Above these income limits, the payment amount decreases. Income cap for full amount (individuals/couples) $75,000/$150,000:

Stimulus Check 2022 Limits E Jurnal

2020) stimulus check 1 (march 2020) check amount:

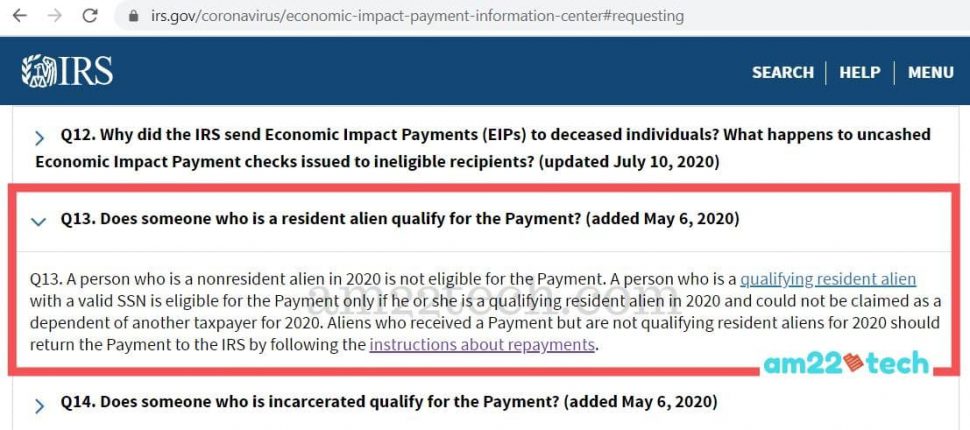

Stimulus check 3 income limits. Under the cares act, the $1,200 payments for individuals phased out at an income of $99,000, and the $2,400 payments for couples phased out at a combined income of $198,000. That applies to anyone whose reported adjusted gross income for tax years 2018 or 2019 was at least: Since the maximum income threshold is fixed, your total stimulus check will be reduced proportionately by the amount earned over $75,000 for individuals, $112,500 for heads of households, or.

Individuals who have an adjusted gross income (agi) of up to $75,000, heads of household with an agi of up to $112,500, and married couples with an agi of up to $150,000 per year qualify for the entire stimulus check amount, which is $1,400 for individuals and $2,800 for heads of household and married couples filing jointly. The checks will be a maximum of $1,400 per individual, or $2,800 per married couple, plus $1,400 per dependent. Under the bill that passed the u.s.

There's a strict income limit for the third stimulus payment. If your income is at the following amounts or higher, you won’t receive a stimulus payment, even if you have dependents: Like past direct payments, this third round will be based on income.

What are the income limits for the 3rd stimulus check? If you meet the following four requirements, you likely qualify for the first stimulus check. The american rescue plan was signed into law on march 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of americans.

Each eligible dependent — including adult dependents — also will qualify for a payment of $1,400. Under the senate plan, single taxpayers would be over the income limit with an agi of $80,000, heads of household at $120,000 and those who married and file jointly at $160,000. President joe biden has agreed to a compromise with moderate democrats to narrow the income eligibility for the next round of $1,400 stimulus checks that are included in a bill the senate is.

Income limits with stimulus checks posted by moneyg on 3/19/20 at 4:13 pm to the pirate king quote: Who gets a 3rd stimulus check? You are eligible to receive the full payment if your adjusted gross income is below $75,000 and a reduced payment amount if it is more than $75,000 the adjusted gross income limit for a reduced payment is $99,000 if you don’t have children and increases by $10,000 for each qualifying child under 17.

$1,400 stimulus check income limits The same holds true with a third stimulus check. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

$99,000 for individuals and married couples filing separately How the third stimulus check became law. The irs said it sent 30 million payments to households earning more than $75,000 during the first round of stimulus checks.

Additionally, there are changes to the 2021 child tax credit, the 2021 earned income tax credit, 2021 child and dependent care credit, and. That means a family of four could receive as much as $5,600 in total. Individual taxpayers will get $1,200 each if their adjusted gross income (agi) is less than $75,000.

I would consider 150k household income above “upper middle class” House, the third stimulus checks would phase out at incomes above the limits mentioned earlier. Here's who qualifies for a full $1,400 check:

Some wealthier families might not receive a stimulus check. The maximum amount for the third round of stimulus checks will be $1,400 for any eligible individual or $2,800 per eligible couple filing taxes jointly. This payment is composed of a $1,400 stimulus check to qualifying individuals and $1,400 per their dependents as part of the american rescue plan act, or president biden's early 2021 tax plan.

Individuals with incomes above the $75,000, $112,500, and $150,000 limits will still be able to receive partial payments. You are ineligible for stimulus payment if you earn more than the income limit. If you are filing as single with an adjusted gross income (agi) up to $75,000, married filing jointly with an agi up to $150,000, or head of household with an agi up to $112,500, you will receive the full payment.

