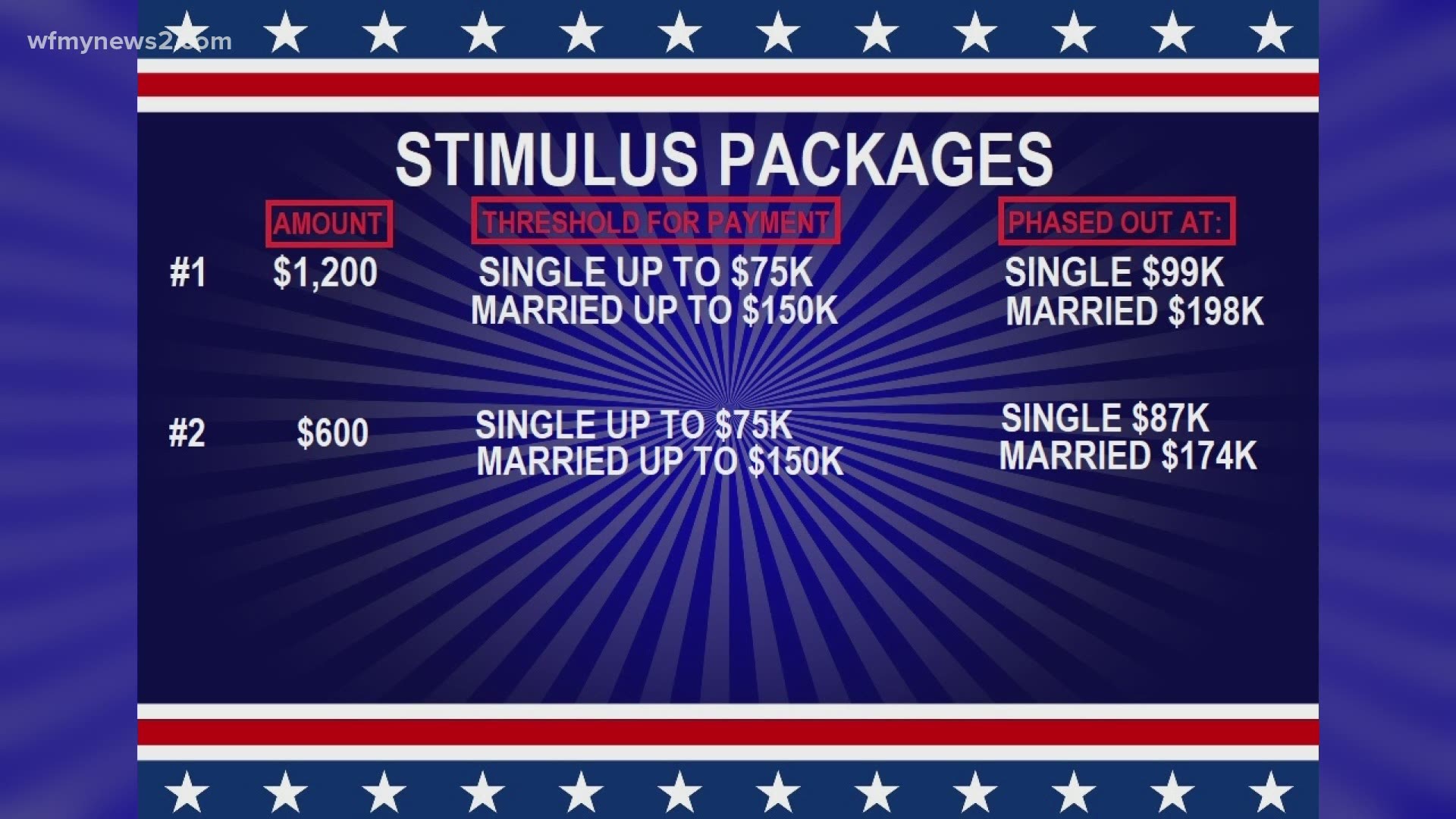

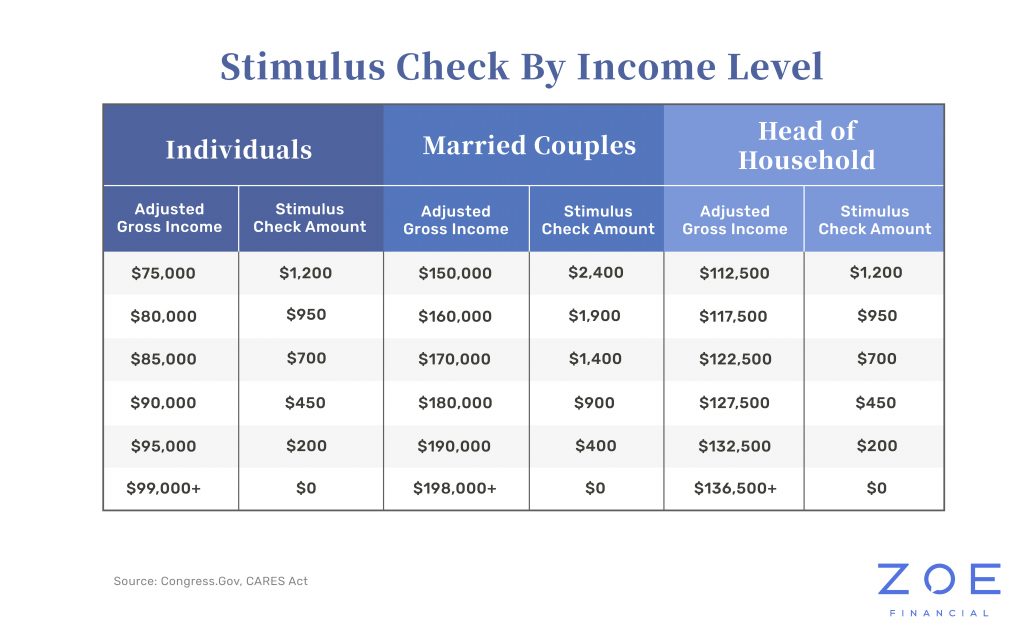

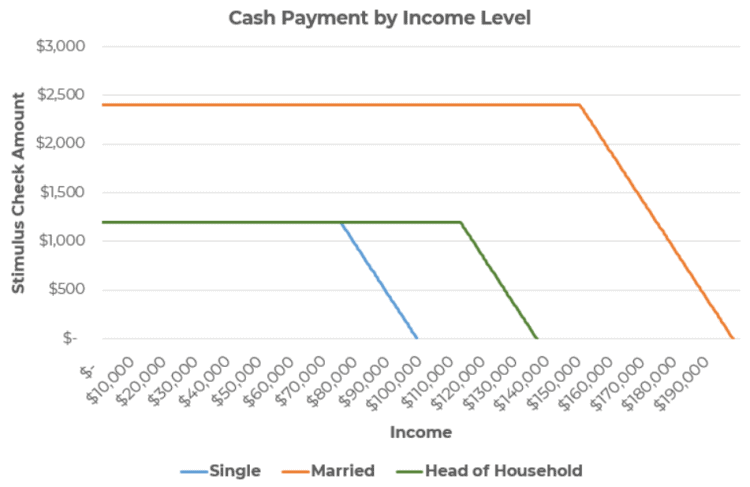

Phased out gradually to zero at $100,000. Stimulus checks to phase out at $80,000 instead of $100,000 ($150,000/$160,000) for joint.

