Child And Dependent Care Credit Phase Out 2022

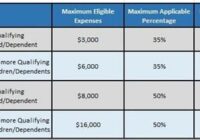

Child And Dependent Care Credit Phase Out 2022. There are two major benefits of the credit: A tax deduction simply reduces the amount of income. Columbia Farmers Market Voted 1 News Item City of from www.como.gov However, the basic starting point is that you get up to $3000 for one dependent and up to $6000 for having multiple… Read More »