguably historic laws has been reviewed in three components, with the primary two targeted on the funding appropriated by the Senate Committee on Agriculture, Vitamin, and Forestry; this third installment reviewed all the laws as presently scored. These preliminary evaluations shall be up to date and supplemented by new info because it turns into accessible and with further evaluation or views.

References

“Senate-Handed Inflation Discount Act: Estimates of Budgetary and Macroeconomic Results.” PWBM, Printed on 8/12/202. https://budgetmodel.wharton.upenn.edu/points/2022/8/12/senate-passed-inflation-reduction-act

Coppess, J., Ok. Swanson, N. Paulson, C. Zulauf and G. Schnitkey. “Reviewing the Inflation Discount Act of 2022; Half 2.” farmdoc day by day (12):120, Division of Agricultural and Client Economics, College of Illinois at Urbana-Champaign, August 12, 2022.

Coppess, J., Ok. Swanson, N. Paulson, C. Zulauf and G. Schnitkey. “Reviewing the Inflation Discount Act of 2022; Half 1.” farmdoc day by day (12):119, Division of Agricultural and Client Economics, College of Illinois at Urbana-Champaign, August 11, 2022.

Jacoby, Samantha. “Added IRS Funding Would Assist Guarantee Excessive-Earnings Households, Companies Pay Their Taxes.” Middle on Funds and Coverage Priorities, August 12, 2022. https://www.cbpp.org/weblog/added-irs-funding-would-help-ensure-high-income-households-businesses-pay-their-taxes

Sachs, Rachel. “Understanding The Democrats’ Drug Pricing Package deal.” Well being Affairs, August 10, 2022. https://www.healthaffairs.org/content material/forefront/understanding-democrats-drug-pricing-package

Wang, Amy B. “Biden Indicators Sweeping Invoice to Sort out Local weather Change, Decrease Well being-Care Prices.” The Washington Publish, August 16, 2022. https://www.washingtonpost.com/politics/2022/08/16/biden-inflation-reduction-act-signing/