Stimulus checks GOP plan includes 1,000 stimulus checks

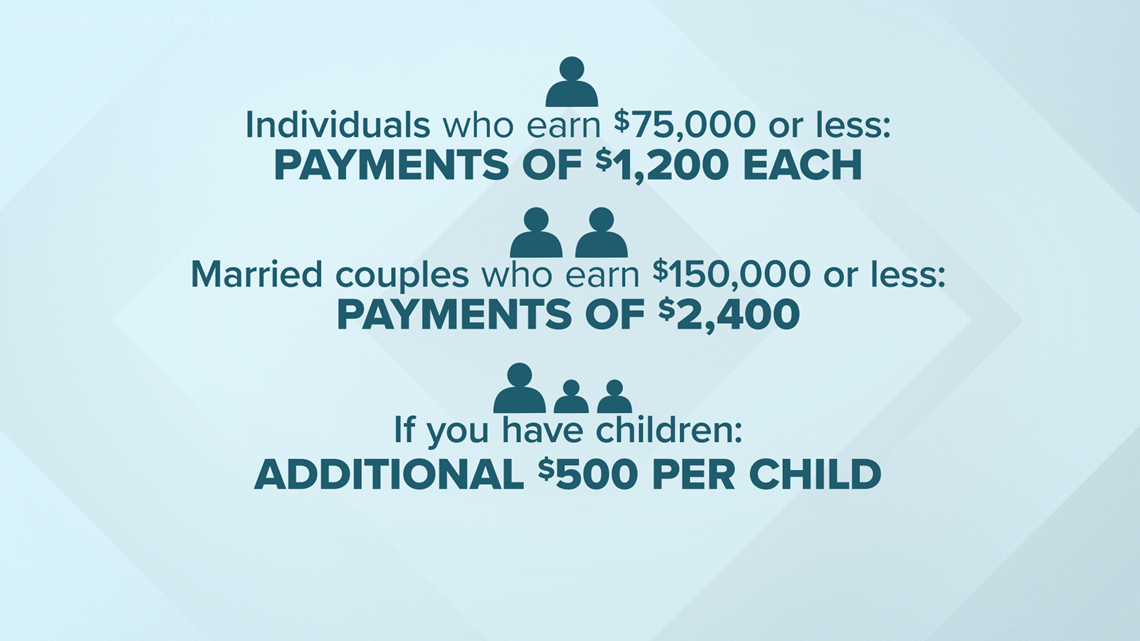

The legislation provides a third stimulus check that amounts to $1,400 for a single taxpayer, or $2,800 for a married couple that files jointly, plus $1,400 per dependent.

Stimulus check 3 phase out. The payment amount phases out completely once a filer’s agi exceeds the maximum agi for the filing status. The key difference is the senate plan phases out the $1,400 stimulus checks at a faster rate for those with incomes above the initial levels. $2,000 for couples making up to $80,000.

If you are a non filer and did not file a return for the previous stimulus checks or simply did not get your full amount, you can file a 2021 return to claim the stimulus three. The third economic impact payment is worth up to $1,400 per individual and dependent. That is less than the biden plan that includes $1,400 checks and phases out at $75,000 with a $115,000 cap ($206,000 for couples).

Democrats could phase out $1,400 payments at $50,000/year Although the income levels at which third stimulus checks start to be phased out (i.e., reduced) are the same as the amounts used for the first two stimulus payments, the rate at which the phase. Single filers earning an adjusted gross income (agi) up to $75,000 and heads of household earning up to.

