San Francisco Gross Receipts Tax Due Date 2022. Effective january 1, 2022, businesses subject to the san francisco administrative office tax (aot) must pay an additional annual overpaid executive tax (oet) of 0.4% to 2.4% on their payroll expense in san francisco when their highest paid managerial executive earns more than 100 times the median compensation paid to employees in san francisco. Tax, and homelessness gross receipts tax that would otherwise be due on april 30, 2020, are waived for taxpayers or combined groups that had combined san francisco gross receipts in calendar year 2019 of $10,000,000 or less.

An extension can be filed by february 28, 2018 to extend the filing due date to may 1, 2018 under the condition that the person made payments. The san francisco annual business tax return (return) includes the gross receipts tax, administrative office tax, early care and education commercial rents tax and homelessness gross receipts tax. Quarterly sales and use tax filing;

The Tax Is A Progressive Tax Imposed On Businesses That Are Subject To The Gross Receipts Tax (I.e.

An extension can be filed by february 28, 2018 to extend the filing due date to may 1, 2018 under the condition that the person made payments. This tax is an addition to the gross receipts tax and will become effective january 1, 2022. Under the revised general rule, the registration fee is $52 for businesses with less than $100,000 in gross receipts.

Proposed Gross Receipts Tax Rates.

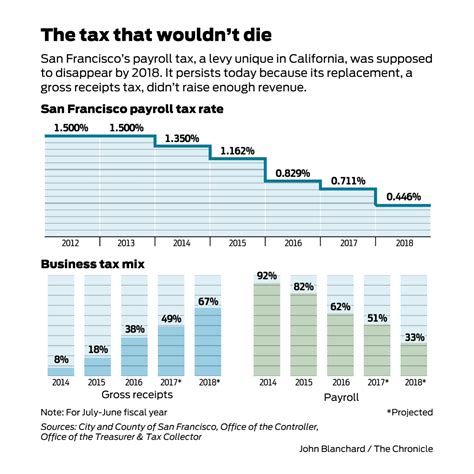

Welcome to the san francisco office of the treasurer & tax collector's business tax and fee payment portal. The due date for filing the san francisco 2021 annual business tax (sf abt) return, which includes reporting and payment of (1) the gross receipts tax (grt) or administrative office tax (aot), (2) the homelessness tax (hgrt) or the homelessness administrative office tax (haot) and (3) the commercial rents tax (crt), is february 28, 2022. Proposition f fully repeals the payroll expense tax and increases the gross receipts tax rates across most industries while providing relief to certain industries and small businesses.

Consideration Should Be Given As To Whether A Filing Obligation Exists And How Gross Receipts Should Be Apportioned To The City.

The changes are reflected in the 2021 annual business tax filings (due february 28, 2022). The business tax and fee payment portal provides a summary of unpaid tax, license and fee obligations. The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april, july, and october, respectively.

Payroll Expense Tax And Gross Receipts Tax Returns Due.

San francisco's 2019 gross receipts tax and payroll expense tax are due on or before march 2, 2020. San francisco’s gross receipts tax (grt) is calculated based on individual employees’ time spent in sf. Tax, and homelessness gross receipts tax that would otherwise be due on april 30, 2020, are waived for taxpayers or combined groups that had combined san francisco gross receipts in calendar year 2019 of $10,000,000 or less.

50% Less Time In The City May Mean A 50% Reduction In Tax Owed.

Interest and penalty (if any) will be levied by the city of san francisco if the statement and payment aren’t submitted by midnight on the due date. You may pay online through this portal, or you may print a stub and mail it with your payment. San francisco 2022 tax deadlines for startups.