Single filers with agis of $75,000 or less;

limits with stimulus checks Page 3

Stimulus Check 2022 Salary Limit E Jurnal

2nd Stimulus Package Limit LUSTIMU

Senate Democrats, White House Agree To Tighter

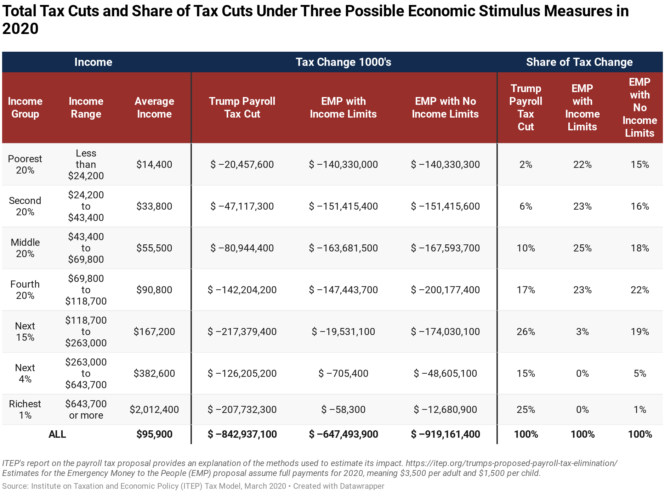

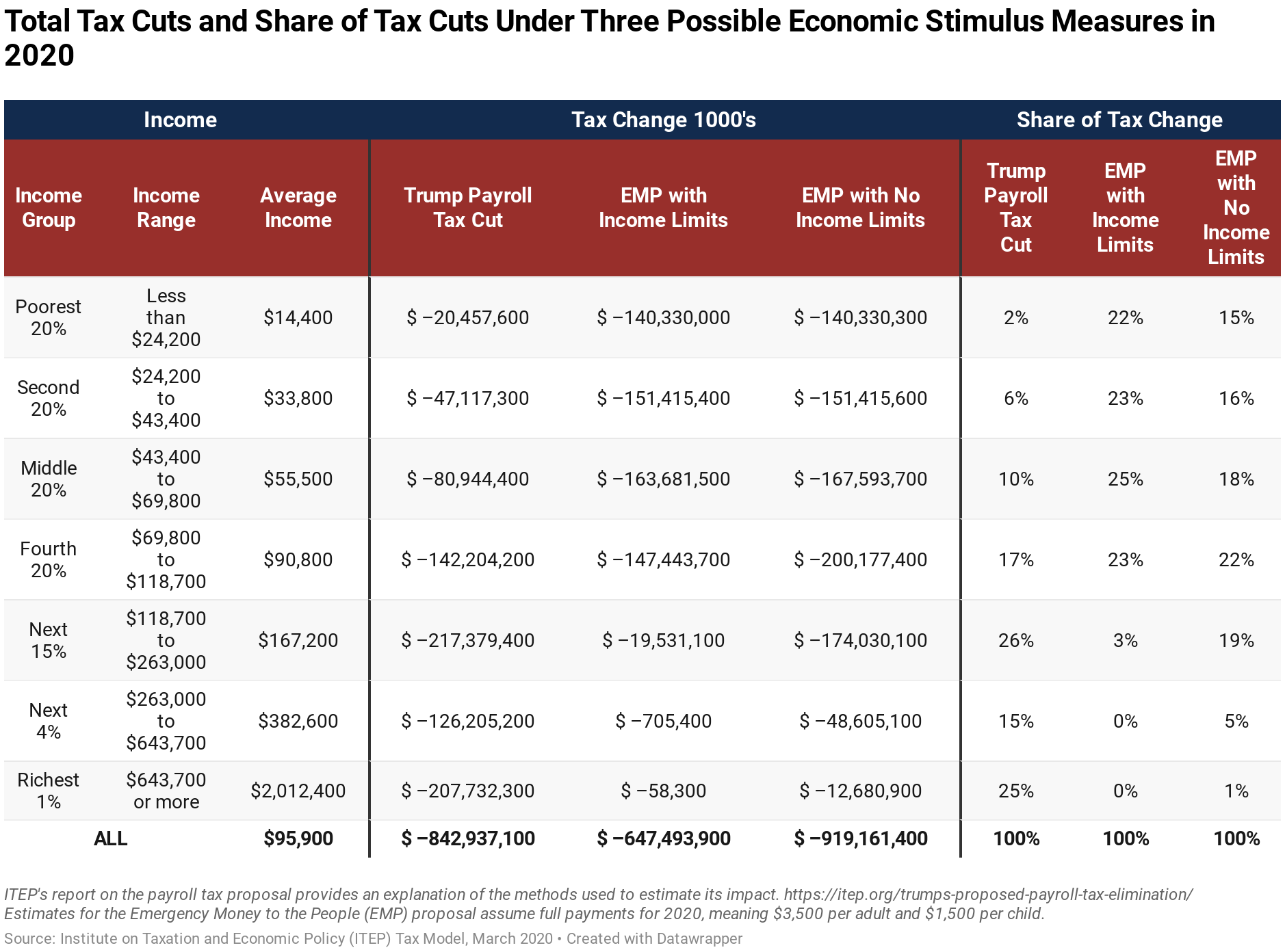

Checks to All vs. Trump’s Payroll Tax Cut ITEP

Stimulus check Qualifications, fine print, limit

Irs 2nd Stimulus Guidelines IRSYAQU

Stimulus Check Eligibility Joint MULUSTI

IRS uses stimulus check formula to calculate how much cash

3 Ways to Check the Status of Your Stimulus Payment wikiHow

Stimulus Check Qualifications Single STIMUQ

Stimulus Check 2022 Limits E Jurnal

limits with stimulus checks Page 3

Dems OK tighter limits for COVID19 stimulus checks

Democrats approve tighter limits for 3rd stimulus check

Stimulus Check 2022 Salary Limit E Jurnal