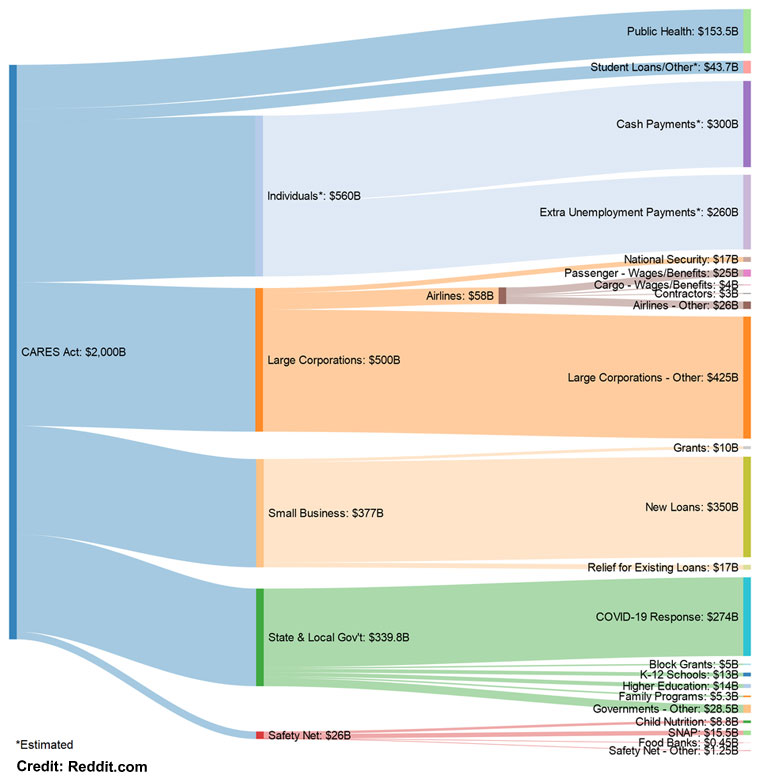

The phase three coronavirus stimulus bill, currently in the works, will likely include large stimulus checks and other direct benefits for u.s. Eligibility for the third stimulus checks is based on your tax filing status. The december stimulus phased out at $174,000 income.

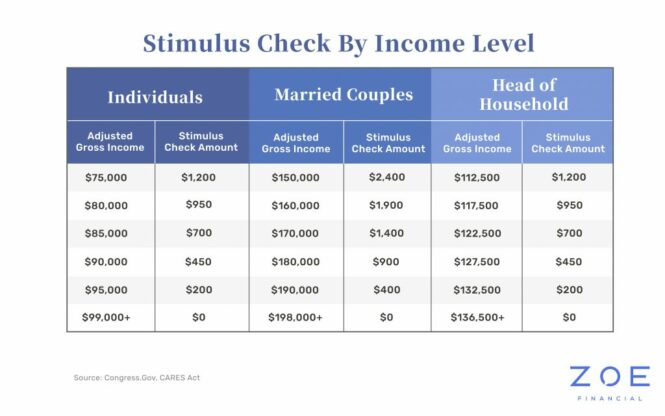

For every $100 more than $75,000, $5 will be deducted from the $1,200. President biden signed the american rescue act plan into law on march 11. But some senate democrats have proposed limiting the scope of the third round of stimulus by phasing out payments completely for individuals earning more than $80,000 and couples earning more than.

Where we stand as january ends the cornerstone of the gop plan appears to be $160 billion for the health care response — vaccine distribution, a “massive expansion” of testing. According to multiple sources @joebiden. This means that for every $100 that you make over the limit, your check goes down by $5.

Head of household checks start getting phased out at incomes over $112,500. Meaning many people, many who got the previous checks, will not receive it this time around. As a result, third stimulus checks under the current senate version would be reduced to zero for all taxpayers at or above the $80,000, $120,000, and $160,000 agi levels (depending on your filing status).

Payment amounts will begin to phase out, or decrease, for individuals who make more than $75,000. Once the agi for a filer hits the income limit for the full stimulus check, the amount of the payment is reduced by $5 for each $100 above the threshold. Who may qualify as a dependent for a third stimulus check?

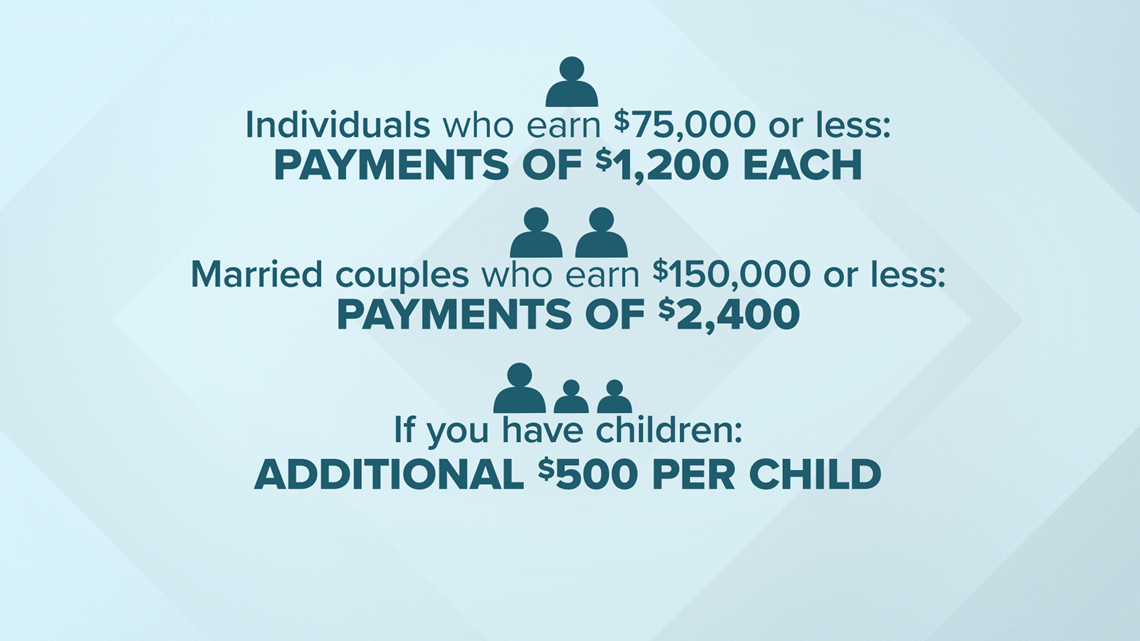

The new eligibility rules mean the checks will phase out more quickly than during the two previous rounds, when the cutoff was $99,000 for individuals and $198,000 for joint filers with no children. The stimulus check amount for 2020 is adults would get $1,200 each (so $2,400 for couples filing jointly) and children $500 each (children are qualifying children according to irs rules claimed in the household under 17 years old). The benefit would start to phase out at a rate of $5 for every additional $100 in income.

This means that the stimulus check is completely phased. But whereas the first and second rounds of stimulus payments phased out checks on a sliding scale of $5 for every $100 over the income limit, the new plan cuts off high earners at $80,000 for individuals and $160,000 for couples. So under the senate deal, individuals making $80,000.

Under the pending deal, confirmed by cbs news, the $1,400 direct payments would begin to phase out at $75,000 for individuals, but would. The irs reduces stimulus payments by 5% for the total amount that you made over the agi limit. How much you will get in the next stimulus will depend on a formula the irs will use to calculate how much of the maximum $1,400 one is allotted to, which will consist of determining which hard income limits would be put into place to exclude those who originally were eligible under previous stimulus checks to get the upcoming one.

At high enough incomes, the checks phase out entirely. This new law provides a third round of stimulus payments of $1,400 for each qualifying tax filer and each qualifying.

Coronavirus stimulus checks How much will you get and

Examples of stimulus presentation in Experiment 2 and 3

310 Billion Additional Stimulus PPP Funding! Check Your

Stimulus Funds Further Explained, Rounds 13, Those Near

How Does the Coronavirus Stimulus Package Affect Me? Zoe

Third stimulus check GOP plan starts to phase out at

Will You Still Get a Third Stimulus Check Under the New

/cdn.vox-cdn.com/uploads/chorus_asset/file/19825993/taxfoundation_caresact_stimulus.png)

Adventurealleyproductions Stimulus Check / Stimulus Check

Stimulus Check 3 Chart Don't Believe These 12

Stimulus check update Couples will be sent 2,800 and

Trump ‘Dramatic’ Phase 4 Stimulus Package Corona Alerts

How Does the Coronavirus Stimulus Package Affect Me? Zoe

484 Billion Phase 3.5 Stimulus Package Wallet Monkey

Coronavirus Stimulus Package U.S. Gov Connect

Third stimulus checks Democrats could phase out 1,400

Stimulus Settings Used In Each Phase of Training